“Oh I like this one... One dog goes one way, the other dog goes the other way, and this guy's sayin', "Whadda ya want from me?’” Tommy DeVito

Cannabis is on fire (inhales deeply).

We won’t rehash the backstory or recent events out of respect for your time, but it’s happening and it really hasn’t mattered which side of the border it’s been.

In fact, despite generational opportunities in U.S cannabis, Nanook of the North is outpacing us.

Note: $MJ is a Canadian Cannabis ETF; $MSOS is the U.S cannabis ETF (<- we advise)

We touched on this dynamic in our last letter to investors on Jan 15, when we shared:

We intend to invest in the U.S. and trade Canada, with the exception of Village Farms (NASDAQ: $VFF), which is our lone Canadian core. Still, we found it curious the Canadian licensed producers (LPs) saw more upside beta in response to the U.S. Senate results than the U.S. multi-state operators (MSOs) that will directly benefit.

We chalk this up to several dynamics:

1. Greater fools, of which there are many, who actually think Canadian LPs = U.S. exposure.

2. Liquid sympathy vehicles for hedge funds and institutions who can’t access U.S. names yet.

3. A third derivative read through on cross-border and international opportunities.

4. Canadian fundamentals upticked from 'blech!' to 'meh.' (what bottoms are made of).

5. Short covering (short interest down considerably from the highs but still a factor)

All fair points, but as someone once said: “the leaders coming out of a crisis are rarely the same as those who entered it” and that’s the truth. Just ask Fidelity:

OK, don’t ask Fido. Chazzers. You know what a chazzer is, Frank?

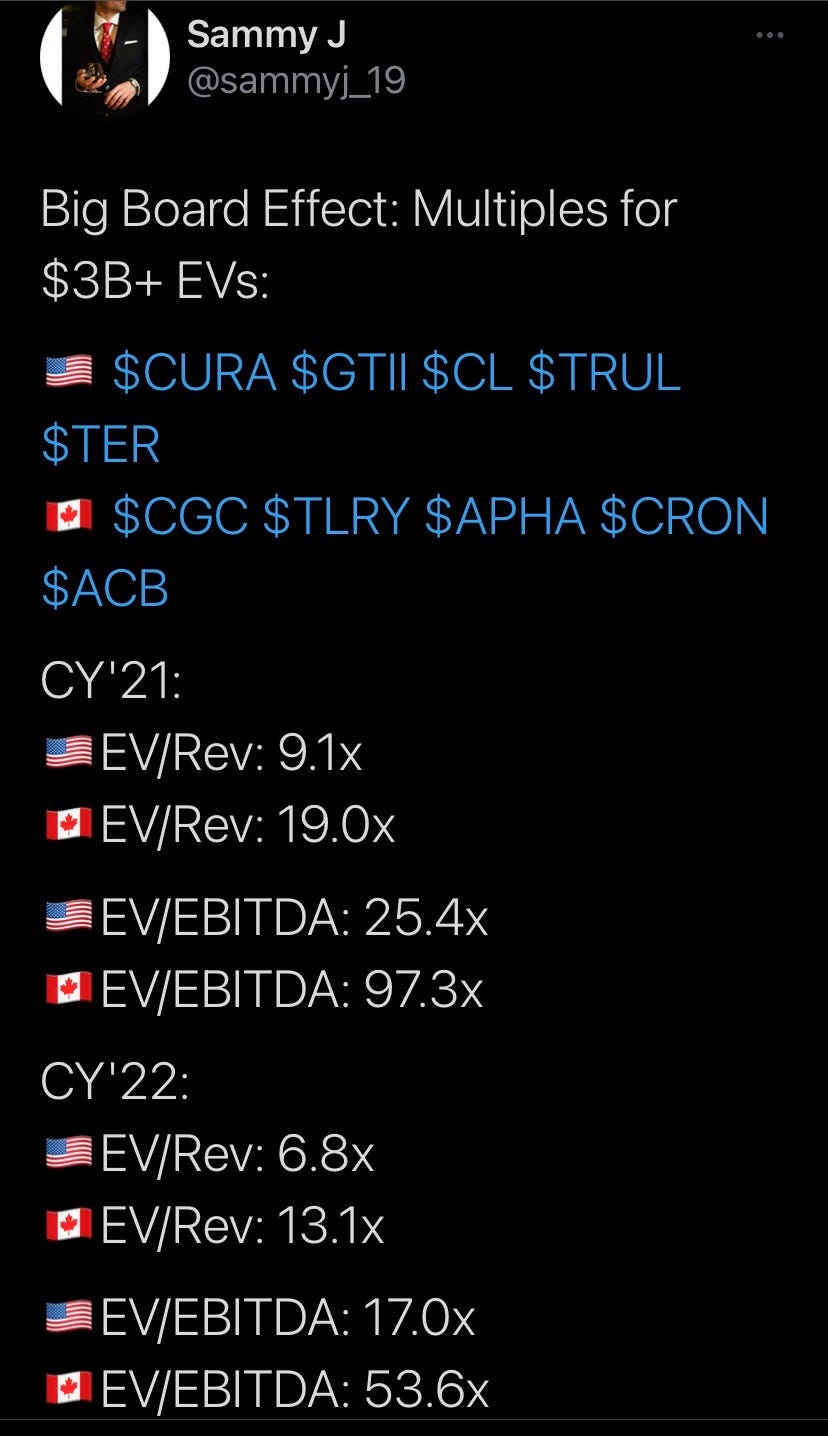

Ask me, because we discussed this. Or ask Sammy J, who fashioned these graphics:

Thanks Sammy J! Such a mensch.

Where was I? Ah yes, US vs. CAD. Night and Day. The Odd Couple.

