The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click the title to access any article; most stock stuff and analysis is behind the paywall and you can access a free trial by clicking below; thanks for your support.

Hollow Man 👈

U.S. canna stocks never opened in Canada.

May 20, 2024

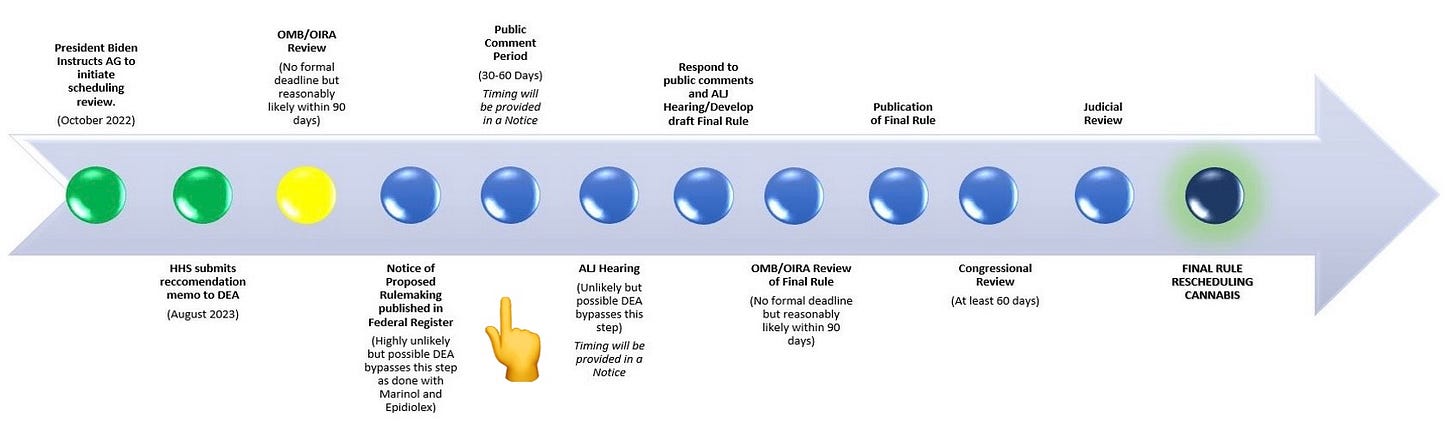

President Joe Biden officially confirmed that cannabis is set to be rescheduled from a Schedule I to a Schedule III substance and that rescheduling will likely happen before the upcoming presidential election, per analysis by Bank of America.

This ‘tectonic shift’ in policy has been widely expected since April 30th, when the AP reported that sources within the DEA confirmed that they would support the move, with confirmation coming from the DOJ last week.

Comment Section

The DOJ says it is interested in receiving public comments on the “unique economic impacts” of its cannabis rescheduling proposal given that state-level legalization has created a “multibillion dollar industry” that stands to benefit from possible tax relief.

The Justice Department’s move to place canna in Schedule III of the CSA has already generated intense public interest and the 60-day public comment period that opens this week is expected to garner a wide-range of feedback from all sides.

Citi Habitats

Over the weekend, the New York City Sheriff's Office raided an illegal smoke shop on the Upper East Side as part of their ongoing crackdown on unauthorized smoke and cannabis outlets across the city's five boroughs.

During the initial week of enforcement, the Task Force, which includes members from the Sheriff’s Office, NYPD and New York City Department of Consumer and Worker Protection, sealed 75 locations and imposed fines totaling nearly $6 million.

Viridan on U.S. cannabis sub-sector returns:

AGP on U.S. Cannabis:

We see a path to a final ruling to come before the election, with top MSOS trading at 7.9x 24E EV/EBITDA, despite most MSOS now already getting the 280E CF benefits and a strong probability that the ability not to pay 280E will become official in ‘24 with rescheduling (retroactive to Jan 1).

ATB on U.S. Cannabis

'high probability rescheduling gets done this year; AG has authority over DEA; clear political will to finish < election; and, Ohio adult-use could start next month.”

Better Call Saul! 👈

Attorneys opine on recent concerns.

May 21, 2024

The Associated Press, which broke the canna rescheduling news on April 30th, added further flavor from behind the scenes on how the decision was arrived at, noting the Department of Justice basically bogarted the process from Anne Milgram’s DEA.

