It’s been a monster year for risk assets as U.S cannabis investors ready for the holidays.

And while you can’t blame them for feeling boxed-in, the winds of change arrived last week in a most-unexpected way, setting the stage for what could be the single greatest comeback in the 14-month lifecycle of U.S cannabis ETF $MSOS. This is that story.

Monday, November 1st

We entered the week with a subtle sense of déjà vu as I published this post:

[if you haven’t read pls do bc this is a movie not a snapshot and context matters]

Suffice to say that JP Morgan the bank took a page from it’s namesake and attempted to manipulate the fate of cannabis. And while the story had yet to be picked up by the MSM, we know that PTSD (Pershing Traumatic Stress Disorder) ghosts were crowding young cannabis investors’ fragile eggshell minds. Still, we offered,

This JPM stuff isn’t that, for several reasons:

Pershing cleared canna for most of the funds that were involved in the space, whereas JP Morgan, while massive, was / is a bit player in U.S canna.

There are other custody solutions / no forced selling but it’s entirely possible that some funds might punt / punted their US canna exposure and take what may be the only viable tax-losses in the entire financial universe.

The fundamentals are night and day vs then. U.S cannabis leaders are cashed up and generating FCF despite all the onerous regulations.

The credit curve improved > 400 bps over the last year (←credit leads equity).

But maybe that was the reason U.S cannabis was getting smoked? Perhaps the putrid price action—the incessant, relentless selling we’ve witnessed since the February top (or the pain since the summer) was related to that? Maybe it’s priced in…?

Tuesday, November 2

As the rest of the world’s risk assets continued to gallop higher, enjoying the trillions of dollars that are chasing everything from trading cards to NFTs to digital doggies— a literal slap in the face to a U.S cannabis industry generating billions in tax revenues as America’s single-fastest growing industry / jobs creator—the U.S govt’s inability to end The War on Drugs, the the single biggest stain on the fabric of our Flag, is beyond disappointing, it’s embarrassing. But that’s a conversation for another day.

U.S Canna ETF $MSOS lost another 5.5% on Tuesday to bring YTD performance to -30%, or ~50% below the February high, closing at $26.88. As that was happening on my screens, this went on behind the scenes (and a lot of it):

And I get it, of course; as I would tell Jesse a few days later (←tease), ‘I empathize with those feelings because I’ve been there and in many ways am there’ as I watched what was an unbelievably fantastic start to the year turn into an average one, if that.’

We’re all responsible for our own decisions, I told myself despite knowing full well that people follow my lead in this space and as much as I tell myself not to wear it, how can one not take it personally? I turned my DMs off and the only time I went on Twitter was to post, not read.

Instead, I watched media outlet after media outlet run the BREAKING NEWS: JP MORGAN ABANDONED U.S CANNABIS as if they were ever there to begin with.

“Are you ready?” my wife asked, breaking the silence. “We’re leaving at 4:30,” said a blonde blur as it rushed by my office on the close. One of her partners’ daughter was getting married in Jersey and I didn’t have time to think as I hadn’t shaved all week. I wasn’t in a mood to celebrate but it’s weddings and funerals, right? So off we went…

…and I must have had a GREAT time because I def don’t remember tweeting this:

Wednesday, November 3rd

I awoke a bit groggy to our friend Pablo at Cantor who, along w the rest of the street, had been slashing third quarter earnings estimates. But this wasn’t that; Pablo was saying that U.S cannabis is effectively dead money for the next few months.

Now I don’t think anyone was expecting blowout earnings from U.S operators given we’re stuck in the middle of post-COVID normalization (YoY vs. pantry-stuffing ) and the sloppy / unpredictable east coast roll-out. Still, it felt like everyone all-of-a-sudden realized that numbers won’t be great and maybe 2022 numbers are too high.

‘This is sorta good,’ I thought / perhaps lied to myself. Set the bar low so it’s easier to beat—under-promise to over-deliver—and tbh I am hoping to see / hear more of that next week when U.S Cannabis FAANG begins to step on stage.

