The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click through the title to access any article; most stock stuff is behind the firewall + you can access a free trial by clicking below. Thank you for your support.

Se7enth Heaven

Unpacking a new year in cannabis.

January 2nd, 2023

A former top official at the FDA’s Center for Drug Evaluation and Research argues that fears surrounding a potential move to Schedule III are alarmist and misguided.

“If you’re going to launch an enforcement initiative against cannabis, why would you start with saying, ‘Oh, by the way, it’s less of a risk than we thought?”

“Agencies want to get their work done in an election year by the summer…the DEA could accomplish this by then.”

MJ Biz-ness

As the cannabis industry awaits the DEA decision, 2024 could host the single biggest development in U.S. cannabis policy in over 50 years. This potentially seismic shift is among the seven predictions from MJBiz, shared below:

1. The Drug Enforcement Administration will propose rescheduling marijuana.

2. Tax relief will come … eventually.

3. Rescheduling might be the only progress at the federal level in 2024.

4. The next states to legalize marijuana will be … Florida and Pennsylvania.

5. Marijuana reform will be a 2024 presidential campaign issue – for somebody.

6. States will make moves against the illicit market.

7. States will deliver on ambitious social equity promises or reimagine “a fair industry.”

Random Thought

Expect to see cap raises—and a lot of them—into the eventual DEA rally. These will be necessary and extremely healthy given the steadfast capital starvation diet that the industry has been forced to endure.

Roth on U.S. Cannabis

We Have a Pulse!

U.S. cannabis joins 2024.

January 3rd, 2024

Cannabis “continues to be the most used drug, with an estimated 219 million users (4.3% of the global adult population) in 2021,” per a report from the United Nations.

Opioids, meanwhile, “continue to be the group of with the highest contribution to severe drug-related harm, including fatal overdoses.”

State Farms

While everyone awaits next steps for federal reform, marijuana legalization will soon be in play across multiple states, including Florida, Hawaii, Pennsylvania, South Dakota and New Hampshire.

54% of the U.S. population already lives in a 420-friendly state.

O-HIGH-O

Ohio’s Republican governor is adamant that lawmakers must pass legislation as soon as possible to expedite regulated recreational marijuana sales and ban purchases of intoxicating hemp products.

With the legislature coming back into session, Gov. Mike DeWine (R) said “we just need to get something done” to address the adult-use sales rollout timeline under a voter-approved legalization law that took effect last month.

13:29:18: *DEA REVIEWING MARIJUANA'S CLASSIFICATION: PUNCHBOWL

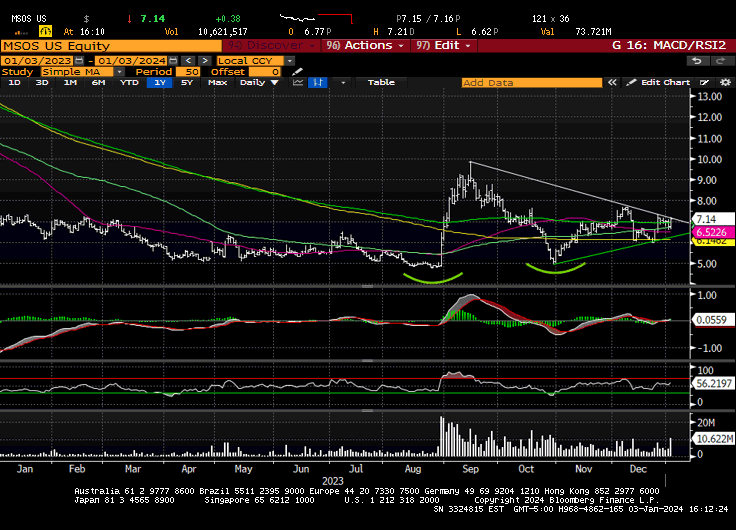

MSOS—which we use as a proxy for U.S. canna but it is, in fact, the only NYSE-listed pure play, creating a Trojan Horse, of sorts—reclaimed all notable moving averages by the close and seems poised to capture this flag with some follow-through:

We’ve got alotta wood to chop technically and we’ll likely need real news + continued volume to validate higher prices still but the set-up is there, even if nobody seems to think that today’s headline was news, or even particularly newsworthy.