Justice Department attorneys defended Garland’s move to proceed without Milgram’s backing, the AP reported, saying the action was prompted by “sharply different views” between the DEA and the Department of Health and Human Services.

Either way, the DEA published the proposed rule in the Federal Register this morning, which officially punched the clock that began the 60-day comment period, and we’ll speak with a few legal eagles on the impact of these inferred implications below.

Pregame (written at 6:15 AM 👀)

Late Friday, I wrote:

"By 2PM, the ETF halved its losses as GTI and Trulieve tried to lead a late-day reversal but the space felt tired, if not trapped. Great expectations and lurching, bureaucratic processes don’t make for the best bedfellows, particularly when a side of the stadium is still sitting in their cars."

Yesterday, trappy turned crappy turned into a jam job; the bear case that we postured:

'"SIII/ 280e partially baked-in with the rest likely to wait until clarity on a final rule and/ or line of sight on custody/ listing via SAFE or SIII/Garland.

60-day comment period; barring SAFE /Garland, what’s the summer headline risk?

no risk of a surprise takeover or institutional squeeze.

crypto crowd saying, “too much opportunity cost””

...helps to contextualize the recent price action and by the way, we saw a similar move ahead of the March WSJ article re: dissention at the DEA. I've watched enough Netflix government conspiracy docudramas to know where that leak is.

Recall, as well, after the HHS' news leaked at the end of August, $MSOS ran 105% in two weeks before giving it all back the following two months, before doubling anew in the three months that followed. Warning: the next chart might cause dizziness:

Several weeks ago, we offered there would be all sorts of scary headlines + opposition agendas between where we were and where we're going. Given what we know about the drama to date, this final frontier shouldn't come as a surprise.

Insofar as liquidity is the opposite of volatility, we also also know that as gates open + the space normalizes, a rise in the former will serve to quell the latter, resolving, quite hopefully, ‘up and to the right.’ Until then, every day promises to be a battle.

Better Call Saul!

Question: Does this blurb from the AP article concern you?

"Officials also noted that while the CSA grants the AG responsibility for regulating the sale of dangerous drugs, federal law still delegates the authority to classify drugs to the DEA administrator.”

Answer, from informed attorney #1:

“The fact that the AG signed doesn’t concern me. Congress delegated the authority to him, he redelegated to DEA Administrator, but it remains his authority. He’s the boss.”

Answer, from informed attorney #2:

"Not concerned nor is it news that some senior folks at DEA aren’t happy, but this is driven by Biden so if they want a job next term if Biden wins, they’ll go along with it."

Echelon on U.S. cannabis:

Rescheduling Implementation Officially Underway & De-Risked. Large/Mid-cap MSOs trade at 9x 2024E EV/EBITDA vs. trough multiples of 6x, peak multiples (Feb. 21) of 24x, and comparable industries (i.e., Beer, CPG, Retail) bw 10x-16x.

Make America Green Again™️ 👈

U.S. cannabis has bipartisan support.

