The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click the title to access any article; most stock stuff and analysis is behind the paywall and you can access a free trial by clicking below; thanks for your support.

Fall Ball 👈

Canna starts Autumn with a Dub.

Sept. 23, 2024

With only weeks until the election, the White House is again promoting the Biden-Harris administration’s cannabis policy accomplishments but this time, they’re using less lofty language than during their “Mission Accomplished” moments of the past.

The White House shared an updated webpage that provides an overview of various successes the administration is claiming credit for, including, “Issued a Review to Reschedule Marijuana,” while also mentioning ‘Biden’s mass cannabis pardons.’

Inside-Out

Thanks to a $30 billion state-licensed cannabis economy spanning 38 states—15 of which are Republican states—marijuana legalization is becoming a proxy for classic conservative issues: pro-business, states’ rights and freedom from Big Government.

Jeremiah Mosteller, policy director at AFP, billionaire Charles Koch’s political advocacy group, has been lobbying GOP lawmakers on canna reform since 2018. He says that, after years of perpetuating the war on drugs, the GOP has finally realized that legal cannabis is happening with or without them.

Rep. Dave Joyce (R-OH) is among the converted. Last December, Joyce introduced the States 2.0 Act, which would formally legalize state markets under federal law. If passed, the state-rights’ approach would mirror how sports betting is now legalized.

Crock Pot

A recent supreme court decision that weakened power at US government regulatory agencies such as the Drug Enforcement Administration (DEA) has added additional confusion to America’s already chaotic cannabis law.

This month, a federal court was able to overrule the DEA on what qualifies as legal hemp, in part because of a supreme court decision that nullified the Chevron doctrine, which once directed courts to defer to the expertise of federal agencies—but now the reverse will apply and courts may have the final say over highly technical regulations.

“It’s a mess. When you have the DEA saying one thing, you have the farm bill saying another thing, you have the court swinging in one way or the other. It just goes to show that these hemp derived products need to be regulated in a sensible manner.”

Dr. Peter Grinspoon, Harvard Medical School instructor

Raison d'état

A new report by the libertarian nonprofit Reason Foundation blames arbitrary business model structures and their resulting competition for hemp and marijuana on illogical federal laws that conflate the two plants, which are essentially the same with differing cannabinoid profiles.

“The proliferation of intoxicating hemp-derivative products like delta-8 THC stems from the fact that hemp-derivatives are cheaper and more accessible because they are not federally prohibited and not yet burdened by state regulations to the same extent as marijuana.

There is clearly a demand for intoxicating cannabis products, and consumers will continue to seek out such products whether they are defined as marijuana or hemp and whether they are legal or illicit.”

Welcome to Autum 2024

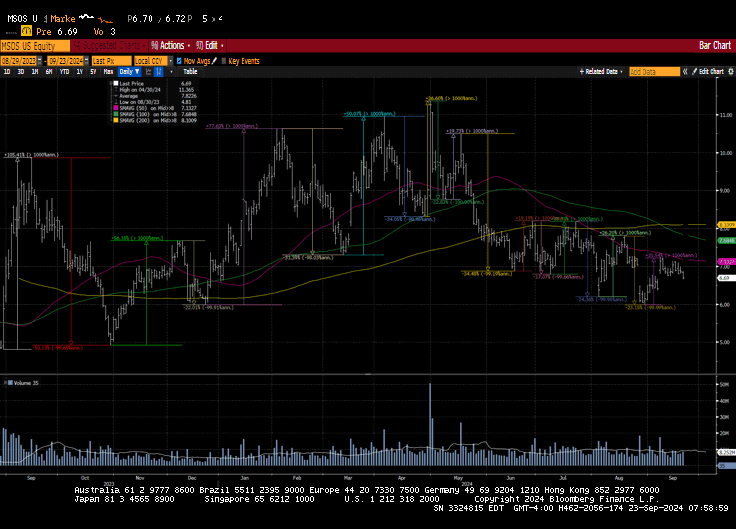

If volatility is the opposite of liquidity, the lack of custodian solutions for U.S. cannabis stocks has created a double black diamond course on our way to the promised land.

