We Have a Pulse!

U.S. cannabis joins 2024.

Daily Recap

Cannabis “continues to be the most used drug, with an estimated 219 million users (4.3% of the global adult population) in 2021,” per a report from the United Nations.

Opioids, meanwhile, “continue to be the group of with the highest contribution to severe drug-related harm, including fatal overdoses.”

State Farms

While everyone awaits next steps for federal reform, marijuana legalization will soon be in play across multiple states, including Florida, Hawaii, Pennsylvania, South Dakota and New Hampshire.

54% of the U.S. population already lives in a 420-friendly state.

O-HIGH-O

Ohio’s Republican governor is adamant that lawmakers must pass legislation as soon as possible to expedite regulated recreational marijuana sales and ban purchases of intoxicating hemp products.

With the legislature coming back into session, Gov. Mike DeWine (R) said “we just need to get something done” to address the adult-use sales rollout timeline under a voter-approved legalization law that took effect last month.

Markets

It was a tale of two tapes as our usual snoozer was interrupted by a midday headline that sent the space into a tizzy. When the dust settled, U.S. plant-touching volume was $122M and U.S. canna ETF MSOS closed +6% into a technically significant zone.

We’ll tell you all about it; all you’ve gotta do is scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT Notional: $122M

Top Stories

Cannabis Still the World’s Most Used Substance, UN Report Says

Most Veterans Support Expanding Medical Cannabis Access

New Jersey Dispensary Count Nearly Triples in 2023

New York Makes Two MSOs Wait for Recreational Market Entry

Recreational weed in Missouri is a year old. What can the industry expect in 2024?

Stocks & Stuff

Same shit, different year, or that was the vibe we picked up on over the last few days, replete with the same sorta agita that has persisted throughout recent memory.

I reminded myself, as I did a few of them yesterday and this morning, that it’s the first few days of the year. Still, sentiment was decidedly one-sided:

“Beyond frustrating.”

“Exhaustion everywhere.”

“No tax loss bounce; no volume; no bueno.”

“I’ll give it to the election—but that’s it!”

Perhaps ‘the first week of January’ was the wrong lens given it’s been 1057 days since that fateful top but well, that’s how we measure time. It’s been a long, hard journey, I know, but there’s another side of this cycle, or that’s what we’ve been led to believe.

Plant-touching U.S operators traded $10M notional an hour into the session…

…with all but $2.5M via MSOS, as the broader tape and crypto took a healthy and well-deserved respite following their beastly year-end runs.

Around 11AM, a customer rolled a huge MSOS call spread from January to March…

MSOS color - looks like customer rolls ratio call spread out, from Jan to March.

Cust sold 44,562 Jan 8 calls @ 0.30, bot 28,875 Jan 12 calls for 0.13 (looks closing)

Cust bought 44,562 Mar 8 calls for 0.94, sold 28,875 Mar 12 calls @ 0.43 (opening)

…which created ~250K MSOS to buy (as dealers hedge), lending a midday bid into the structural abyss that has come to define this fuckery sector.

At 1230, with only $17M ($13M via MSOS) on the tape, I made an executive decision…

…which, of course, could only mean one thing: that news was about to hit.

13:29:18: *DEA REVIEWING MARIJUANA'S CLASSIFICATION: PUNCHBOWL

When I saw our trader calling me three-quarters of the way through my Pelly, I knew he was doing so for a reason. As he read me the headline, I said, “that’s it?” before I started getting alerts that MSOS had been halted to the upside.

I got back to my turret before the halt lifted and wrestled with a single question:

While we knew the DEA is in the midst of a review, is the first public acknowledgement of that review by the DEA—on the third day of the year, no less—enough to attract fresh capital, or even feint interest, to a sector that’s long been left-for-dead?

You know the next sequence: once MSOS reopened, that hearty pre-headline 8% gain…

…quickly evaporated. The bears made all-gone in a matter of minutes, after which the ETF vacillated in 2% clips, option markets dollar-wide. I couldn’t keep up with all of the negativity, coming through every channel, window, device and orifice:

“for fuck sake, why can’t they pull the trigger?”

“What a joke!”

“It’s a nothing-fucking burger!”

“I hate this fucking sector.”

I get it, of course, we’re all products of our environment and if you’ve been invested—or if you’re a U.S. operator, for that matter—these have been Dogwalker years with an unhealthy amount of soul-searching and ample depression.

