The Second City

Benzinga Shines in Chicago

Daily Recap

One day after the U.S. Senate Committee on Banking, Housing, and Urban Affairs finally approved a bipartisan cannabis banking bill, the magnitude of this historic milestone quickly shifted to the potential pitfalls on the path ahead.

Cannabis investors know all-too-well what D.C disappointment tastes like. After SAFE Banking came within a kitten’s whisker of passing last December, it was set to sail through the senate last Spring until the SVB blowup harshed our mellow.

The culprit this time is the manifestation of an unfortunate reality: we know the U.S. govt is broken but if they don’t get their shit together by this weekend—and there’s no indication that they will—the system will actually cease to function.

Yes, this partisan brinkmanship will be temporary—how temporary we don’t know—but the steady drumbeat of positive catalysts that shocked the system with the end-of-summer seismic shifts will require lights to be on and the phones to be working.

This/ next week’s Cannabis Confidential will adopt a slightly abbreviated flow and a fair amount of creative license given an abundance of travel. Have laptop will travel and I’ll share as able from the road: Ohio this AM→ Vancouver (via CHI) Sunday→ Baltimore (via DEN) Friday→ New York next weekend.

As such, we’ll dig in and below, we’ll share a few insights that were picked up at the Benzinga Chicago show, illuminate some of the dark pool flow, take a fresh sniff at short interest, call bullshit on the latest FUD, eye the timing of a DEA response and pay tribute to the man in the arena.

Thursday’s plant-touching notional volume was $193M.

Top Stories

U.S. Senate Committee Approves Bipartisan Marijuana Banking Bill, Sending It To The Floor

Pot Banking Bill Receives Backing From US Senate Committee

‘Quite a journey’: Cannabis banking bill clears Senate committee

Landmark marijuana financing bill clears big hurdle in the Senate

Cannabis companies have high hopes for legalized banking

New York’s Cannabis Advisory Board admits it hasn’t been doing its job

Curaleaf Announces Proposed Offering of Subordinate Voting Shares

Market Stuff

A few observation from the road on Wednesday (per X-subs)

Last Friday, we noted how the shorts were putting up large prints in the dark pools in and around ~$8.50 before offering multiple six-figure size “out loud” (for all to see) on the way out. Again, 34 years tape-watching: this is duplicitous/ manipulative behavior.

MSOS opened $8.80 on committee day, sold off, and then failed multiple occasions to climb back over $8.40.

If I were wearing their hairy shoes, I’d be leaning against a govt shutdown too, betting that even more uncertainty, coupled with the continued gating of institutions, would turn the tide to the south side.

Still, zooming out/ looking back—because that’s what charts do—the set-up remains strong-to-quite-strong, as those things go. A massive upside rerating (100%+) with a thus-far healthy back-and-fill on declining volumes that has worked off short-term overbought conditions.

Meanwhile, short interest we can measure (MSOS) with a new post 8/30 high.

Note: the footprint on that large seller in MSOS suggests > 10M shares sold since 8/30.

Gotcha Not

Last week during a sentiment check we noted that, following the initial move off all-time lows, some of the louder voices on social media proclaimed the hours-long U.S. cannabis bull market to be over.

While it would be hard to argue with recency bias and as a rule of thumb, it’s a waste of time to argue on the internet, these warnings are nothing new. We’ve seen several false alarms like this—such as screaming about scheduled insider sales used to fund the tax-liabilities on shares issued at much higher prices—but they just don’t get it.

The latest sanctimonious screed was aimed at Curaleaf Chairman Boris Jordan, who went on CNBC earlier this week and offered that tier one MSO’s were well-capitalized and likely wouldn’t need to raise material capital at these levels.

The following day, Curaleaf announced a small obligatory offering that was mandatory for their stock to list on the TSX—the exact same thing TerrAscend did before they up-listed July 1st—and while that unleashed a rash of half-baked gotcha! takes…

…anyone who paid attention knew that the TSX is carved out of the marijuana-related business custody restrictions across Wall Street; so, if recent history holds, this will allow Pershing, Morgan Stanley and others to custody Curaleaf on behalf of investors.

I will add that there are legitimate risks to any industry/ stock, top-down and bottom’s up—and now, I suppose, from both sides if the govt shuts down—but as we’ve said + will repeat again: the federal reform train left the station on August 30th.

“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.” John Templeton

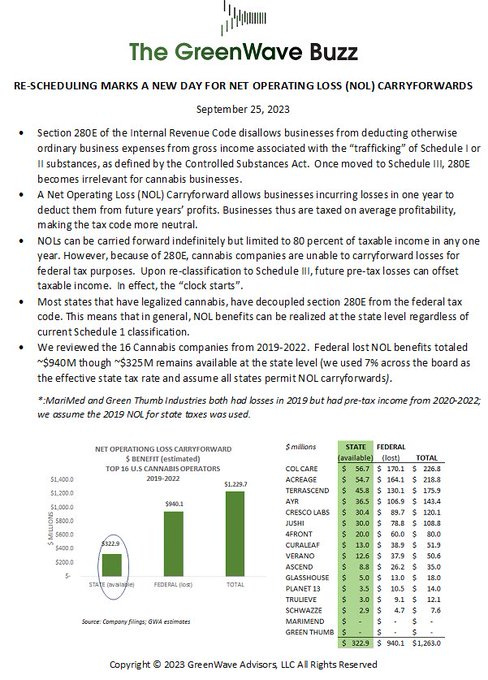

The primary reason Schedule III is entirely more powerful first domino that SAFE(R) Banking is the removal of IRC 280E, which you know. And while this dynamic won’t save the space soup-to-nuts, it’ll have a profound impact on the tax planning for the top players.

With regard to the timing of the federal mule—and with a nod to the asterisk that is the D.C work stoppage duration—the general sense is that, working backward from next year’s election and allowing for the 8-step review, the initial opinion from the DEA (along with, we believe, the Garland Memo) should hit the wires by year-end.

I understand that two-to-three months, if that’s what it is, sounds like a long time and a lot can happen between here and there but it’s hard to understate the significance of the progression that has already begun. We’re talking historic and defining wholesale changes—the stuff we’ve been waiting on for decades.

A few more months ain’t all that. The time to pay attention is now.

One Night Only

Regular readers are familiar with Weldon Angelos + the efforts we’ve made to launch a nationwide round-up program to effect federal cannabis reform. On Wednesday night, September 27th, we set out to thank those who helped make that happen.

We would be remiss if we didn’t thank Jason Raznick, the Brothers Lane and Brittany Mac, as well as Darren and Michael at GrowGen for powering the pristine powwow…

…and while there are no victory laps on the road to redemption, mindful moments that appreciate the good are always appropriate. It was truly inspiring to see the leaders of the industry join forces to support such a worthy effort.

So thank you Verano—who started it all—Glass House, TerrAscend, PharmaCann, AYR, 4Front, Curaleaf—a new commitment—Mattio, Vangst, SALT, Village + JW, Ricky, Mike, Heather and everyone else who gave their time, energy and money.

It’s easy to be angry at the cannabis industry and even easier to sit in the cheap seats, point fingers and cast blame. But there are good, hardworking people trying to do the right things for the right reasons, too, and a lot of them were in this room.

Good luck today, have a restful weekend and we’ll circle back next week from Canada.

/end

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.

Todd you are a gifted communicator. Thank you for your efforts and perspective.

Looks like a great night. Congratulations!