May 22, 2024

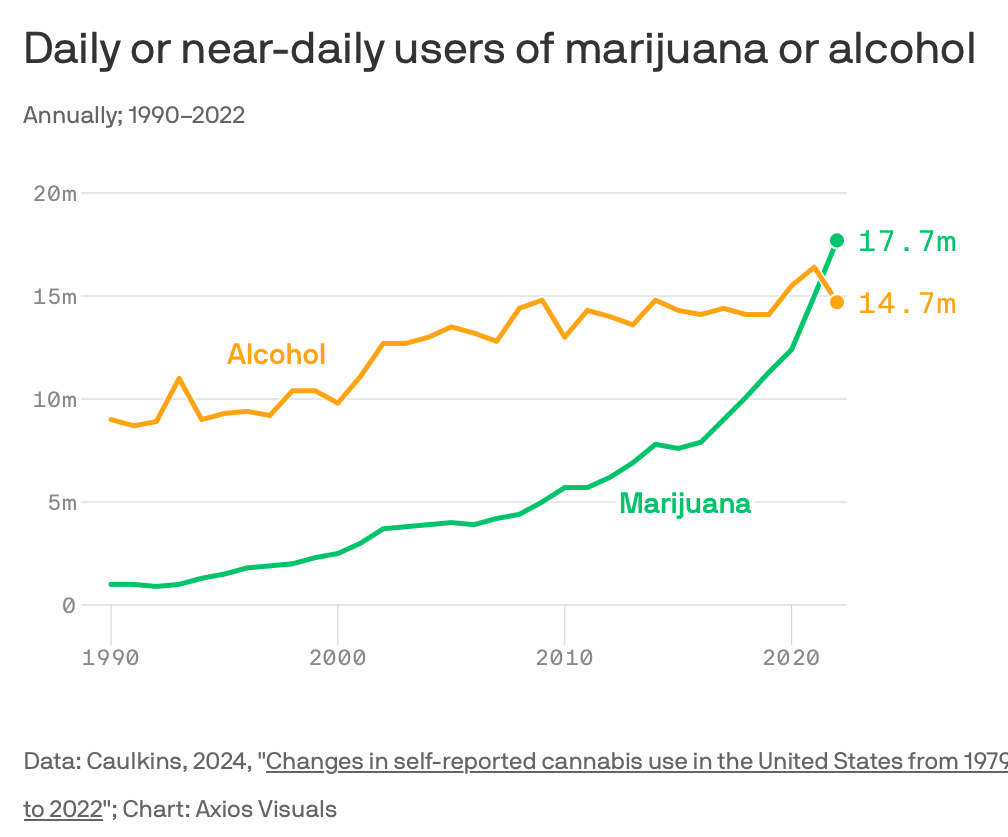

Daily and near-daily cannabis use is now more common than similar levels of drinking in the U.S., according to an analysis of national survey data over four decades. Alcohol is still more widely used, but 2022 was the first time intensive level of marijuana use overtook high-frequency drinking.

In 2022, an estimated 17.7M people used cannabis (near-) daily compared to 14.7M (near-) daily drinkers, according to the study, and from 1992 to 2022, the per capita rate of reporting (near-) daily marijuana use increased 15-fold.

“A good 40% of current cannabis users are using it daily or near daily, a pattern that is more associated with tobacco use than typical alcohol use.”

SPY vs. HIGH

A farm bill battle is pitting hemp against its cousin (by marriage): cannabis. The fight centers on intoxicating hemp products, which have stealthily developed into a multi-billion-dollar industry subject to few rules and regulations.

Some canna companies and trade groups are pushing Congress to close the loophole that allows for the production and sale of intoxicating hemp-derived substances—but the hemp industry has a different ask of lawmakers: leave the plant alone.

“This will probably be one of the more interesting debates and discussions in the farm bill.” House Agriculture Chair G.T. Thompson (R-PA)

The People’s Court

Litigator David Boies, whose prior clients include former Vice President Al Gore and plaintiffs in the case that led to the invalidation of California’s same-sex marriage ban, led his team into a Massachusetts courtroom today on behalf of U.S canna companies.

A ruling on the motion to dismiss could take anywhere from weeks to months, legal observers said of the case, while the full lawsuit could take years to conclude, as it will likely be appealed no matter which side wins at the district level.

Pregame (written 7:30 AM) 👈

We limp toward today's hump after waiting for the watched pot to boil, only to see it simmer slightly into the close.

Technically, we know the drill: MSOS held its primary trendline but the tone has been tenuous at best and the bulls are far from out of the woods. Remember, our sector struggles came amidst a big-time risk-on rally; the other side of that is out there, too.

We spoke about a dearth of known catalysts on Monday and the perceived window for the bears to press. I've been sniffing at other potential headlines that could move our space and one stands out: a pro-pot pivot by the other presidential candidate.

The issue seems plausible for a populist: 91% of the country is supportive of cannabis legalization in some form, and the removal of the uncertainty (if the GOP wins in Nov.) would be enough to pull some (many) of the fence-sitters into the arena.