Still, volume started to come in. By 2:30PM, U.S. plant-touching notional swelled (I jest) to $77M ($47M) as MSOS held a 2% gain. I was still in my workout clothes btw but that somehow made sense as we sweated out the last hour.

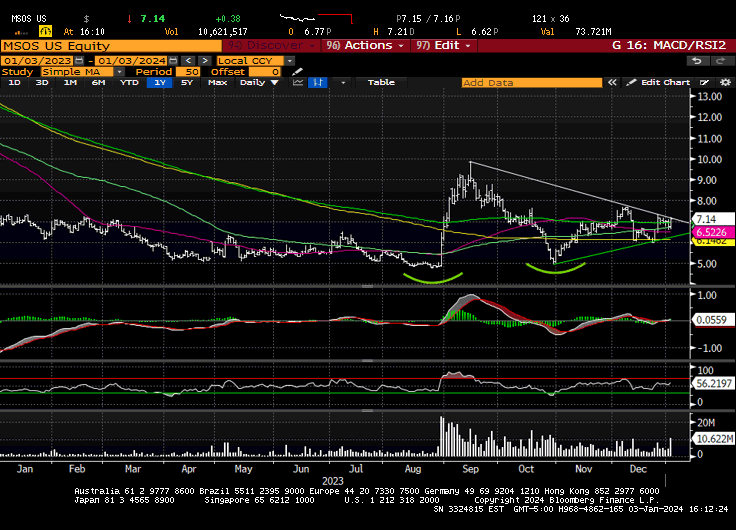

MSOS—which we use as a proxy for U.S. canna but it is, in fact, the only NYSE-listed pure play, creating a Trojan Horse, of sorts—reclaimed all notable moving averages by the close and seems poised to capture this flag with some follow-through:

We’ve still got alotta wood to chop technically and we’ll likely need news + continued volume to validate higher prices still but the set-up is there, even if nobody seems to think that today’s headline was news, or even particularly newsworthy.

Viridian on U.S. cannabis:

EV/NTM EBITDA Multiples are 25% below levels seen after the 5th SAFE Act passed in the House in Feb. ‘22. Still, the rescheduling news is more significant as it dramatically impacts cash flows. We conclude that there is significantly more potential for multiple expansions. If valuations multiples rose to where they were after the announcement of the Schumer-Booker bill, the incremental gains would equal 101.5%.

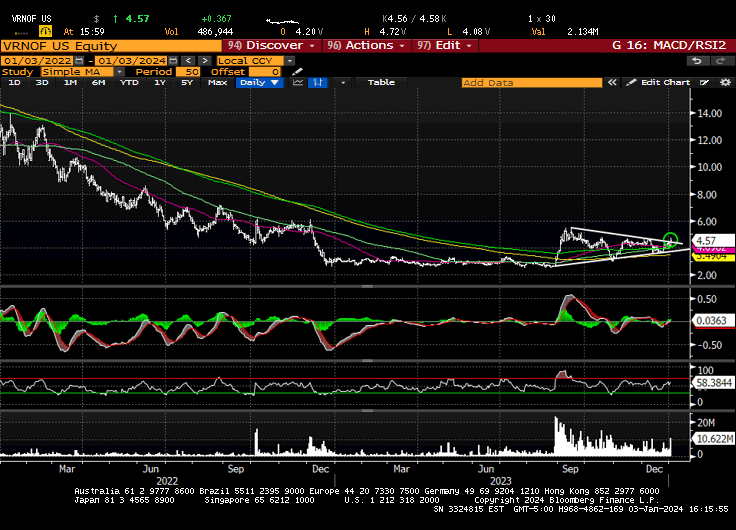

Random Chart: Verano

Stems & Seeds

UFC Removes Marijuana From Banned Substances List For Professional Fighters

Enjoy your night, be safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

I don’t understand the negativity. Aren’t we all used to this by now? Just a couple weeks ago I was buying Verano and Terrascend over 20% lower on no news and ultra low volume. Price action has been good in my eyes. Bureaucracy takes time. We only found out about the hhs news because someone leaked it. Pressure has got to be on the dea from the administration.

headline was good for a chuckle, thanks.

real news is now there's added empirical proof that when you're afk shit happens - couple of canna lifetimes back you were on some caribbean aisle when something transpired, today - so...