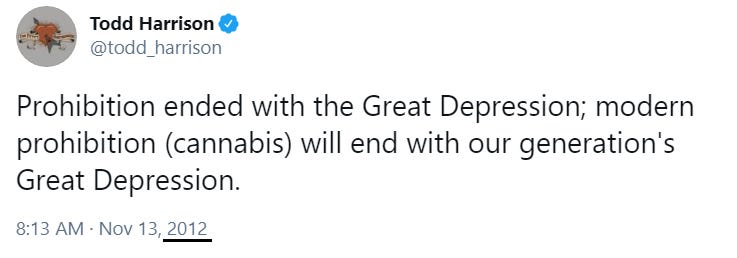

We’ve been talking bout cannabis a long time.

But it wasn’t enough to just talk about it. After deep-diving more than a decade ago and learning as much as I could about the history, science and next-level f*ckery that was The War on Drugs; how those artificial impediments and moral hazards evolved through time; the manifestation and human toll, both for those incarcerated and those devoid of medical and therapeutic treatments; as I first began to comprehend the potential for efficacious agility and contemplated what a natural business cycle would look like once this dormant asset class mobilized into a taxable realm… yeah, I think it’s safe to say I got it and once I did, I wanted everyone else to get it too.

If you’re new to the space, we’ve written about cannabis every month dating back to January 2018, right as the tippy-top of cannabis 1.0 (Canadian cultivation) printed and just before the BI Global Cannabis Competitive Peers Index lost 92% into last March.

[note: that index was +370% from last March to the Feb high and still +195% YoY]

I share this perspective for a few reasons. Yes, to understand where we are, we must appreciate how we got here, which is why I like to reference the past as a prelude to the future. But it’s also to remind ourselves that this is a movie, not a snapshot; a fluid and ever-changing probability spectrum that we’re all trying to solve in real time.