Since the HHS leak in August 2023, we've seen rallies of 105%, 56%, 77%, 50%, 37%, 20%, 19%, 20%, 26% 21%—as well as drawdowns of 50%, 22%, 31%, 24%, 23%, 34%, 17%, 24% and 23%. That all happened in a little more than a year.

U.S. canna ETF MSOS was trading at $4.85 right before that BBG leak crossed in the dog days of last summer, which means the ETF, despite a wild ride, is still 38% above where it was a ~year ago.

That is of little solace considering the ETF was trading $56 in the Spring of 2021 but a lot has happened since then (on state level)—and a lot hasn't (on federal level). But, as the Street views this space as a singular referendum on federal reform, here we are.

We fingered the Trump Gap last week and that it would resolve, should it fill, at $6.41, which was where the ETF was trading prior to the GOP presidential nominee derisking S3 and perhaps SAFE Banking; it was just talk not walk but still, a seismic political shift.

Word on the street is that the Wyden Hemp Bill will drop this week and while we've discussed what it might say and if it could pass, we're keen to read the language and see where this effort lands; again, it would still need to clear both changers + POTUS.

43 days until the election +FL. Polymarket has KH 51% to DT's 47% but that's subject to change, as it has, as the campaign enters the home stretch and the next iteration of our political future awaits. What a time to be alive.

Ground Game 👈

Three yards and a cloud of puff.

Sept. 24, 2024

The slate of cannabis ballot referendums this November will be headlined by Florida, the third-most-populous U.S. state, where voters will decide whether to legalize adult-use marijuana through ballot measure Amendment 3.

A victory in Florida would be one of the top legalization events in recent U.S. cannabis history, trailing only California’s successful referendum in 2016, New York’s Legislature approving adult use in 2021 and President Biden seeking to reschedule marijuana.

Cali Sober

Governor Gavin Newsom’s controversial emergency ban on all hemp THC products in California was approved by the Office of Administrative Law on Monday, effectively shutting down a thriving product category within California’s cannabis industry.

Retailers will no longer be able to sell popular products like drinks made with hemp THC, an intoxicating cannabis compound and many types of medicinal products made with CBD, a nonintoxicating compound.

MO Lester Hemp

Sales of products containing intoxicating hemp-derived cannabinoids may resume in Missouri after a top state official indicated a change in enforcement priorities.

That move defies an order from Missouri Governor Mike Parson that led the state Department of Health to use state food laws as the legal basis for a wide-ranging embargo on intoxicating hemp products.

Land of Lincoln Benjamins

After not announcing the monthly totals for July, Illinois Department of Financial and Professional Regulation announced adult-use canna sales totals for July and August.

For the fifth-straight month, Illinois’ sales totaled at least $141 million. July sales were $143M and August sales reached $147M, which was the third-highest monthly tally since legalization began in January 2000.

Village Farms International Acquires Remaining Equity Ownership in Leli Holland

The Hemp Bill Hits 👈

Sen. Wyden drops his draft.

Sept. 25, 2024

Sen. Ron Wyden (D-OR) introduced a new bill that would create a federal regulatory framework for hemp-derived cannabinoids, allowing states to set their own rules for products such as CBD while also empowering the FDA to ensure that certain safety standards are met in the marketplace.

Rather than impose an outright federal ban on hemp products containing traceable amounts of THC, as has been proposed in recent months, Wyden’s bill would offer a regulatory pathway that many hemp stakeholders view as more sensible.

Up in Smoke

Members of the California hemp industry—including Cheech and Chong’s cannabis company—filed a lawsuit seeking to overturn new regs that outlaw most consumable hemp products, including those containing any intoxicating cannabinoids.

Newsom’s emergency ban won official approval from Cali Office of Admin Law on Monday and took effect immediately. The rules prohibit hemp products with any “detectable amount of total THC,” while hemp products that don’t contain THC are limited to five servings per package and may only be sold to adults 21 and older.