Viridian on U.S. cannabis:

EV/NTM EBITDA Multiples are 25% below levels seen after the 5th SAFE Act passed in the House in Feb. ‘22. Still, the rescheduling news is more significant as it dramatically impacts cash flows. We conclude that there is significantly more potential for multiple expansions. If valuations multiples rose to where they were after the announcement of the Schumer-Booker bill, the incremental gains would equal 101.5%.

Fool's Rush In

Canna continues to lift on 'no news.'

January 4th, 2023

The Drug Enforcement Administration is telling lawmakers that it reserves “the final authority” to make any scheduling decision on marijuana following the HHS review, although it’s worth noting that the DEA has always followed the lead of the HHS.

While some corners are concerned that the U.N Single Convention on Narcotic Drugs could force the DEA’s hand higher (than Schedule III), there have been several signs, signals and statements that suggest Schedule III will soon become our new reality.

Florida Keys

A measure to put a proposed recreational cannabis amendment on the 2024 general election ballot has garnered enough signatures to move forward and is currently being reviewed by the Florida Supreme Court, which is expected to rule on it by April 1.

If the past is a prologue, and assuming the Supreme Court does the right thing, legal canna advocates are on solid footing: Floridians overwhelmingly voted in favor of an amendment authorizing medical cannabis in 2016 with 71% approval.

Stocks

It was another wild ride for the U.S. canna sector as an initial rally got halved during the lunch crunch only to rebound in an end-of-day push. MSOS finished the session +4%, which is a close above yesterday’s high and +12% vs. yesterday’s afternoon low.

Consensus remains that yesterday’s headline was a nothing-burger—anyone paying attention knew the DEA is conducting a review—which has served to aggravate an already incredulous audience that’s been burned one too many times to remember.

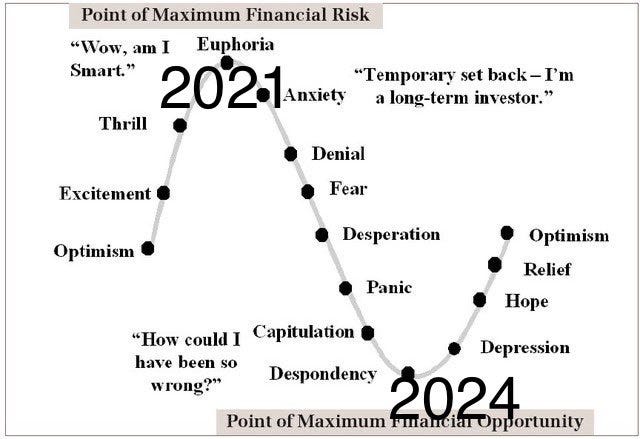

MSOS (as a proxy) ended the day +4%, which was off the highs but another solid step as this sequence continues to evolve. IDK if the sector depression is any more self-evident than the euphoria was on the other side, but I know one thing:

There are no victory laps on the road to redemption; not here, not now and certainly not for a while. It’s been a bruising double-black diamond 1058-day bear market and while we sense the buyers are higher, I plan to greet them with a humble handshake.

Senate Majority Leader Chuck Schumer on SAFER Banking:

ATB on U.S. Cannabis:

Mission Statement

A year ago today we conceived the Mission [Green] Alliance as an industry support mechanism for Weldon Angelos and his efforts to effect federal cannabis reform.

A kind thank you to Verano, PharmaCann, Curaleaf, TerrAscend, 4Front, Mattio and the many others who have come together to support such meaningful work.