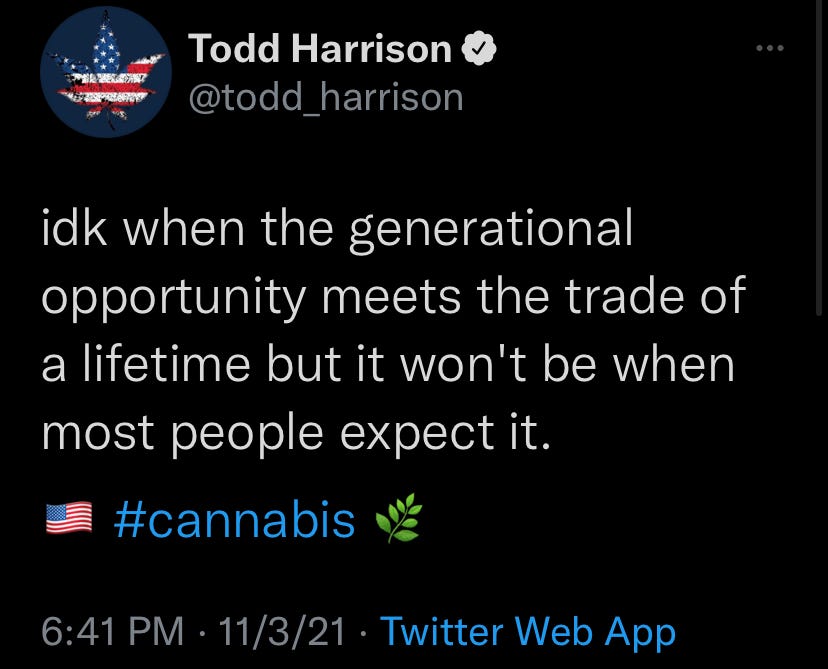

Still, hope springs eternal…

…and given my conversations with must-follow Brady Cobb, who’s hearing there are now 18 GOP Senators who support SAFE Banking via the NDAA, which jibes with the political calculous he and I have discussed, we felt it was more than just hope.

[explains why House Republicans were so supportive of SAFE / NDAA before teeing it up for their colleagues across the hill; we know the ABA wants this bad and has for some time. why? follow the money]

[note: conventional wisdom / smarter political observers than I DON’T expect this]

Perhaps more importantly, we picked up other whispers in the wind…

…but nobody seemed to care. $MSOS continued to slip, closing at $26.51, on higher volume which is important bc volume qualifies price + the whisper-thin environment has been a fertile hunting grounds for pernicious algos / short / naked-short operators who’ve had their way for a while and were getting greedy.

But inside, I began to stir. I’ve been trading 31 years and sometimes instincts, price action, sentiment and set-up align. It doesn’t happen often but when it does, I’ve come to embrace it. Yeah, it’s to safe to say my antennae were twitching.