Feed the Turtle

Maryland collected $22.4M in cannabis taxes from April to June 2024, marking a 52% increase compared with revenue collected in Q124. Despite the surge, local govts still receive only a tiny portion of the revenue.

Adult-use cannabis in Maryland carries a 9% sales tax, which supports several State funds. Local governments, however, receive just 5% of that revenue, which is among the lowest shares nationwide.

Viva Las Vegas

A new report confirms that Nevada has been suffering a multiyear downturn in its cannabis trade since the end of COVID-19 but it now predicts a brighter tomorrow, with a shrinking illicit market and more growth for the legal framework.

While sales appear to have leveled out in the short term, “projections show a reversal of that trend, with growth estimated to continue through 2030, as well as a projected increase in the number of consumers.”

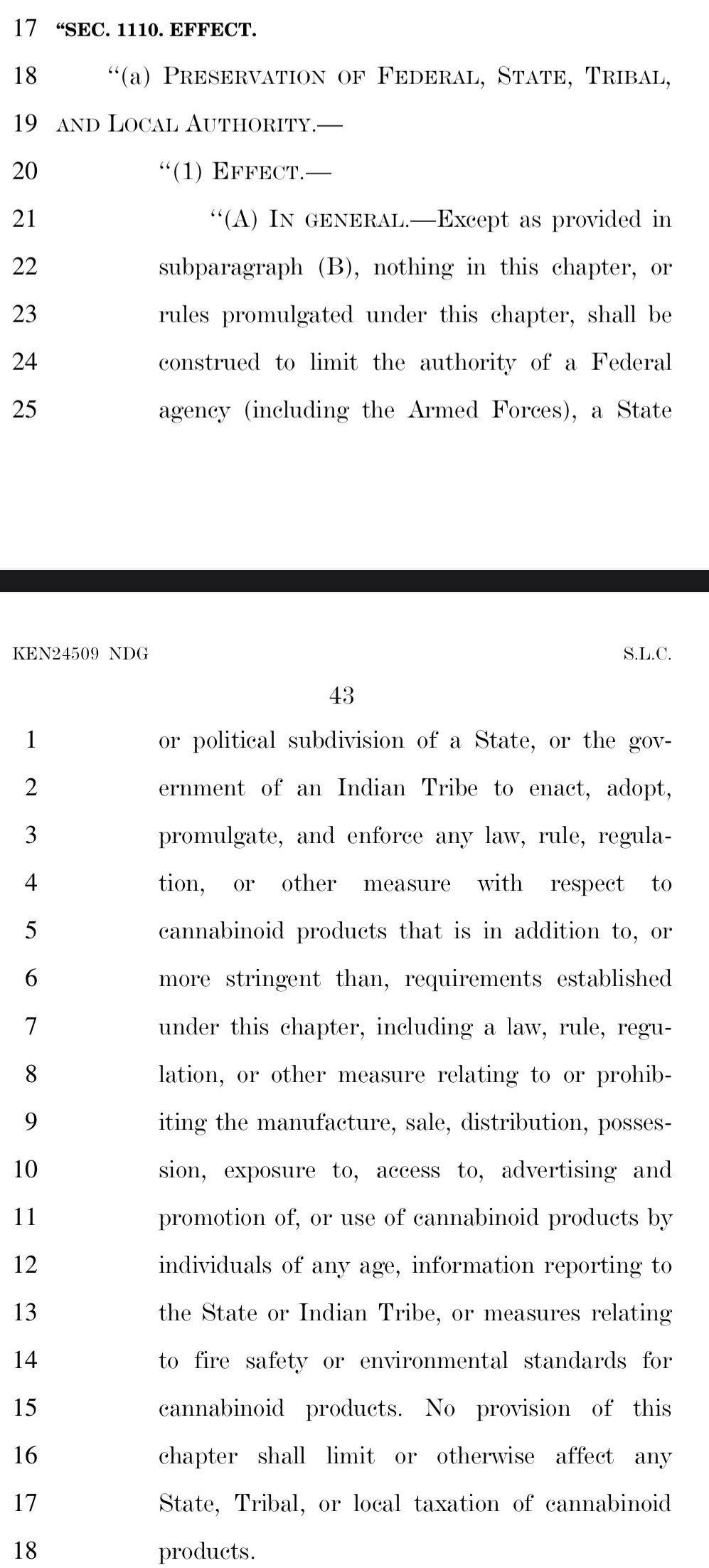

A few top-line takeaways after reading the latest Wyden draft:

There wasn't a political will to try to dismantle state-level frameworks. We didn’t sense they could given the 10th amendment but its encouraging to see a deference to those constructs in all but one area (labels) that would create minimum standards for states that don’t currently have a regime.

[the Center for Cannabinoid Products within the FDA needs to be sussed]

Low-dose hemp beverages are a loss leader for U.S canna dispensaries and take up too much space. As LDHB cannibalizes alcohol not weed—and we view them as a funnel to a deeper cannabinoid experience—the proposed framework makes sense.

States could/ should/ will take actions to protect tax revenues and the jobs of their constituents—see Cali, New Jersey and others—given so many programs took years to evolve. Each state has unique alcohol provisions; cannabis should look the same.

Removing synthetic cannabinoids should benefit the entire cannabinoid curve.

Semi-synthetic cannabinoids (conversion of cannabinoids found in the plant into other cannabinoids found in the plant) would still be allowed, which would facilitate D8 and D9 as long as the proper consumer protections were in place.

When we sniffed this last week, we offered the following:

we heard [TTB] will regulate/ tax cannabinoids similar to how they currently works with and respects state laws for alcohol.

Given 'A' players want to be graded and 'C' players don’t, one would think a rules-and-regs driven marketplace would benefit legal operators who've been compliant.

^ told it would ban TCH-A by defining what THC is.

^ told it’ll focus on categories such as low-dose beverages and gummies.

^ would explain why NJ + CA govs took anti-hemp steps last week.

Those thoughts still check. Now, we’ll see how the particulars socialize and whether the political appetite exists to attach this to must-pass legislation like the Farm Bill.

^ slip SAFER banking in there too bc cultivators are farmers, which makes it germane.

Why, you ask, would anyone care about another cannabinoid-based bill when SAFE banking was introduced eleven years ago and is still dying on Chuck Schumer’s vine?

Because 280E likely goes away this year and the government will wanna replace it with another tax architecture. Follow the money. It’s always about the money.

40 Days and 40 Nights 👈

A new chapter awaits U.S. cannabis.

Sept. 26, 2024

A new government-commissioned report urges more marijuana-related guidance from Congress and federal agencies such as the CDC, finding that the “the federal government has been noticeably missing from this dialogue” as more states across the country have legalized cannabis for medical or adult use.

“States have received little federal guidance on how to proceed regarding the health impact of cannabis on the public and communities. Other than two memoranda deferring to states”—guidance rescinded under the Trump administration—”the federal government has been noticeably missing from this dialogue.”

Talk Soup

The Democratic Senate sponsor of a bipartisan marijuana banking bill says it’s “great” and “helpful” that former President Donald Trump came out in support of the reform, but he cautioned the pathway to passage in the chamber remains uncertain.

Sen. Jeff Merkley (D-OR) told Marijuana Moment that lawmakers will “look to the next possible vehicle” to advance SAFER Banking. Asked whether Trump’s support might move the needle on the GOP side, he said the legislation was “never a partisan” issue.

As SAFE has sat on a Senate shelf for 11 years, industry stakeholders might disagree.

Challenge Flag

Democratic vice presidential candidate Tim Walz said he thinks cannabis legalization is an issue that should be left to the states, and added that electing more Democrats to Congress could also make it easier to pass federal reform like banking protections.

The VP candidate stopped short of pledging to pursue federal legalization if elected, though both he and his running mate, current Vice President Kamala Harris (D) have taken steps in the past to support legalization.