Higher Love

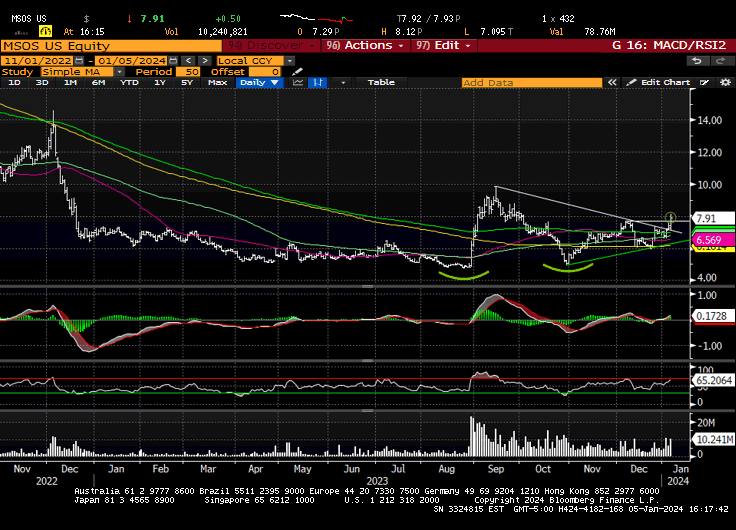

U.S. canna takes out the Dec. highs

January 5th, 2024

Congressman Steve Cohen (TN), a longtime advocate of lifting regulatory restrictions on marijuana, today wrote to Drug Enforcement Administrator Anne Milgram asking her to act expeditiously on an August 29 Department of Health and Human Services (HHS) recommendation to reschedule marijuana to Schedule III.

“I urge you, in the strongest possible way, to follow through on HHS’s recommendation. It is critical the DEA’s review is expeditious and your agency initiate the rulemaking process.

Tinkers by Evers and a Chance

Wisconsin Gov. Tony Evers (D), who’s pushed for the full legalization of recreational marijuana, said that he’s open to a more limited medical marijuana legalization that is being promoted by Republicans.

“I would think that getting it all done in one fell swoop would be more thoughtful as far as meeting the needs of Wisconsinites that have asked for it but if that’s what we’re able to accomplish right now, I’ll be supportive of that.”

DEA tells Congress it’s considering easing marijuana restrictions

The session started quietly, with $27M ($16M) PT notional through lunch and the ETF trading 2-3% lower. By 2PM ET, however, volume came in and the tape found a bid as MSOS took out yesterday’s high and challenged the December high at $7.70.

More buyers stepped; 50K lots at first, then multiple six-figure prints in Verano and Curaleaf. The bears made a stand during contra-hour bc they knew that succumbing to bovine desires would register a technically significant higher high.

As I readied for my 3PM call w Weldon + others, MSOS was trading triple sevens…

…with total notional $75M ($38M the ETF).

By the time I got off that call, ten minutes before the closing bell, that had swelled to $132M ($70M) with MSOS having traded as high as $8.12 before retesting $7.70 (twice) and finishing the week at $7.91.

We know this space has been in the pay-no-mind club for years and the flat YTD perf in 2023—despite eye-watering rallies elsewhere—had our ‘hood all out of sorts earlier this week. Ask me for receipts how I know.

After a trough-to-peak 22% move higher in two-ish sessions, MSOS is +13% YTD and it would seem that at least some circles have started to pay a bit more attention.

Humility > Hubris as we collectively find our way.

AGP 2024 Cannabis Outlook:

“All in, we look for 2024 investor focus to be primarily on the timing of rescheduling, shifting to expected uses of cash flow benefits (w 280E removal) and the potential for incremental federal catalysts (such as SAFER).

Longer term, we expect underlying consumption to persist (volumes up 28% November YTD per BDSA), as we still view cannabis as a $105B US mature market with larger CPG companies eyeing the industry for opportunities to enter (federal reform likely needed).”

Jefferies on near-term catalysts

“While rescheduling alone may not be enough for capital market changes, if we also see this alongside things like SAFER Banking and a new Cole Memo, prospects become much greater in our opinion. Critically, however, we think uplisting — to NASDAQ or NYSE at least, as opposed to TSX — is very unlikely on the basis of SAFER Baking and a new Cole Memo alone, and making rescheduling the key contributor to making it happen.”

The Secret to My Marriage Is Daily Cannabis Consumption

Enjoy your weekend, be safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.