Thursday, November 4th

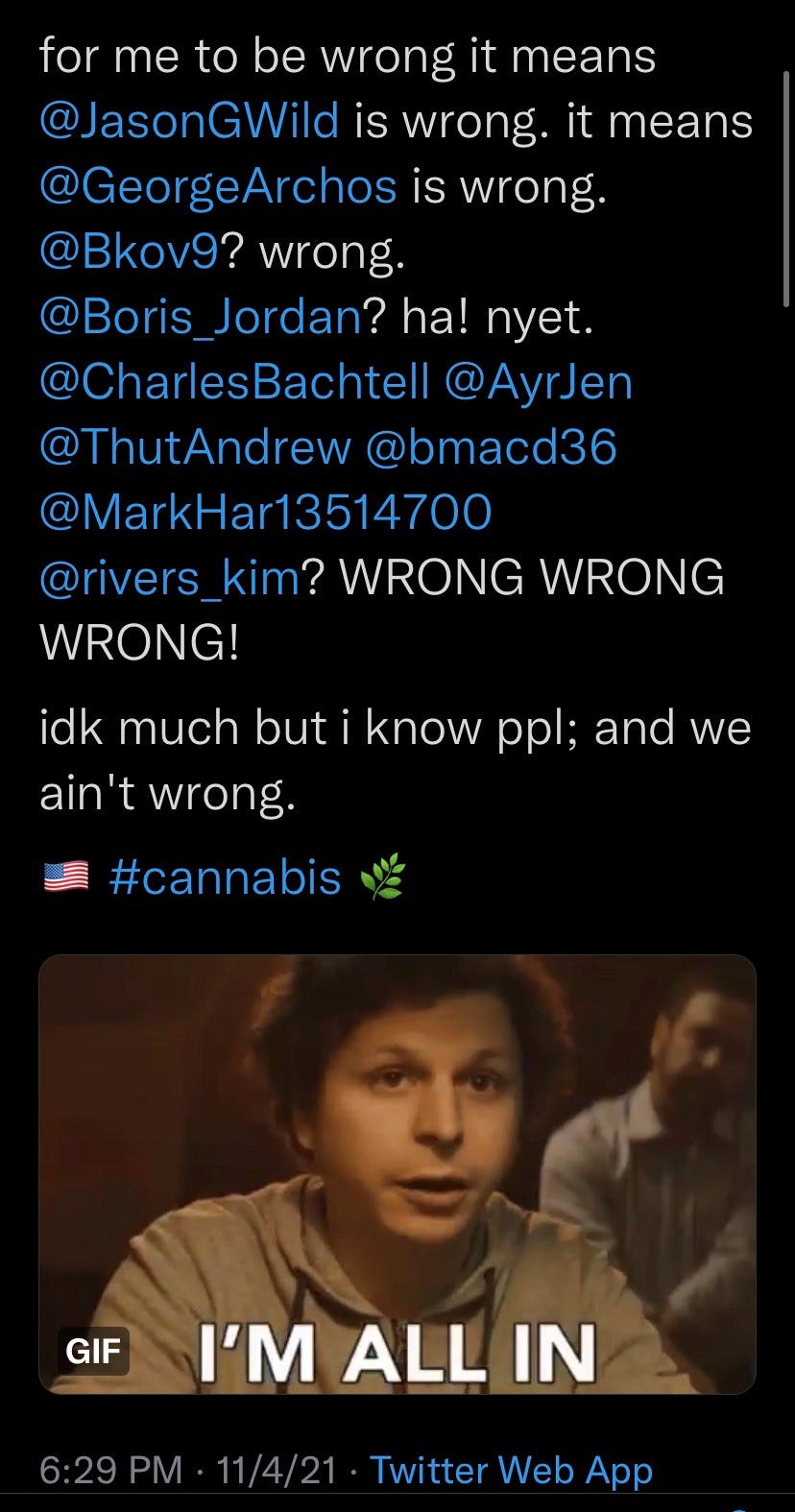

I’m a long-term investor in U.S cannabis for reasons articulated in January. I’ve been bullish for over a decade and while I cut my teeth as a trader for many yrs, I’ve learned / tried to adapt my style to the opportunity and remain patient.

But I’m a trader at heart and with earnings on tap, I know:

1. numbers have already come down across the board.

2. bad (not horrible) earnings get bought when stocks are deeply oversold.

3. positioning is ripe for an off-sides given longs are out / harvesting tax-losses.

4. shorts are pressing and complacent.

5. any hint of fed progress would matter way more than softer-than-expected earnings.

And if there was beef on the bone of the GOP flanking the Dems—and SAFE / NDAA, in the process—the hairs on the back of my neck were standing on end for a reason.

As ATB lowered numbers / price targets across the board—and as I tried to spin that positively on Twitter only to have a Holy Hell unleashed upon me—Gallup released a new poll showing 68% of U.S adults support legalizing cannabis.

But U.S cannabis kept melting while everything else continued to rip. I juggled phone calls from frantic friends / traders as I layered into clothes and a wool hat—we ran out of oil so there was no heat or hot water on the first 40 degree day of the year—when I remember what Jimmy Cramer wrote in Confessions of a Street Addict circa Y2K.

And I was cold—freezing—in more ways than one, I thought to myself as I swallowed hard and bought another slug of $MSOS calls, which we layered on into this latest leg of the melt. I also remembered I was taping a podcast with my friend Jesse Felder at 2PM, which he would later call The Trade of a Lifetime. (←a well spent hour IMO).

"We're right about there,” I told Jesse long after I forgot we were recording, '“I mean we're talking now it's November 4th 2021, it's a Thursday, $MSOS is trading at $25.84, it's the lows of 2021 and I think it's a great time for us to be having this conversation."

$MSOS didn’t care, closing at $25.70, which was the lowest level of the year and right about where it came public on September 1st, 2020. Again, there was higher volume.

Friday, November 5th

There were a couple of early prints early Friday but nothing out of the ordinary as I saddled up to my desk. We had made a big bet; as we edged through the trading day, we got even bigger. I couldn’t stop thinking about the GOP calculous; the brilliance of it but even more, the potential ramifications for society and a sector that’s been left for dead / abandoned on the side of a road; and then I did something I’ve never done.

I would like to continue this story but I’m up against the data limit again / the podcast will tell you everything you need to know if you would like to learn more.

[cliff-notes: Tom Angell broke the story 45 minutes later, $MSOS went vertical / +10% for the day / +12% off the lows on all-time record volume; shorts scrambled; bulls who sold to harvest losses realized they’re under-exposed if federal movement is back on the table; $MSOS +3% AH]

I do want to link two more items though if I still can:

1. Please support this effort to help our friend Jane navigate thru some tough times. I know the sector has performed poorly this year but bad seasons define good fans just as bad times define good friends. Please help, as able, and thank you.

2. Big Brady Cobb, Juicy Jeff Schultz and I will be hosting a U.S Cannabis Town Hall on Twitter Spaces on Tuesday, 8PM ET to discuss all of this. Everyone is welcome to attend just remember to be kind to each other and stay positive.

It’s been a long year but it’s beginning to look a lot like Christmas.

position / advisor $MSOS

position in stocks mentioned.