Lost & Found

A classless asset looks for a home.

There’s an old adage that goes like this: you get two dogs; one from a breeder and one from the pound and you give them both a bowl of warm water. The fancy dog doesn’t want the water—it’s warm. The dog from the pound will stay loyal for life.

I thought about that as we’ve watched U.S canna evolve from a red-hot growth sector that was gonna ride a blue wave to generational wealth…

…to value plays because they got so damn cheap…

…to value traps when there was no visibility on how or when the federal government would get off the schneid and provide visibility—any visibility—on how U.S. cannabis companies could generate enough free cash flow to service their debt.

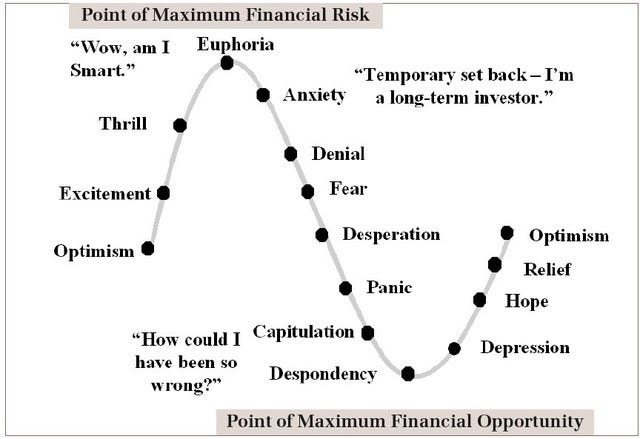

This space, having endured not one but two 80% drawdowns during the last five years, managed to alienate growth investors (after companies were forced to slash CAPEX to survive) and value types who succumbed to the notion that the status quo is called the status quo for a reason.

Make no mistake, this has been a long, dark and dreary road. There are no victory laps on the road to redemption but there are signs and guideposts; and those of us who obsess about follow such things have found them to be encouraging.

The proposed change is wholesale. The entire space will benefit. The only people who won’t benefit are those who remain in prison for this plant but we’ll save that for another day.

The sector was left for dead as naked/ structural/ algorithmic shorts piled into what became an almost-too-good-to-be-true shooting-fish-in-a-barrel trade that paid-off most days but here’s the thing: the denial, migration, panic thing swings both ways.

We’ve spent an abundance of time the last two weeks discussing the current set-up and we shared the passage below September 7th when these seismic shifts first hit:

We used to contemplate what might happen if SAFE passed/ 280E went away/ stocks could list on major exchanges/ CPG M&A was back on the table/ institutions ungated/ MSOS trended on WSB/ there was insider buying and stock buybacks—but I’m not sure that anybody contemplated these catalysts potentially happening all at once.

The timing of last week’s leak into the barren wasteland of summer’s end + the (listed and naked) short base + potentially seismic catalysts + napkin math suggesting a 2-3X fundamental turn sans 280E = perhaps the single best set-up I’ve seen in my 34 years on Wall Street.

After yesterday’s close, an NBC News Exclusive reported that SAFE Banking would get a committee vote at the end of the month. As this set-up is catalyst-dependent—SAFE, no gov’t shutdown, DOJ response, etc.—it was (reported to be) another step.

If the HHS recommendation to move cannabis to a Schedule III—which would solve for 280E—was the first and largest domino to fall, SAFE moving through the Senate would certainly be an enthusiastic encore for our interconnected wish-list.

All of which brings us back to the puppy parable. After being abandoned on the side of the road for two-and-a-half years, U.S cannabis investors are—or should be—super appreciative and exceedingly humble as our space attempts to demonstrate that it will no longer bite the hands that feed it.

There will be a great demand for these puppies, once properly trained.

State Farms

In other news, 12 states sold more than $1B in cannabis in August, with Michigan leading the way at $276M and Illinois ($165.7 million), Massachusetts ($158 million) and Missouri ($119 million) reporting nine-figure sales for August.

We’ll dig into that and edit today's market movie into a series of snapshots, offer some qualification on the short interest conversation and the wave that MSOS flag, wave it wide and high.

But first, some context for those new to this space: you have no idea how lucky you are.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ PT Notional: $265M

Top Stories