Daily Recap

The weekend was abuzz with anticipation after the HHS recommended to reschedule cannabis last Wednesday. While The Morning After echoed what some of us shared in real-time, the holiday respite allowed those possibilities to marinade far and wide.

The back-of-the-envelope analyst math suggests a 2-3X turn for U.S cannabis plant-touching securities and that’s before any short squeezes or animal spirits, the latter of which have been scattered on dawn's highway bleeding, ghosts crowding their young fragile eggshell minds.

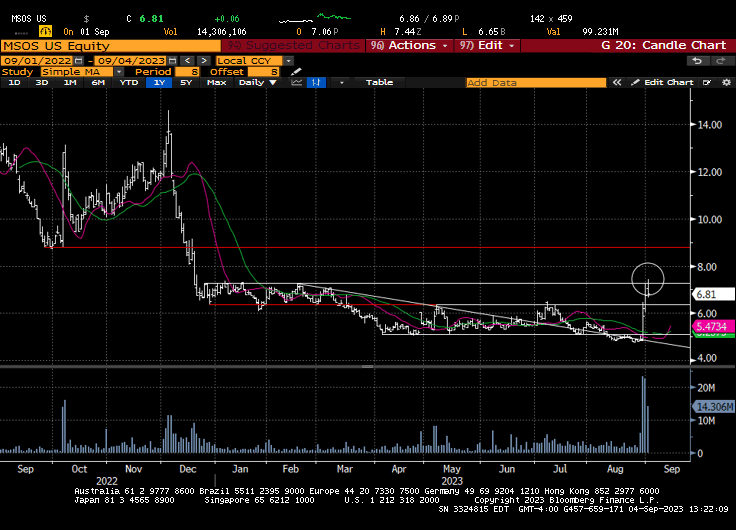

For perspective, this news hit 12:11 PM ET on Wednesday and in just 2 1/2 sessions, U.S cannabis ETF MSOS AUM increased by $157M, or 33.18% w/ 3.25M share creates valued at $20M. AUM at MSOX, with is the 2X levered MSOS, increased by $9.6M, or 132.88% and had 740,000 share creates valued at $3M.

All of this during the final days of summer when most folks were paying no mind.

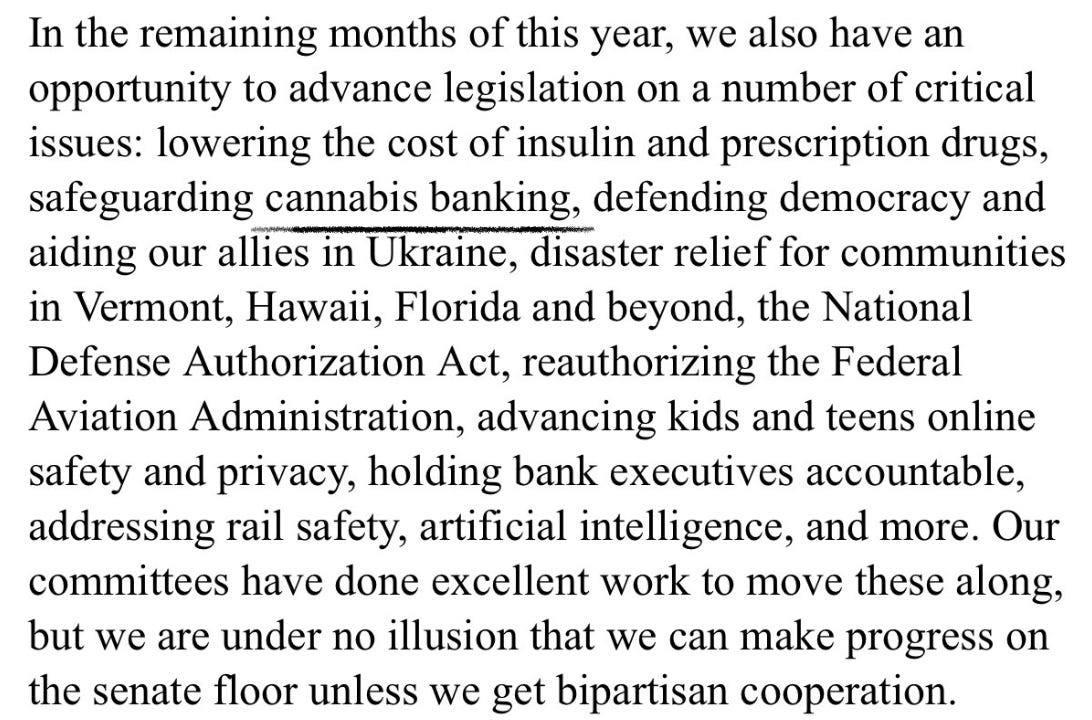

In today’s column, we’ll walk through our anticipated sequence of catalysts—the 2023 year-end Cannabis Wish List—which may start soon if Senate Majority Leader Chuck Schumer has his way, per his ‘Dear Colleague’ letter that was released on Friday:

Yes, we’ve heard this before but our sense is that last week’s news upped the pressure on the Senate to avoid looking any more ineffectual than they already do; we expect a few more GOP SAFE co-sponsors to emerge, perhaps as early as this week.

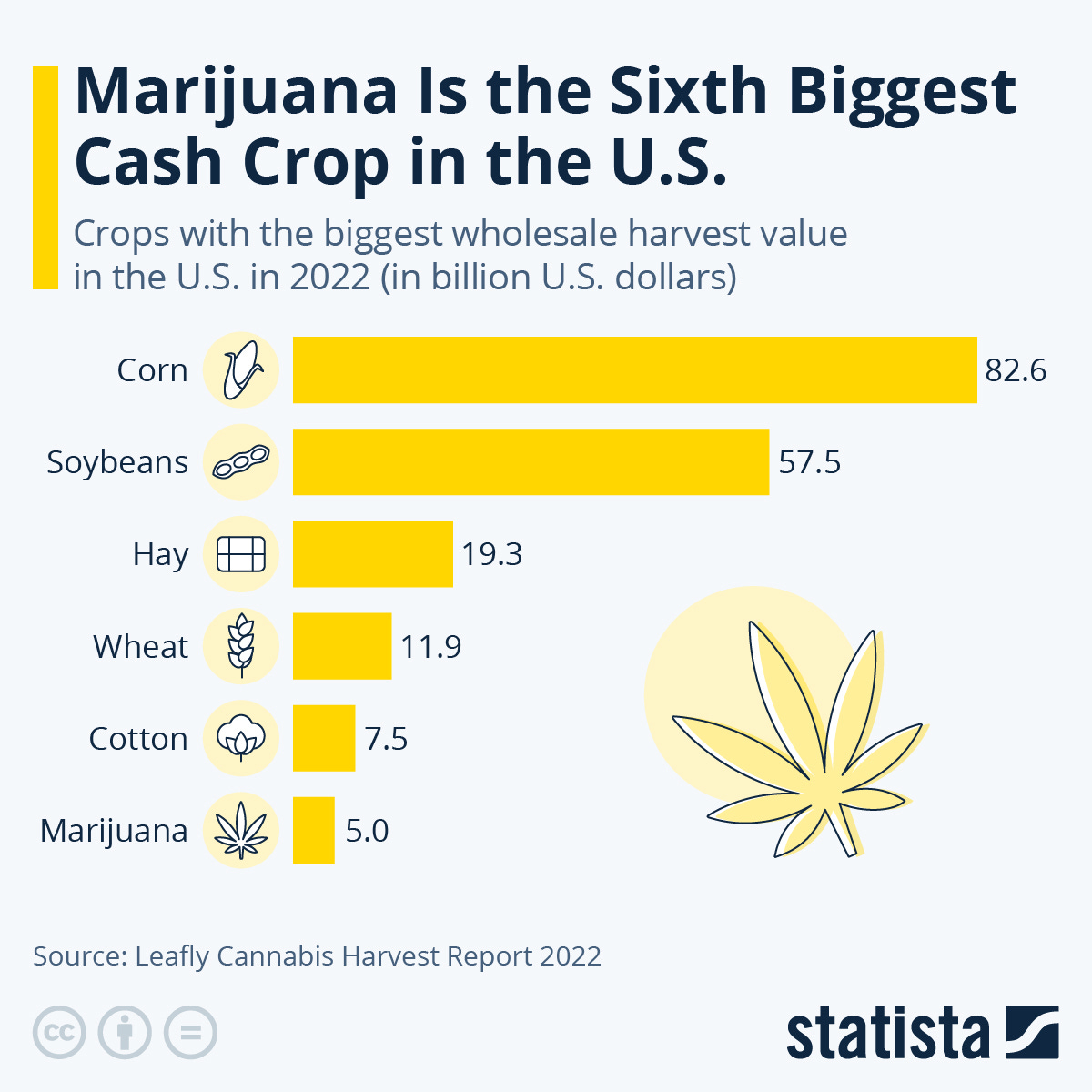

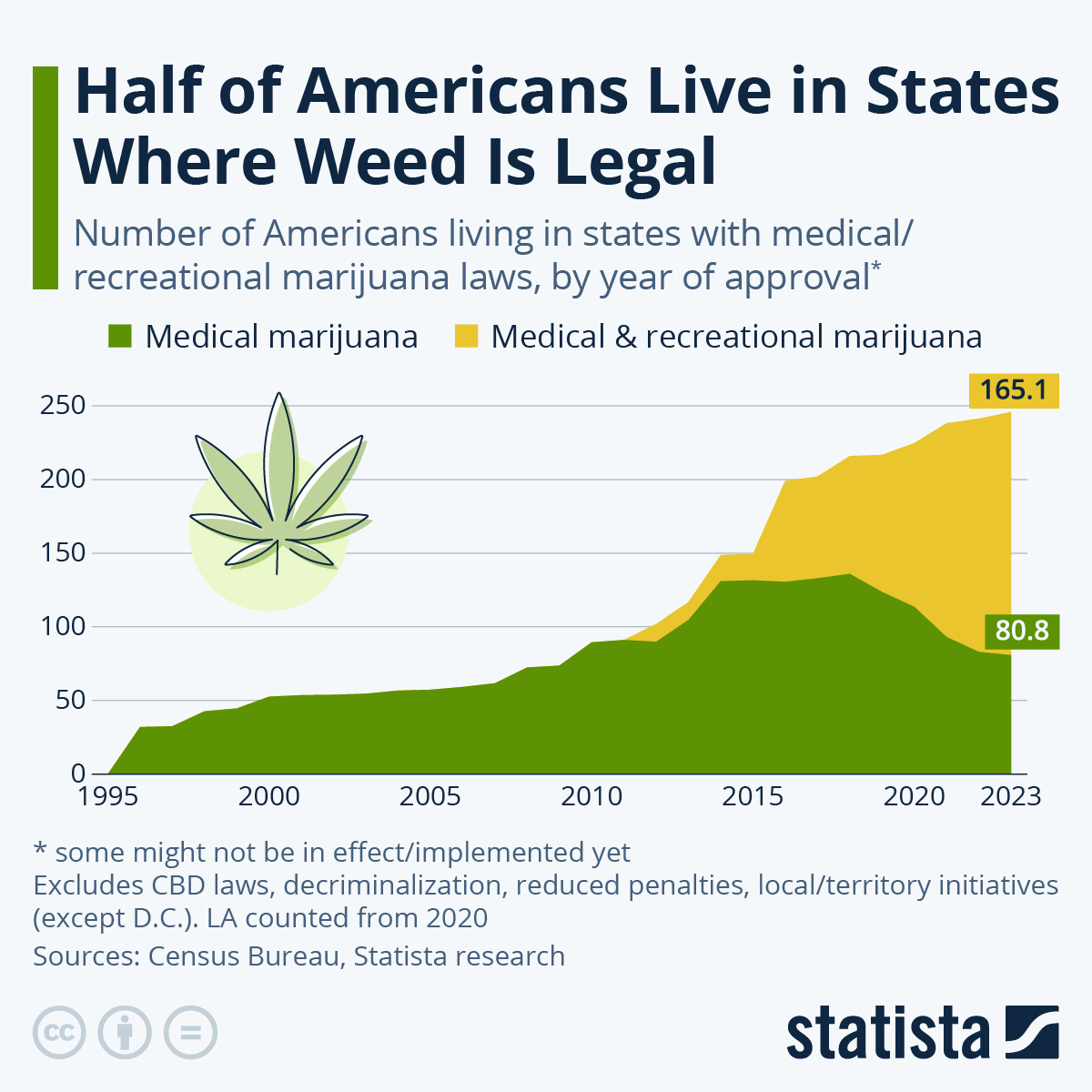

In other sector news, Arkansas MMJ sales will likely surpass last year’s record $270M; Western Australia MMJ regulations will be reviewed amid calls for immediate action; the German government anticipates a huge windfall with the legalization of cannabis; the Oklahoma Bureau of Narcotics shut down 800+ illegal cannabis farms the last two years; some studies support the use of cannabis in pediatric cancer; NY had promised to help people with weed convictions but instead, they’re stuck in a legal nightmare; the opioid settlement may spur cannabis as potential new pharmacy revenue stream; Lloyds of London is now lobbying for SAFE Banking; Marijuana was the sixth most valuable wholesale crop in the United States last year at $5 billion, trailing only corn, soybeans, hay, wheat and cotton; half of Americans live in states where weed is legal and we learn how to cope with a bad high.

All this and more, just scroll down…

Top Stories

Cannabis businesses could recoup millions on exit, thanks to ‘280E asset’

WAPO: Possible easing of marijuana restrictions could have major implications

Arkansas Medical Cannabis Sales Set To Surpass Last Year’s Record Of $270M

German government anticipates huge windfall with legalization of cannabis

Oklahoma Bureau of Narcotics Shut Down 800 Illegal Cannabis Farms Last Two Yrs

Some Studies Support Use of Cannabis in Pediatric Cancer; More Research Needed

German government anticipates huge windfall with legalization of cannabis

Western Australia medicinal cannabis regulations to be reviewed amid call for 'immediate action'

Opioid Settlement May Spur Cannabis as Potential New Pharmacy Revenue Stream

2023 Year-End Cannabis Wish List

After 931 days of persistent misery, the world changed last Wednesday when the HHS officially recommended that cannabis should move to a Schedule III. It was a shock to the system—mine, yours, the markets—which is now widely reverberating.

The set-up couldn’t be better. As shared last week,

If it was leaked, it would be the most bullish set-up possible given the holiday-thinned ranks into the last few days of August. There was zero warning for the abundance of bears caught short, pressing the most recent technical failure. No head’s up for any interested longs, most of whom were in wait-and-see mode heading into September.

Who are these bears? Can’t say for certain but word on the street these last two years was that a cabal of Canadian hedge funds algorithmically pressed these names lower as banks and custodians systematically restricted investors from accessing any U.S. cannabis plant-touching securities.

The experience was brutally horrific if you wanna know the truth but the tables have seemingly turned; and the only thing better than a one-off positive would be a steady drumbeat of good news and evolving conditions, which could look like this:

HHS recommends cannabis move to a Schedule III (8/30/23)

SAFE Banking moves through Senate Finance Committee (September)

SAFE Banking moves through the full Senate (October)

Garland Memo. (Sept/ Oct)

PREPARE Act in Senate (regulatory framework)

DEA response to HHS

SAFE through U.S House of Reps

Amplification via MSM/ WSB.

Uplisting to NYSE/NASDAQ

CPG M&A

Ohio/ Florida/ Pennsylvania—2024 electoral swing states—all flip green.

Given how illiquid so many of these securities are (custody restrictions), the ability to disseminate this opportunity—even amplify it—would be welcomed by cannabis bulls and loathed by the bears who, given short interest increased significantly into the end of last week, appear to have made a last-gasp stand at MSOS $7.30 resistance.

Over the weekend, the youngins at Wallstreetbets got the memo, broadcasting to their large and unruly universe the lurking opportunity in U.S cannabis. I genuinely feel for the bears who got stuck pressing this sector lower; what I feel I’ll keep to myself.

Other wish-list items include a NYSE or NASDAQ listing—Trulieve CEO Kim Rivers said after the close on Friday the NASDAQ is reviewing it’s policies to see if Schedule III would allow for it—and CPG M&A, and Curaleaf CEO Matt Darin touched on that too, noting that strategics have been circling for some time.

And then there’s Ohio, Florida and Pennsylvania potentially on deck.

All of these were aspirations one week ago, maybe even a pipe dream.

Now they’re all in play, all at once.

A few Random Thoughts

The U.S canna landscape flipped last week as the most upside-torqued names were companies with balance sheets deemed event-dependent (states flipping, federal reform). Names like AYR Wellness (AYRWF) and 4Front Ventures (FFNTF), et al.