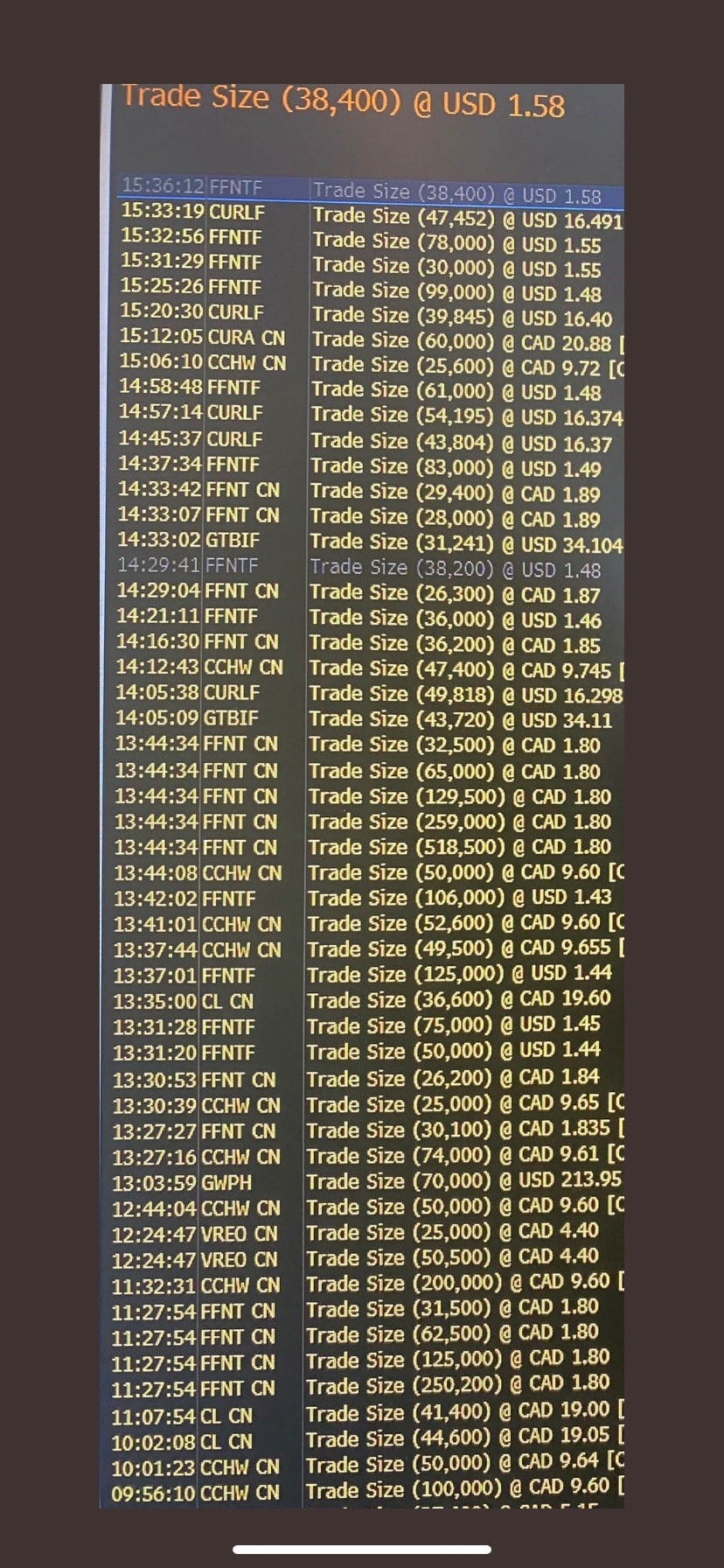

There’s lotsa reasons US > CAD, per Sammy J. But on the U.S side, there’s also this:

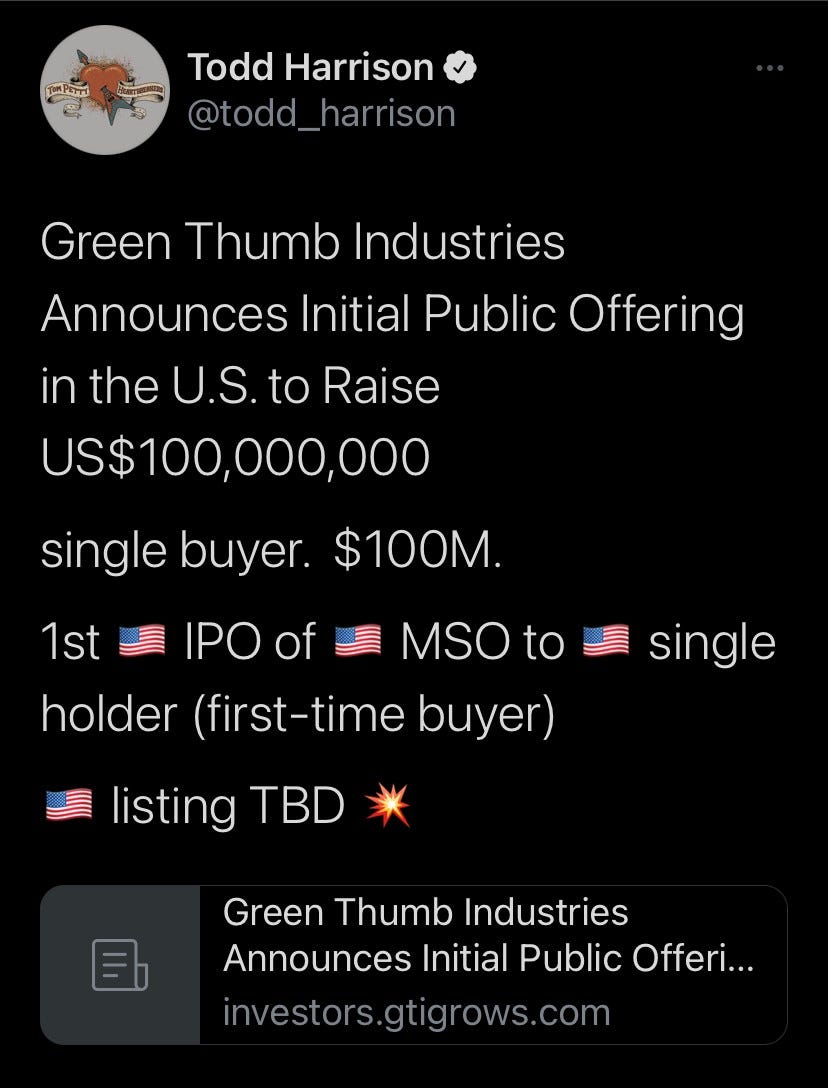

which translates to this, from Monday.

Followed by this, on Tuesday:

Yes, they’re here. But that’s not even the best part.