Walz’s comments are believed to be the first time either member of the Democratic ticket has publicly discussed marijuana during the current campaign.

Hempseed

Members of Congress are looking to establish national standards for hemp products.

The Cannabinoid Safety and Regulation Act, which was introduced yesterday by Sen. Ron Wyden (D-OR) would create a comprehensive regulatory framework for hemp-derived cannabinoid products under the Food and Drug Administration’s oversight.

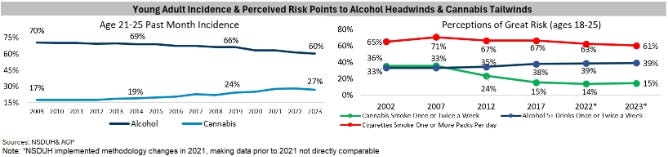

AGP: Data Points to Long-Term Risk to Alcohol & Tailwinds for Cannabis

ATB: Flower Still In Power, Pre-Rolls Gain Popularity: A Look at Form Factors

Do Terpenes Contribute To Medical Marijuana’s ‘Entourage Effect’?

Past Due 👈

Cannaland waits as the status quo grates.

Sept. 27, 2024

V.P Kamala Harris has previously supported federal canna legalization and continues to back reforms, but it’s not clear exactly how far she would go if elected president.

Since launching her campaign, Harris has not spoken about marijuana at length and her website’s policy page contains no mention of the issue. Further, her campaign declined to elaborate on her current position when reached for comment this week.

Speculation persists that the reason her team has been silent on the issue is because she favors decriminalization and articulating that stance while the DEA is finalizing a years-long rescheduling review process—a directive from her Administration—would muddy the waters late in the game.

Common Wealth

Strong majorities of Pennsylvania voters in five key tossup districts are in favor of legalizing cannabis in the state and they want to see reform enacted this year.

The poll shows that more than 60% of voters in five state House districts—HDs 16, 72, 118, 144 and 151—back the policy. Notably, in four of those districts, Donald Trump is currently leading Kamala Harris in the presidential race.

Florida Man

When Donald Trump came out in favor of Amendment 3, it was a surprising wrinkle in the ongoing effort to legalize adult-use cannabis in Florida. Supporters are hopeful the former president’s support will help nudge undecided voters, who represent 15% of the electorate, in the direction of a “Yes” vote.

With little over a month before the national elections, polls show the future of Florida adult-use cannabis balanced on a knife’s edge. Ballot measures in Florida must garner at least 60% of the vote to pass, meaning every vote is critical.

And Rand

Sen. Rand Paul (R-KY) has reintroduced a bill that would triple the concentration of THC that the hemp could legally contain, while addressing multiple other concerns the industry has expressed about the federal regulations.

Hemp and its derivatives were legalized under the 2018 Farm Bill, but the proliferation of intoxicating cannabinoid products led to pushes in Congress and state legislatures across the country to reign in the largely unregulated market.

Viridian on U.S. cannabis multiples

The graph below shows the enterprise to next twelve-month valuation multiple for each of the tier 1 MSOs on 9/22/23 (blue bars) and 9/20/24 (orange bars) and the percent decline in multiples over the year.

On 8/30/23, the United States Department of Health and Human Services (HHS) announced that it was recommending that cannabis be moved from Schedule 1 of the Controlled Substance Act to Schedule 3, a change with massive tax savings implications that we estimated to be $700M – $1B for the top ten MSOs alone.

Stocks rocketed on the news; aggregated EV / Next Twelve Month (NTM) multiples for the group rose from 6.48x on 8/25/23 to 9.00x on 9/22/23. A year later, aggregate multiples for the group are 6.92x, nearly back where they started, despite being a year closer to the effectiveness of a landmark change in regulation and taxation.

Are we surprised multiples have fallen so far? Of course! However, with S3 continuing to march toward completion, renewed talk of SAFER, and both candidates espousing positive cannabis rhetoric, we continue to believe the opportunities for genuinely massive gains are in place.

Investors who ride through election-year histrionics are likely to be rewarded in the first half of 2025.

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.