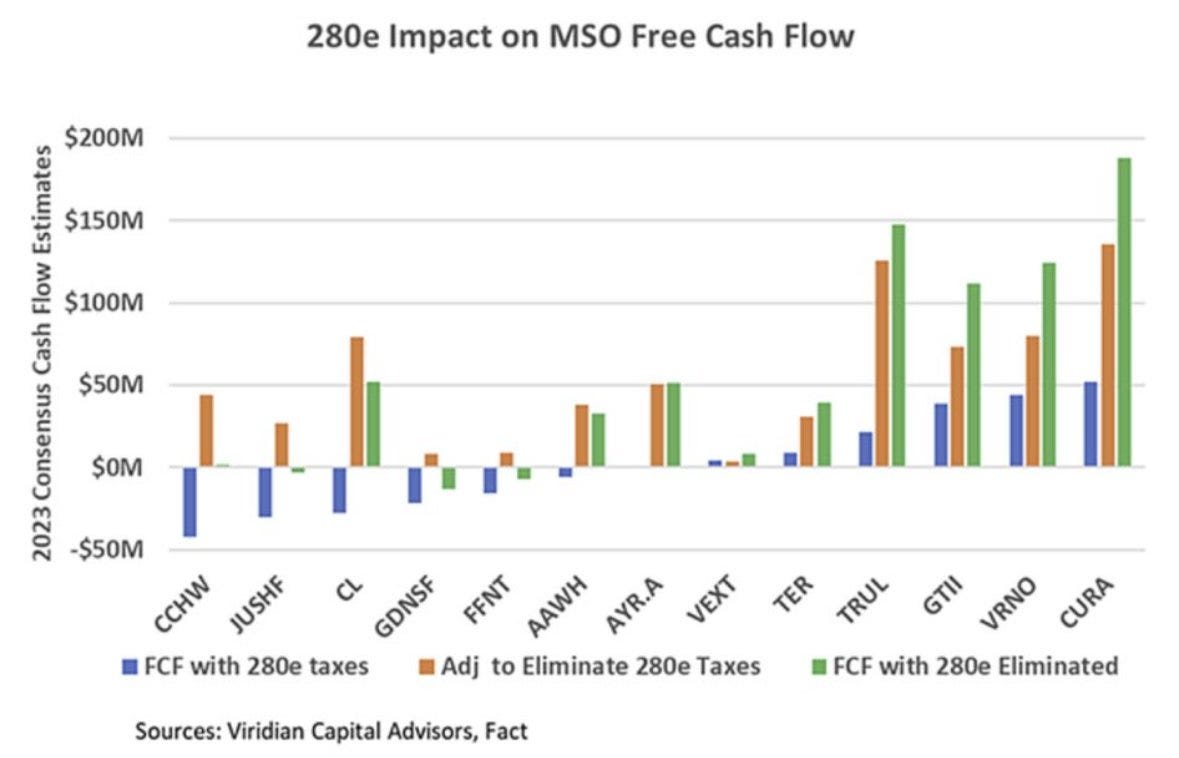

That’s not to say Tier1’s will be left out; they have the most leverage to the elimination of 280E and if history is a guide, the largest companies will be most attractive targets to both CPG and institutional investors who are looking for size, scale and liquidity.

[^ Verano (VRNOF), Green Thumb (GTBIF), Cresco (CRLBF), Curaleaf (CURLF) and Trulieve (TCNNF) come to mind and we would add TerrAscend (TSNDF), as well]

There are others who stood tall in the toughest of times—Glass House Brand (GLASF) for instance, which continues to crush it in Cali—but the takeaway is simple:

While real risks remain, both for the market and this sector, the prevalent skepticism and doubt is super-healthy and the bears, who’ll eventually be forced to unwind their structural shorts, will provide the fuel—that is, until the institutional buyers arrive.

There are, of course, no guarantees—we recently walked through a host of caveats—but as we ready to fire up our turrets on Tuesday, I reminded myself not to overthink this too much, and to let these names (finally) work for us.

[note: we to see expect capital raises across the space as these stocks rally for the first time in over two years—that is nothing to fear—and if the money is raised is from the right/ strategic investors, it would trigger emotions that would be the opposite of fear]

Stems & Seeds

Marijuana was the sixth most valuable wholesale crop in the United States last year at $5 billion, trailing only corn, soybeans, hay, wheat and cotton.

Half Of Americans Live In States Where Weed Is Legal

How To Cope With A Bad Marijuana High

/end

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.