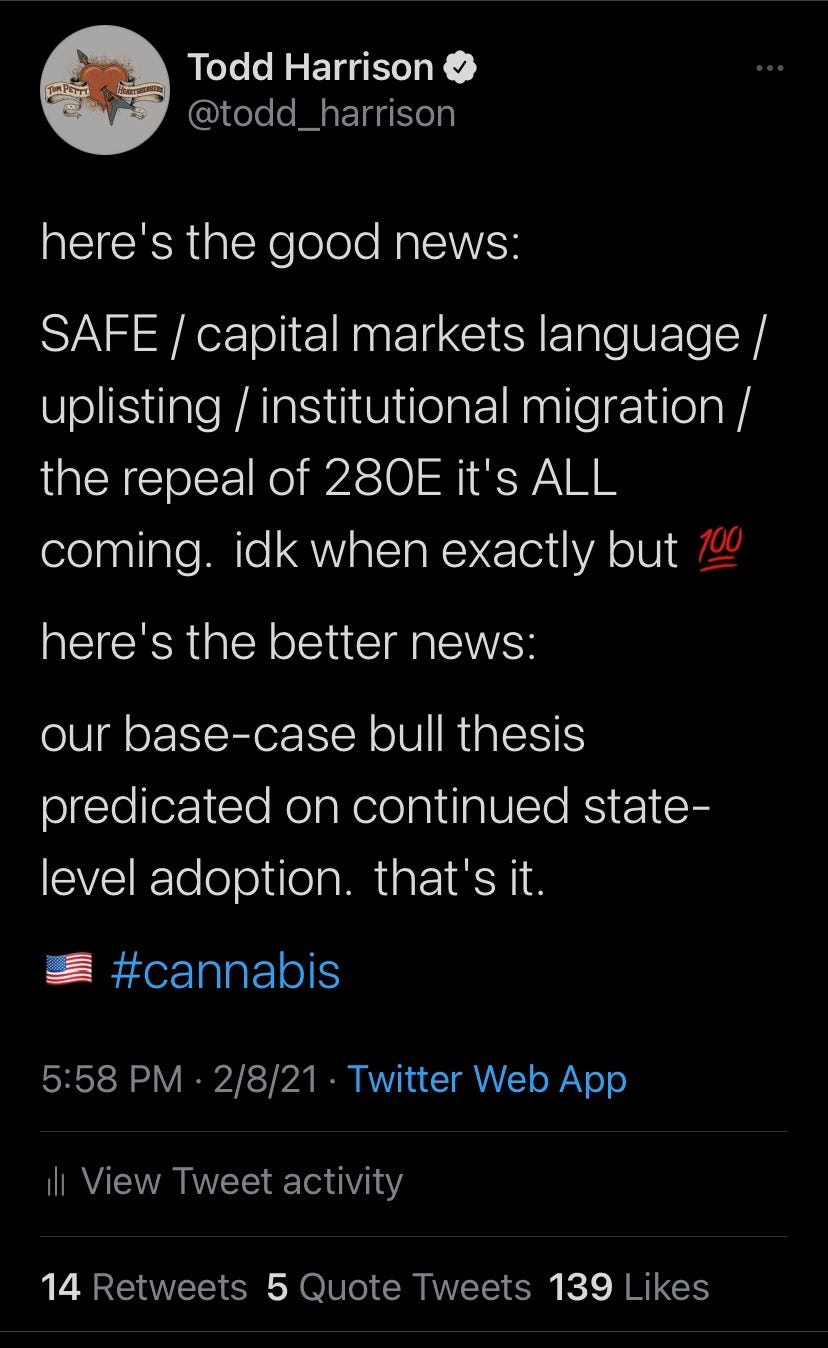

And if I had to spit it out quick, it would look like this:

Doesn’t make it right, just makes it honest.

And honestly, the U.S is where you wanna be for the 2021 cannabis migration.

We see the Candian cananbis short squeeze; our money is piled on the U.S cannabis long squeeze.

But this, you know.

click here for: The Odd Couple Part II: The Charts!

/positions

/advisor $MSOS

♥️ Pedal to the metal ♥️🙏😜

You've probably seen this question before: How would you foresee the price/growth of the major MSO US tickers ie CURLF, GTBIF, TCNNF, etc playing out compared to the same companies with tickers in Canada ie CURA.CN, GTII.CN, TRUL.CN As a Canadian without access to the US tickers, if the Canadian symbols of the large MSOs would work just as well I definitely would like a piece... in addition to current investment in MSOS