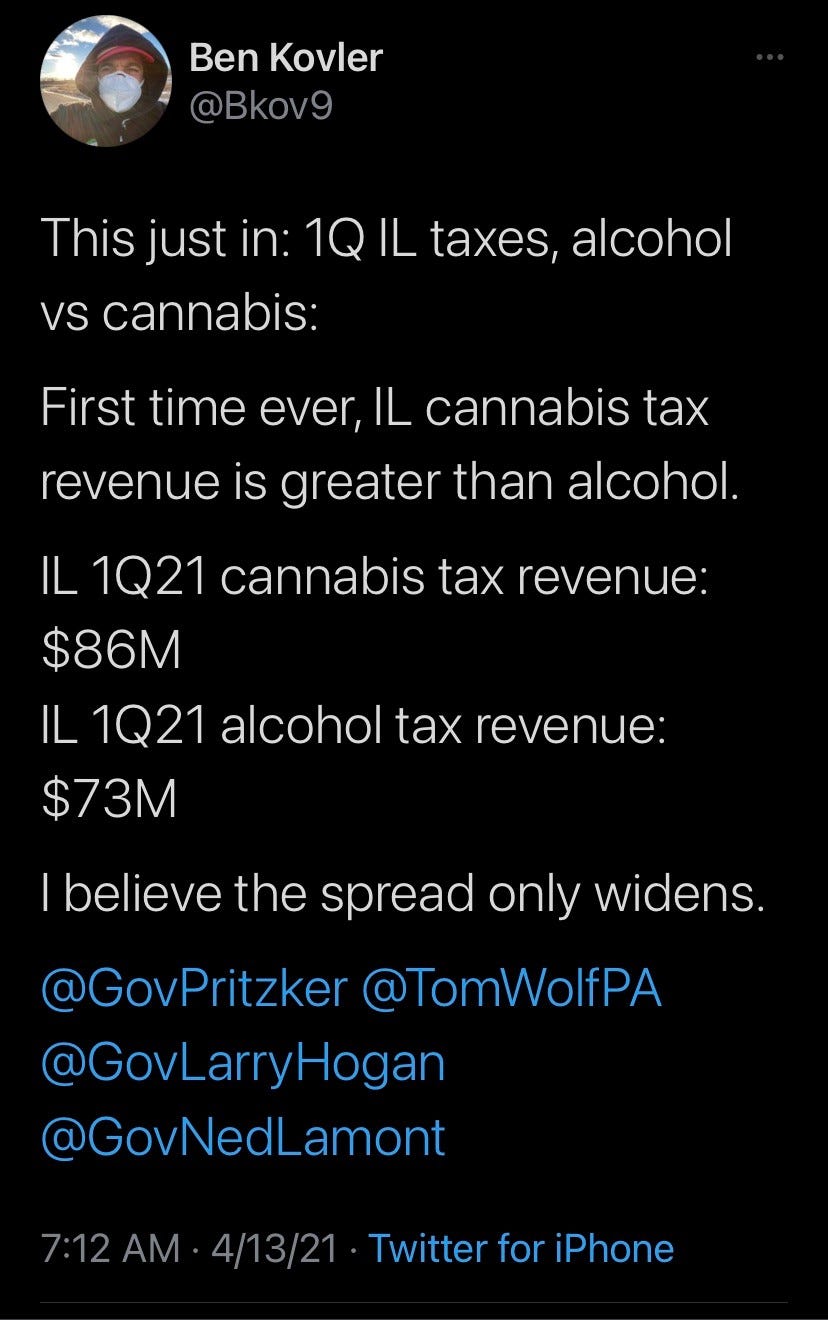

It’s an observation in social mood, as well. Two months ago, we were high-fiving and for good reason; the space had not only risen from the dead, it got up and ran. Straight through the pandemic, for which it was deemed essential; it kept going as a solution for tax-strapped states and municipalities and as income for displaced workers, and found its stride as a social justice hammer against the War on Drugs.

With a unifying cry last November that echoed in blue and red states alike, and with the Georgia run-off fueling the specter of meaningful federal reform, there was just so much to like as we turned our attention to St. Valentine’s Day.

U.S cannabis ETF $MSOS is up a respectable 12.7% YTD—it’s April—but also 26% below February levels, with many stocks off more than that. Maybe you haven’t heard but there’s no dog pictures no more. And those things you once thought were funny?

Nobody likes to lose money and when they do, they def don’t wanna hear quippy shit like, “stay humble or the market will do it for you.” I get it, I do, but there are lessons in every misstep and those unwilling to learn ‘em are likely to repeat ‘em. That goes for newbies and Neos alike; the whole lot of us, as we forge this forward path.

We must also remember we’re navigating the frontier here; no trail maps, double black diamond, all of it. These U.S operators found the only / crappiest exchange in Canada so they could dilute their stocks (no debt financing) to fund operations and pay (in some cases) an 80% effective tax rate w no banking or insurance, in an illegal industry!

And you know what homie? U.S leaders are still making bank so please…

“We cannot direct the wind, we can only adjust the sails” said somebody once and she was right. It’s a helluva thing when The Perfect Storm is going our way but when the wind cries Mary Jane, it’s all we can do to hold on, balance and breathe.

Having chewed through the near-term nuances— the bulls, bears & f*ckery, so to speak— lets pull on a more profound thread: the “do you remember how cannabis bottomed last March when the news was horrible; what if this is the mirror image of that two-sided scrimmage?” conversation.

By definition, we don’t know what we don’t know but that hasn’t stopped me from spending my time peeking around corners, turning over stones, asking uncomfortable questions and trying to find the south side of this ride.

