DAYUM! Part I

It's Game on for the Global Cannabis Secular Bull Market

A week ago, we shared whispers that SAFE wasn’t gonna be in the next Coronavirus relief package and warned that the fast-money read-through might be that cannabis wasn’t a priority for the Biden administration.

Sure ‘nuff, the space took it on the chin, at least for a few sessions, which was to be expected after I put my performance goggles on last Monday and said:

“Look at Green Thumb, maybe the best pound-for-pound fighter in the US MSO octagon. Down 4% today. Gasp! 4%! That’s LIBOR x Bitcoin, divided by a leap year, rounded down. Meanwhile, GTI, which is +688% in ten months, trades where in a nuclear winter: $20? Maybe? That’s 33% and not to be glib, I’m not that concerned.”

Fast-forward 48 hrs and 25% lower and it’s like holy f*ck what just happened.

While we’ll never know how much of that nut-punch was legislative fear, how much was hedgies forced to de-lever and how much was simple gravity but I do know this: congrats bitches, you just survived the first U.S cannabis bear market of 2021.

Al Harrington interviewed Chuck Schumer last Thursday on insta and the Senate Majority Leader said he was writing comprehensive legislation to decriminalize and legalize cannabis; leave the decision to the states; incorporate social justice reform; and keep the FDA at bay.

I watched it 5X before transcribing every single word and I still couldn’t believe it.

And while a select few sniffed it out– h/t Chris Carey @ WFC and AP @ Stifel- MSM was too busy fussing with GameStop, #wsb, “sticking it to the man” and so forth.

Nobody noticed and if they did, nobody cared.

Friday. Saturday. Sunday. Monday. They were dog days for those obsessed.

On Tuesday, MSM picked up the story.

Six days after our post.

To be fair, we don’t really know what’s in the bill yet—interstate commerce, the regulatory framework, can you really saddle the FDA?—and the passage is far from assured, particularly in this political environment.

But after the two-year period from January 2018 to March 2020, when the BI Global Cannabis Index dropped 92%, you almost gotta smile at how this unfolded:

The slow-motion perfect storm last year.

The Senate river card in January.

And now the SAFE- no SAFE Jedi mind trick for the hopers hoping to buy lower.

My boy JW was right: good news is best in doses and bad news should be served at once. Cue the former, hold the latter, and get me a tendie. :-x

Wall Street is starting to notice. Jefferies spoke to the looming migration.

Craig Hallum is vibing 3X+ in MSO-land by year-end.

And Stifel thinks Goldilocks is here, positing a 20X return from early January levels.

Let’s take a moment.

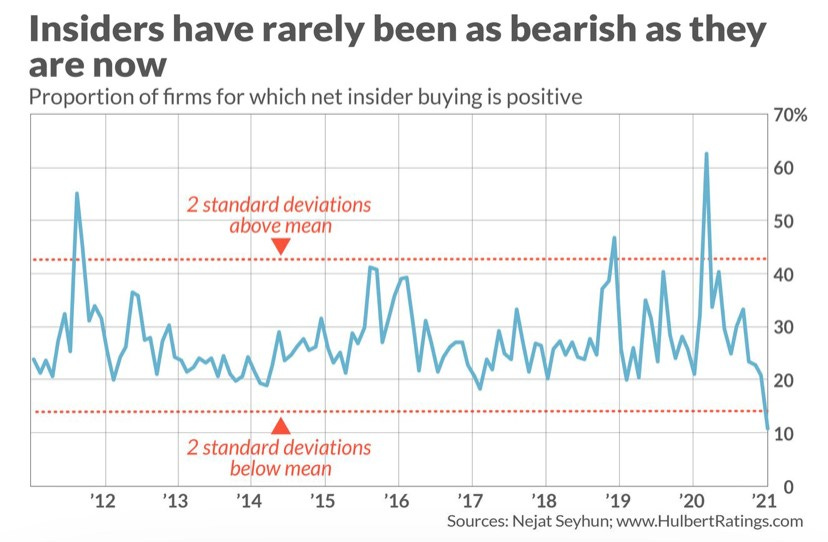

I see what you see. In the world. In the markets. All that late-cycle behavior.

The ridiculous call option volume (h/t @sentimentrader)

The insiders, as the chasm bw financial markets and the real economy widens.

I SEE IT ALL. Even if I can’t believe it.

So, when Goldilocks, 20X price targets and Panama Red all pack a bowl in one session, I get the same nose-scrunch as you and that how-did-I-get-here song in my head.

Roll with it. Drink some water. Shake out your arms. Listen to the music.

At this point, what else are we to do? It’s Mercury Retrograde, we’re balls-to-wall long US cannabis chasing Canadian calls for dessert; really, we’re riding bareback, right into the teeth of every late-cycle flag imaginable.

So why, you ask? Are we mental or something? Because this is our density. Because we could live 50 lives and never be in a better position than this, right here, right now.

90 years of prohibition about to fall down.

A trillion dollar industry about to blossom.

All that money moving into a taxable realm.

The jobs. The medicine. The social justice.

Not only have we entered a secular bull market rife w asymmetric risk-reward, we’re right in the sweet spot of the sweet spot, with the genuine promise of transformative legislation on the horizon with none of the issues that will surely arise.

The set-up is there. I spend a lot of time thinking about these things and spent all day Sunday writing about it: The U.S Cannabis Long Squeeze. It’s why we’re here; what we’ve been waiting for. So please share the link ^. If the kids are gonna fight for their right to invest, they may as well get paid along the way.

A few items from that column bc most of you too busy or cool to click through, so forgive me if you’ve heard this before:

The U.S Cannabis long squeeze is a function of the outsized demand that is waiting for the regulatory changes that will allow for investment in U.S plant-touching operators. Institutions, and many if not most U.S retail investors, are on the outside looking in, unable to access this emerging asset class given the current federal mandate.

Our bull thesis isn’t predicated on any movement at the federal level; it relies on continued state adoption that will drive the total addressable market (TAM) higher. If anything, that is moving faster than even we expected. NY PA VA NM MD CT RI…

The pent-up demand is magnitudes larger than the number of publicly traded US cannabis stocks currently listed. There may be a 15-20 vehicles rt now vs. every institution X multiple managers X U.S retail and that’s before late-cycle adopters realize cannabis is good for you.

One last thing as it relates to timing, positioning, news flow and… is there anything else, other than the broader tape dancing on the head of a pin? Oh yeah, the sweet spot. The sweet spot, the sweet spot, the sweet spot, the sweet spot, the sweet spot.

Please look at the charts that will follow in Part II, notice the volume, understand the set-up, and remember the street woefully off-sides. Massively off-sides.

I’m still not 100% sure that all of this is really happening so as always, be careful out there, do your own work, and keep it real.

Please click here for DAYUM Part II which has all the charts.

and Happy Birthday Mom!

/position $GTBIF

Exceptional! Keep it coming.

Couldn’t agree with you more on the general cannabis market. However, have you ever actually purchased cannabis? Your preference for the American companies puzzles me. They currently sell their products at a 100% premium from where prices will be after legalization. Their “better fundamentals” are just a reflection of this price discrepancy. IMO the winners of the cannabis industry will be the ones who can mass produce with the most efficiency. Do you think that tcnnf will be able to continue selling eighths for 50$ when the rest of the market sells them for 25$?