Groundhog Day

The status quo continues to continue.

January is in the books and while the broader markets are chugging along, cannabis stocks continued to wait in vain for the other side of the President’s Executive Order.

AG Pam Bondi has been pretty busy of late and with a partial government shutdown upon us, the rescheduling process remains a fluid and dynamic situation.

Cannabis reporter Anthony Martinelli offered this thought late last week, which I echo through the lens of confirmation bias:

“According to an advisor to President Trump, AG Bondi informed multiple people this week that the DEA will publish a final cannabis rescheduling order “in a matter of days”. This means if the agency doesn’t meet Trump’s end-of-January directive, it likely won’t be missed by much.”

This is consistent with one of our one sources who told us several weeks ago that ‘it’s coming, but it could slip into February.”

That was before the specter of another shutdown became self-evident but a separate source said that wouldn’t matter for this. I’m as dubious as I was when he told me the government would close the hemp loophole by year-end (which of course happened).

Anthony also shared this tidbit earlier, in response to reports that the Florida adult-use cannabis initiative failed to garner enough votes to make the November ballot.

Despite the state claiming Smart & Safe Florida failed to collect enough signatures to put their cannabis initiative on the ballot, the group says “We submitted over 1.4 million signatures and believe when they are all counted, we will have more than enough to make the ballot.”

There’s more to come from the three amigos, but that’ll take time to manifest once S3 is done. We see the same price action you do, but we also see the other side, one that is wholly dependent on federal reform and the halo effect that’ll create.

^ reminder, not all cannabis companies are created equal.

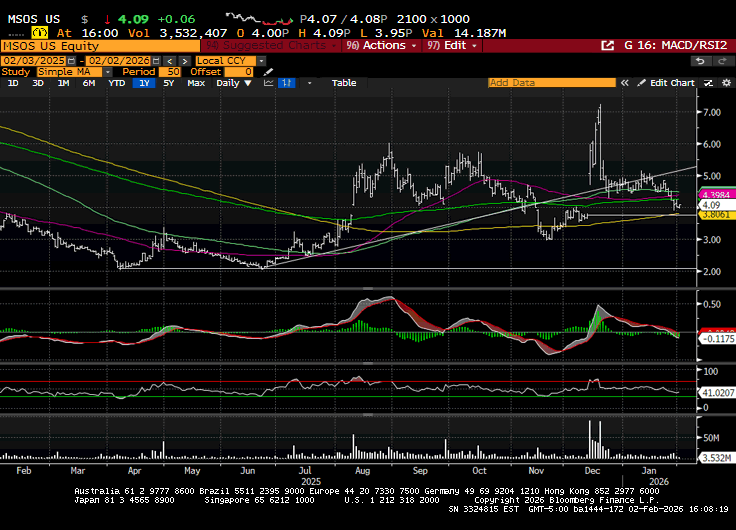

Chart-wise, MSOS held the 200day last week ($3.81), which also happens to be the EO gap, but price action was anemic at best, and volumes continue to be an afterthought, with total notional in the ETF all of $14M today. Take that, Karl Marx.

Top Stories

State of the Market 2026: Navigating the New Cannabis Landscape

Where Is Cannabis Legal In Europe?

New Year, New Cannabis Banking Opportunities?

30 Organizations Back Supreme Court Briefs Supporting Gun Rights For Canna

Marijuana Rescheduling—What’s Moving, What Won’t, And Why It Matters

Loose canna like spilled beer, not open container, state Supreme Court rules

Virginia: Most Voters Favor Retail Marijuana Sales

Scientists: Pot Drinks May Be ‘Harm Reduction’ for Alcohol

Industry Headlines

Cresco Labs Establishes US$100 Million At-the-Market Offering

Cannabist Enters Into Forbearance Agreement With Sr. Secured Noteholders

Trulieve Closes on $60M Private Placement of 10.5% Sr Secured Notes

Marijuana rescheduling means cybersecurity compliance for operators

AGP on U.S. Cannabis

Rescheduling remains of importance for investors, particularly on speculation around timing of when AG Pam Bondi acts as directed by the President within his December 18 executive order. We remain constructive on the AG following through with the directive from President Trump to reschedule in the “most expeditious manner” allowed by law. Speculation will remain until there is action or a direct statement, and we continue to view it as imperative that it comes in the relative near-term.

ATB on U.S. Cannabis

MSO valuations have retreated ~40% since President Trump’s Executive Order to reschedule cannabis. The pullback is unsurprising given the sector’s history, yet still surprising considering the fundamental change in political support.