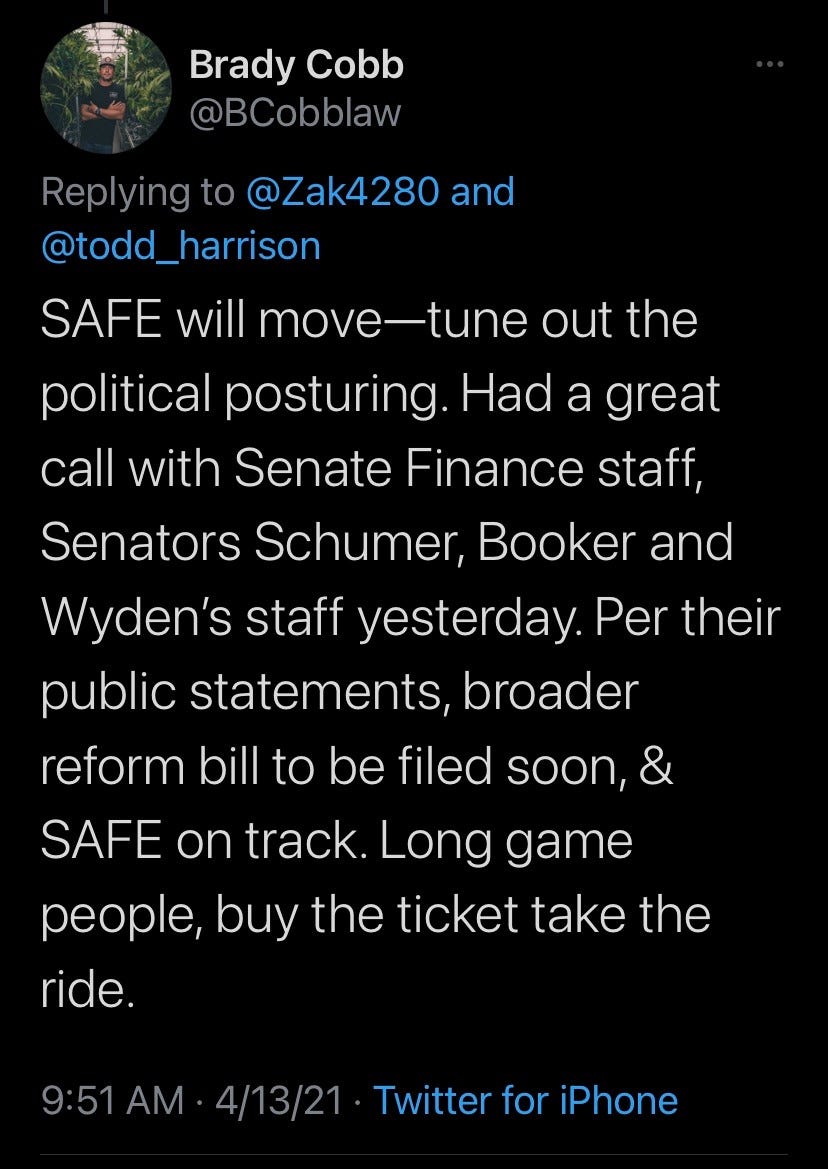

Because it’s a bit confusing, right? Not the pullback, that was overdue; just the subsequent ghost town. $MSOS, to pick a U.S canna proxy, is now trading where it was the day after the Senate flipped in January and that was before New York / New Mexico, SAFE in both chambers, and despite risk assets ripping higher.

My two primary cannabis bogies are the FDA and interstate commerce so that’s where my nose goes. It’s particularly hard because we don’t know what the language of this comprehensive bill will be, we only know that Chuck teased in January that he intends to keep the FDA at bay and leave legalization to the states

Interstate commerce is tricky and I’ve been reading up on things like the Dormant Commerce Clause (DCC) as I run through various scenarios in my crowded keppe. We have always believed cannabis is a states’ right and if push came to shove it would follow the precedent of online gambling all the way through the Supreme Court.

Think about it. The states aren’t giving back the tax dollars. The people aren’t giving back their jobs. The patients aren’t giving back their medicine. And you remember the 10th Amendment from Social Studies? States as the laboratories of Democracy?