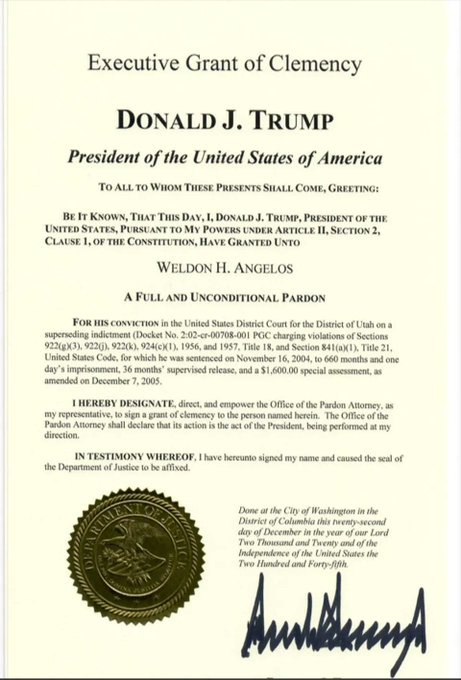

The timing isn't knowable, nor are there any guarantees it’ll happen, but yesterday we saw reports that the Trump campaign will accept crypto, and we know states' rights is a traditional GOP flex—and it's not like the Dems haven’t left themselves exposed.

Put another way, if the presumptive GOP presidential nominee came out pro-canna—through the lens of business, no less—it would chop off an entire tail of concerns and that, to me, is the most viable leftfield upside trigger.

Either way, I know one man who’s “a firm believer in mercy and second chances,” and that’s my friend Weldon Angelos, who was pardoned by Trump in December 2020 after serving thirteen years (of a 55-year sentence) for selling $900 worth of weed.

Random Thought 🤯

Why not attach SAFE Banking to the Farm Bill for all of the new U.S. farmers?

John Maddening 👈

Cannaland continues to confound.

May 23, 2024

The Biden administration’s drug czar said the DOJ’s recommendation to move canna to Schedule III of the CSA is one “based on science and evidence,” adding the change will ease research restrictions around the use of cannabis to treat “chronic illnesses, chronic pain and diseases like cancer.”

“It’s been quite a bit of science that has developed over the last few years, certainly since more than a half century ago when those placements happened, that show us that this may not be where it belongs.” -ONDCP Director Rahul Gupta

Farm System

An amendment to close the loophole permitting intoxicating hemp products was filed ahead of Thursday's farm bill markup in the House Agriculture Committee by Rep. Mary Miller (R-Ill.).

As written, the language would change the definition of legal hemp to only include non-intoxicating cannabinoids derived naturally from the cannabis plant, as opposed to hemp derivatives like Delta-8 THC and Delta-10 THC that have psychoactive effects.

Pregame (written at 8:00AM) 👈

We dust ourselves off for a fresh session after spending the week absorbing supply from frustrated holders as incremental buyers are either gated or on strike.

With earnings, Boies and the DOJ proposed rule behind us, the bears continue to perceive a window of bovine vulnerability as we ready to start summer. Their 🎯 is clear and obvious: to break the charts and in the process, the backs of the bulls.

Speaking with buyside accounts (+hearing same from others), the big money doesn't appear to be in any rush to buy ahead of the election as they're worried SIII won't get done in time and concerned a GOP administration could arrest these developments.

While we're of the view that SIII likely gets done prior to November and the GOP will embrace states' rights for canna (and abortion) given polling in the swing states OH, PA, FL) we're keenly aware this is a show-me story that's vulnerable to duration risk.

In the absence of clarity, people often defer to charts which makes this juncture both obvious and dangerous. I recall last August when MSOS broke $5, the last line of technical defense, and it was game over until one headline, one week and 100% later.

Know what you own and why you own it, and good luck.

Channel Checks

I spent 45 min this afternoon on the phone w a C-level at a tier-one comparing notes, and don’t think were missing much—buyers gated/ sidelined until more clarity, with the bears on attack into the perceived quiet period (a fear we flagged Monday).

I noted that absent incremental news, their motivation to trigger retail capitulation—and if today was the NVIDIA top (idk if it was), they’ll likely continue to press until it stops working.

The good news, albeit not for today, is that there is more good news coming, which could take the form of catalysts we know (SIII, OH, FL, PA, SAFE) or catalysts we've yet to consider (other admin. actions or something else from left field).

It's the here to there that's super-stressful, as evidenced by the fact that MSOS is -29% since the April 30th false breakout, which is little more than eye-watering context as we eyeball the 200-day moving average at $7.86.

Mood Ring

I checked X late in the session and the mood was as we would expect, as capitulation is seemingly afoot with the consensus somewhere between, 'if they can't rally on SIII, there's no hope for this sector," and, "there's no reason to own these this summer."

To the first point, SIII is far from perceived as a given, as evidenced by the fact that every conversation we have or heard about involves getting clarity on the timing of a final rule and/or a line of sight on custody, neither of which are in-hand.