Simply put: If we told investors a year ago that MSOs would be trading at 5.5x EBITDA following a Presidential EO on rescheduling, many would have called it a generational buying opportunity.

Yet, here we are. Cannabis investors have been conditioned to fade headlines, assuming regulatory delays and disappointments are a foregone conclusion.

But this time, we take the other side of that trade.

We think there is little logic in issuing an EO if the administration’s goal isn’t to finalize rescheduling rapidly, within this calendar year. When that materializes, sentiment will likely shift drastically. We see potential for equities to more than double as multiples expand to >10x EBITDA.

This isn’t a bold call: consider that the MSOS ETF 52-week high (in anticipation of the Trump EO) represents 77% upside from here.

We believe the main risk to rescheduling this year is the threat of litigation stalling the process. However, we view this as a lower-probability risk (<20%).

If our assessment holds, the risk-reward for US cannabis in 2026 is exceptionally attractive.

ATB on Cannabis Prices

US Canna Prices Are Still Flying High Relative to Canadian Prices

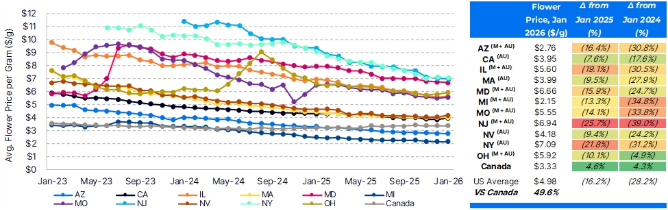

The chart shows monthly average retail flower prices in $/g for 11 states tracked by Headset and Canada (converted to US$).

There are two takeaways from the chart:

(1) Although retail flower prices keep declining across US markets, they’re still nearly 50% above those in Canada, implying that US pricing compression is far from over;

(2) Canadian flower prices improved slightly in 2025 and have remained relatively stable over the past ~8 months.

Canadian Prices Holding Steady: Flower prices in Canada were only slightly above Michigan at the start of 2023 and fluctuated modestly before making gradual improvements in 2025, with Jan. 2026 prices tracking to represent 12 consecutive months of growth on a y/y basis.

Canadian flower prices are up 4.3% compared to Jan. 2024 (and 4.6% compared to Jan. 2025). Despite impacted by extremely high excise taxes of C$1/gram charged at the producer level and which represent ~22% of the ending price at retail, Canadian flower prices still rank third-lowest of the group at ~$3.35/g.

While flower prices have been relatively stable in recent months, we generally believe the market is unlikely to fall back to the state of extreme oversupply seen in the past, due to companies now being more cautious on expansion plans.

Moreover, international sales are absorbing a large portion of the domestic supply, providing a base support to both the domestic supply/demand balance and the more stable pricing level.

Prices in Mature Markets are Still Seeing a Slow Burn

Michigan and Arizona have the lowest prices of the group and continue to see double-digit declines, with flower prices -13% and -16%, respectively, vs. Jan 25 (-35% and -31% vs. Jan 24).

California, which is one of the most competitive cannabis markets in the US, has the fourth-lowest prices of the group, followed by Massachusetts and Nevada; however, although prices continue to decline in these states, all three are now experiencing lower rates of decline than in prior periods.

Meanwhile, despite the notable price declines already experienced in New Jersey and New York (=25.7% and =21.8%, respectively, vs. to Jan. 2025, and -39% and 31%, vs. Jan 24), these states continue to have the highest retail flower prices of the group (39% and 42% higher than U.S. average).

Bottom Line: We expect that US average flower prices will continue to decline, and the rate of decline will be faster in higher-priced states like New York and New Jersey.

Putting a Pin in Pennsylvania’s Flower Prices

While not shown in the chart, based on mid-quarter pricing data, retail medical flower prices in Q4/25 were $7.59/g, representing the highest pricing level of the entire group for the quarter.

Despite being nearly fully surrounded by adult-use cannabis states, Pennsylvania’s medical canna sales remain strong, with Q425 sales +6% q/q (+3.9% y/y); pricing remains relatively stable, with retail flower prices up .3% q/q (-1.8% y/y). We believe the stability reflects operators holding off on further expansion plans until such time that a road towards adult-use legalization eventually becomes clear.

Stems & Seeds

Cannabis Use Correlated With Lower Rates of Obesity

Marijuana Access Associated With “Striking” Decline In Daily Opioid Use

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.