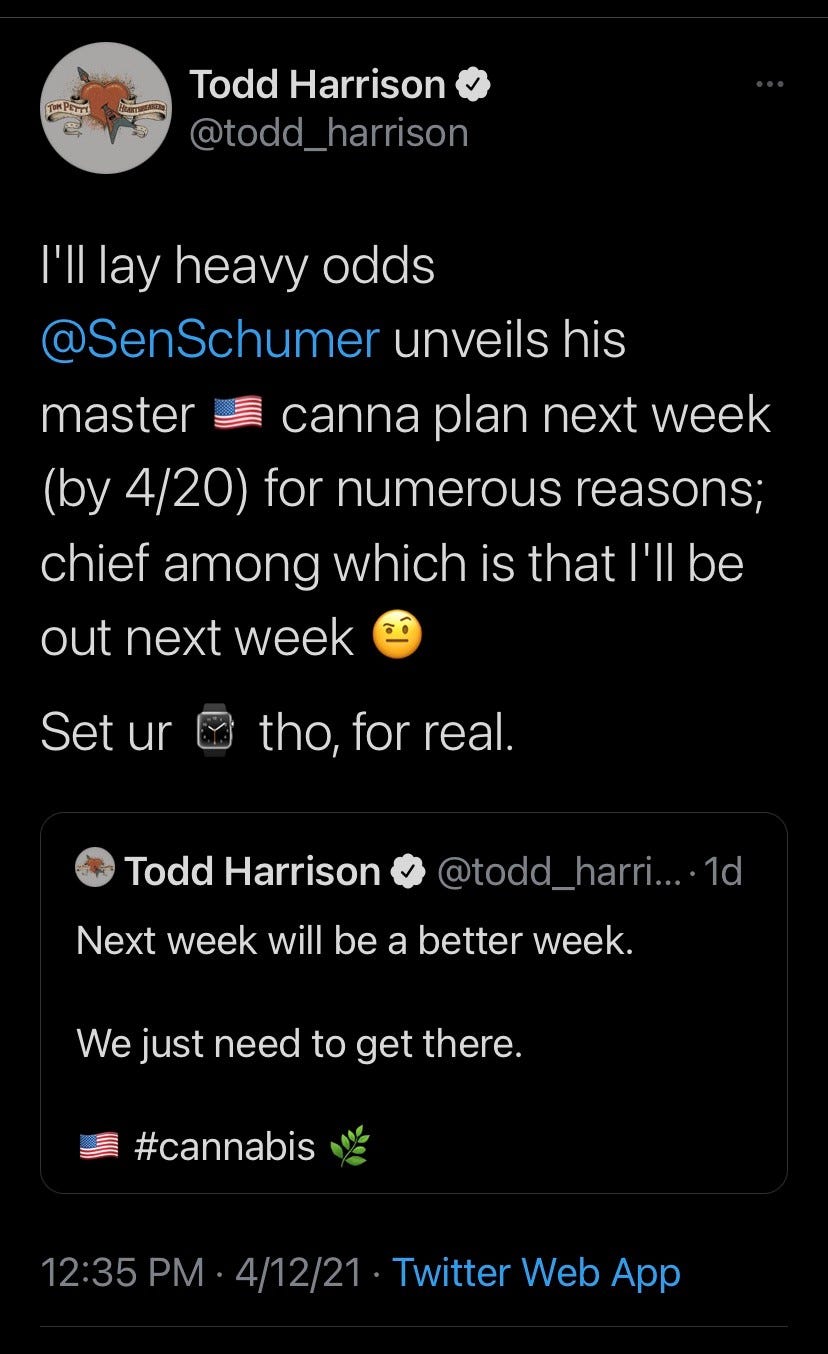

Put a water pistol to my head and I’ll say we’ll eventually see states’ rights protected and interstate commerce phased in over a few years, but that’s a guess bc IDK nor does anyone else, at least not yet. But that could change, perhaps as early as next week.

There’s a camp that believes legalization will allow U.S canna to re-rate higher as Wall Street adopts and institutions onboard. And there’s a camp that believes legalization will be the beginning of the end of those business models because CPG will come in and bogart the best opportunities

Us? We believe that federal reform will coalesce around states’ rights for reasons discussed, and because state-level infrastructure is needed to support and grow this economic / employment engine. It’s also our sense that interstate commerce is several years away, which will allow the existing oligopoly of MSO’s to scale their MOAT.

Again, and I can’t state this firmly enough: I don’t know. I don’t know if Chucky drops his cheese next week (but I think he will). I don’t know how the space will settle if he does (although the first move, I imagine, would be higher). And I don’t know what else is out there, be it a seismic shakeout in the broader market or some other dark swan.

So what do we know? Glad you asked.

We know U.S cannabis fundamentals will be back-end loaded in 2021, meaning Q3 / Q4 earnings > Q1 / Q2 earnings.

We know New York and New Jersey are coming online next year.

We know Maryland and Pennsylvania likely onboard the following year.

We know Connecticut, Florida, Minnesota, Rhode Island and Delaware are coming.

We know the replacement trade is in full effect.

We know SAFE Banking is still in the wind…

We know this monster just came out of left field (or Trenton, anyway)

And we know that no matter what happens, U.S canna is gonna be HUGE.

Serenity Now

We obviously don't wanna lose the technical metric given the potential for these stocks to self-fulfill lower in a whisper-thin liquidity-challenged environment. And yes, that could happen, particularly if the broader market stalls or the good news in the space continues to get sold (reaction to news > news itself).

But this isn't 2018 or 2019, and U.S opeators aren’t Canadian LP’s. In fact, among these companies, is the future of U.S cannabis. The Four Horsemen, circa Y2K.

And it’ll take time, as measured by months and years, not minutes and hours. In the short-term, traders will pull up charts, and vote. Over the long-term, investors will follow the fundies, and weigh.

Between here and there, the onus is on us to sync our time horizon and risk profile, to manage our emotions and balance perspective, and to be good to others and better to ourselves. It isn’t easy, I know; but nothing worth having ever is.

todd

/advisor $MSOS

PS- last week we offered a pro-tip: watch for volume as that will help qualify the intentions of the market. We’re still watching, and waiting.

PPS- I’ll be traveling next week and taking a break from scribing / social media; but I’m sure it’ll be quiet and uneventful. ;-)