Regarding the second assumption, nobody knows what’ll happen this summer but thus far, we’ve gotten everything we’ve needed re: SIII (to remain on the pre-election timeline) and there are indeed other levers to pull on both sides of the aisle given the popularity of this issue and polling ahead of the election.

I ain’t got no lipstick for today’s oinker but I did channel my inner Jeff Bezos at times and reminded myself, “the stock is not the company, and the company is not the stock.” The market looks six months ahead and six months from now is the elections and FLA and beyond that 2025, which should boast better fundamentals.

Technically, you can see the needle and the damage done to the primary uptrend but you can also see the last year has been riddled with insane, gut-wrenching, you’ve got to be kidding me type moves as we continue to grind ahead.

May Days 👈

A tough month sinks sentiment.

May 24, 2024

An amendment seeking to ban intoxicating hemp-based cannabinoids nationwide is now part of the U.S. House of Representatives’ draft Farm Bill. The House Committee on Agriculture passed an en bloc amendment that would redefine hemp to exclude intoxicating hemp-derived cannabinoids.

While the House version of a new draft Farm Bill will include the hemp amendment coming out of committee, its place in the final legislation is far from assured. The U.S. Senate Committee has yet to release its own full text of a proposed bill.

No More Viking Funerals

The Minnesota Legislature gave final approval to a broad package of new rules for the state’s upcoming recreational marijuana industry, giving businesses a clearer picture of what to expect for next steps.

The bill has yet to be signed by Gov. Tim Walz, but he is expected to be on board, the Star Tribune reported. The state Office of Cannabis Management is also in support of the measure, which contains a major overhaul of the state’s medical canna regs.

Canna CHiPs

Two major law enforcement organizations have endorsed a bipartisan bill to end federal marijuana enforcement in legal states, a cannabis group whose membership includes large tobacco and alcohol companies announced.

The Peace Officers Research Association of California (PORAC) and the Oregon Coalition of Police and Sheriffs are both officially backing the Strengthening the Tenth Amendment Through Entrusting States (STATES) 2.0 Act.

Good Day, Sunshine

Dr. Michael Binder, a poly-sci prof at UNF, said the reception of Florida’s proposed Ammendment 3 ballot inititiative has “generally been very positive,” citing one poll with a 67% support rate for the legislation, adding, “I think it has a high chance of passage.”

Random Thoughts

fragile psychology + broken charts + thinning liquidity = they can/ will do whatever they want in this space until it stops working; I mean, wouldn't you? sentiment is as bad as I've ever seen for good (structural) reason but that's not a timing tool, per se.

still feel good on the other side of this process of price discover; SIII + Garland not priced in, nor is FL or SAFE or PA or OH NY + other levers to pull from both sides of the political aisle through the summer.

someone once told me the secret to a succesful life is the ability to view obstacles as opportunities and idk if I practice that enough but I do try to remember it.

Put That In Your Pipe and Smoke It!

ATB on the Farm Bill

A House committee has amended the Farm Bill to impose a ban on hemp-derived cannabinoids, such as delta-8 THC. This doesn't impact MSOs negatively (many of them have pushed for more regulation of hemp-derived cannabinoids), and in fact could be seen as a positive. Hemp-derived products are a competition to regular cannabis products, so the ban could benefit MSOs.

The only MSO that could be seen as negatively impacted would be Curaleaf, given their plans to enter the hemp-derived market. These plans were announced during the Q1/24 earnings call, but this vertical would still be in the early stages and not factored into the street's estimates.

Punch Bowl News

The summer before an election is usually a slow time in the Senate. But Majority Leader Chuck Schumer has a lot on his mind with Democrats’ control of the Senate in doubt next year.Schumer has vowed to find a path for several different pieces of bipartisan legislation that the Senate has been unable to pass.

Think railway safety, cannabis banking, kids’ online safety, the Affordable Connectivity Program, bank executive clawbacks, prescription drugs, AI regulations and so much more.It’s not clear whether any of these can actually pass or whether Schumer will force “show” votes on any of them to put pressure on Republicans or otherwise help boost his most endangered members.

Cannabis Tops Alcohol as Americans’ Daily Drug of Choice

Enjoy your weekend, stay safe and please enjoy responsibly (←26 yrs ago; RIP JP)

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice