The following is a sampling of the Cannabis Confidential content—paragraph grabs, charts that stood out, interesting happenings and other stuff— from last week:

The Mudville Grind

The messy stress continues for U.S. canna.

October 30th, 2023

A fresh bout of PTSD began to trigger for cannabis industry participants when Rep. Mike Johnson (D-LA) ascended to the House Speakership last week but a new lawsuit detailed a different potential path out of the longstanding political gridlock.

David Boies, the lawyer best known for his high-profile cases that have involved U.S. elections, Microsoft, Harvey Weinstein and Theranos, has a new high-profile client: the cannabis industry, and Mr. Boies began working on the case over a year ago.

“It seemed like an important states’ rights and constitutional question, a civil-rights and individual-liberty question,” he said of his rationale for taking up the challenge, “and we knew people for whom access to legal medical marijuana was vital to their well-being.”

The lawsuit would effectively address the ability to access banking services + implies the removal of the punitive 280E taxation structure on a state and federal basis. The lawsuit also adds the potential to recover the 280E taxes that were paid in the past.

It was another sloppy session for U.S. canna stocks as sellers emerged out of the gate to again press the space. After early ugliness almost erased the rest of the post-HHS rally, we spent the rest of the session probing the durability of the double bottom.

One of two things is about to happen:

IF MSOS holds ~$5 on this monster press, we’ll one day look back at the lower volume retest + the most oversold conditions since the Spring and point to a double bottom in the rear-view mirror as we ride higher on the road to redemption.

IF it doesn’t and we break to new lows despite the HHS recommendation—technically known as no bueno—we could see genuine capitulation on real volume as towels toss and fingers wag. We’ve been there before but man is it getting old.

Either way, it’s worth remembering there are companies that are poised to win despite the status quo + ICYMI the status quo is in the process of changing and all else being equal, 280E will likely gonzo by next year’s election.

$4.82 is the all-time closing low as the double-bottom watch continues; worth noting that today’s malaise occurred in the context of a broad-based rally on Wall Street, the latest evidence of a complete decoupling of this space from, well, everything.

IDK when the market will price-in the end of 280E but one would think that the DEA affirmation of the HHS recommendation would be an intuitive enough trigger.

Ghost in the Machine

Weighing a nonfundamental dislocation.

October 31st, 2023

A key House committee will soon consider newly filed amendments to a large-scale spending bill that would prevent the drug testing of certain federal job applicants for marijuana + end the blockade that’s kept Washington, D.C. from legalizing cannabis sales.

Several cannabis multistate operators are upgrading their Canadian stock listings to higher-tier exchanges and more are expected to join them as the U.S. canna complex migrates toward the ultimate prize of listing on the Nasdaq or NYSE.

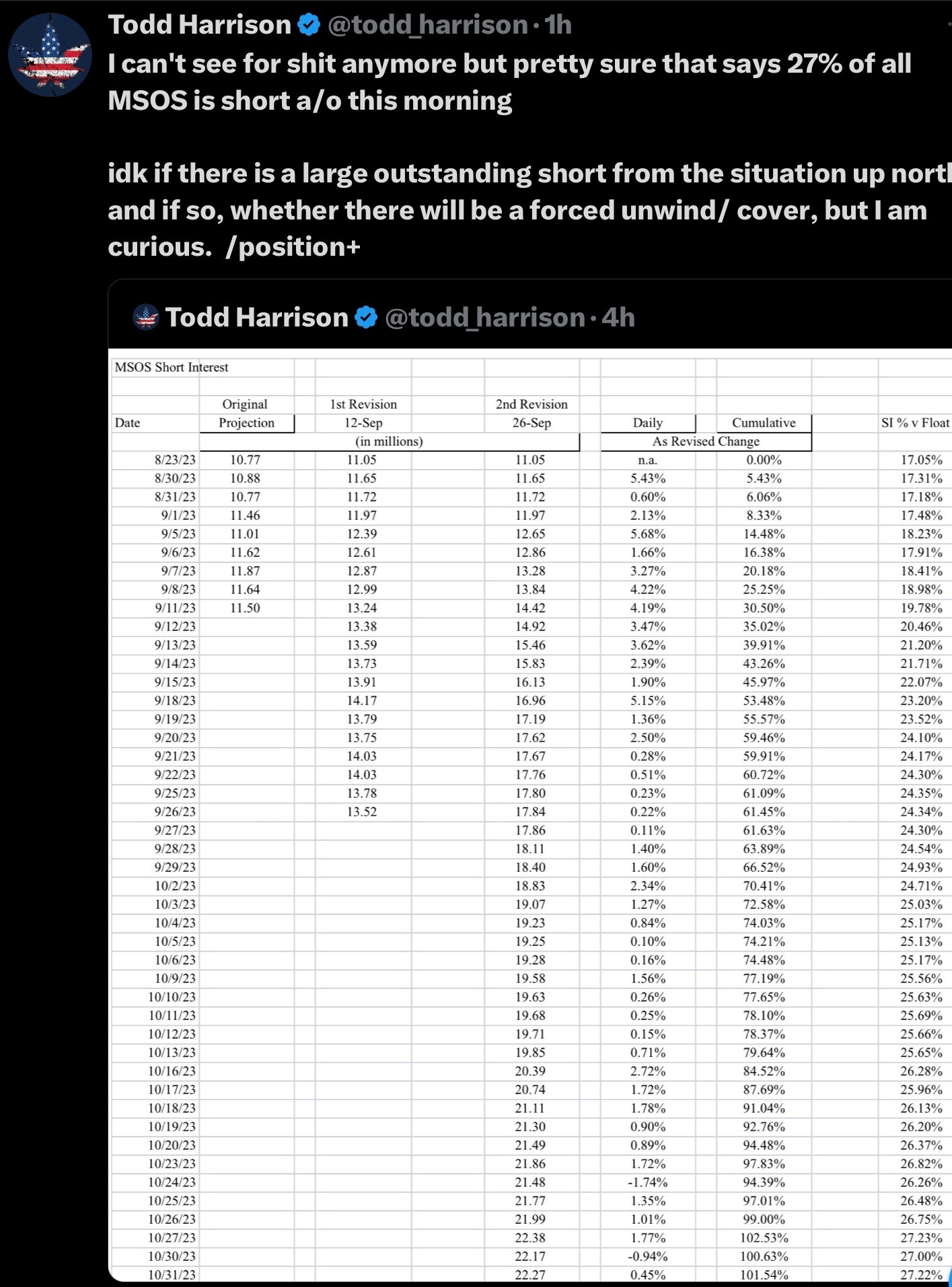

We can not contextualize invisible catalysts such as OPF (other people's flows), be it a forced liquidation or tax-loss selling (to the extent that it materializes) but for those of us who were scratching our heads as to why the HHS rally vanished—and pointed to the Speaker, even though that didn’t quite jibe…

We were lit up this week w questions about the price action. Our assumption is that the market is pricing-out SAFER given the new Speaker but that doesn’t entirely jibe given SIII would have a much larger impact + that’s what actually triggered the rally.

…it may be instructive to dig deeper into sad situation we alluded to yesterday given what has since been publicly disclosed + subsequently reported:

Ontario’s securities regulator barred a Toronto-based hedge fund from trading after its lead manager died and dealers were hit with large losses on the firms trades.

The OSC (regulator) is investigating the financial condition of Traynor Ridge Capital and a series of failed trades that stuck three brokerage firms with losses ranging from C$85M-C$95M ($61M-$68M) after completing trades the week of October 23rd.

“It appears to the Commission that Traynor is in serious financial difficulty” and that “further investigation of these events are required.”

Obviously, this is an extremely tragic situation—we’ve all felt the immense pressure of trying to navigate this frontier market and many of us lost a shit-ton of money during the massive drawdowns. But this—well, this isn’t a P&L, it’s life and death.

I’m sure we’ll hear more in the days and months ahead but the question we’re left to wrestle with is 1. whether they were the multiple-six or seven-figure seller that spent the last six weeks stopping U.S canna rallies in their tracks (we’ve heard this but can’t confirm) and 2. if they were, how much of that, if any, still needs to be unwound?

Here’s the thing, and its important: we don’t know. I spent the better part of the day speaking with sector sleuths, working backward by time and flow trying to figure out the implications—and there are still as many questions as there are answers.

[for instance, if they were long a handful of individual names (rumored to be Cresco, Curaleaf, CBST (in size) and Verano) against an outsized short in MSOS, as is being speculated, the short (initiated > $8.50) woulda printed money during the decline]

The takeaway, at least for me, is this: perhaps we weren’t missing something big and bad—like the DEA saying, “Hey, fuck you Biden! We know it’s an election year but we’re gonna leave this at a Schedule II”—as much as there was something big + perhaps bad going on behind the scenes.

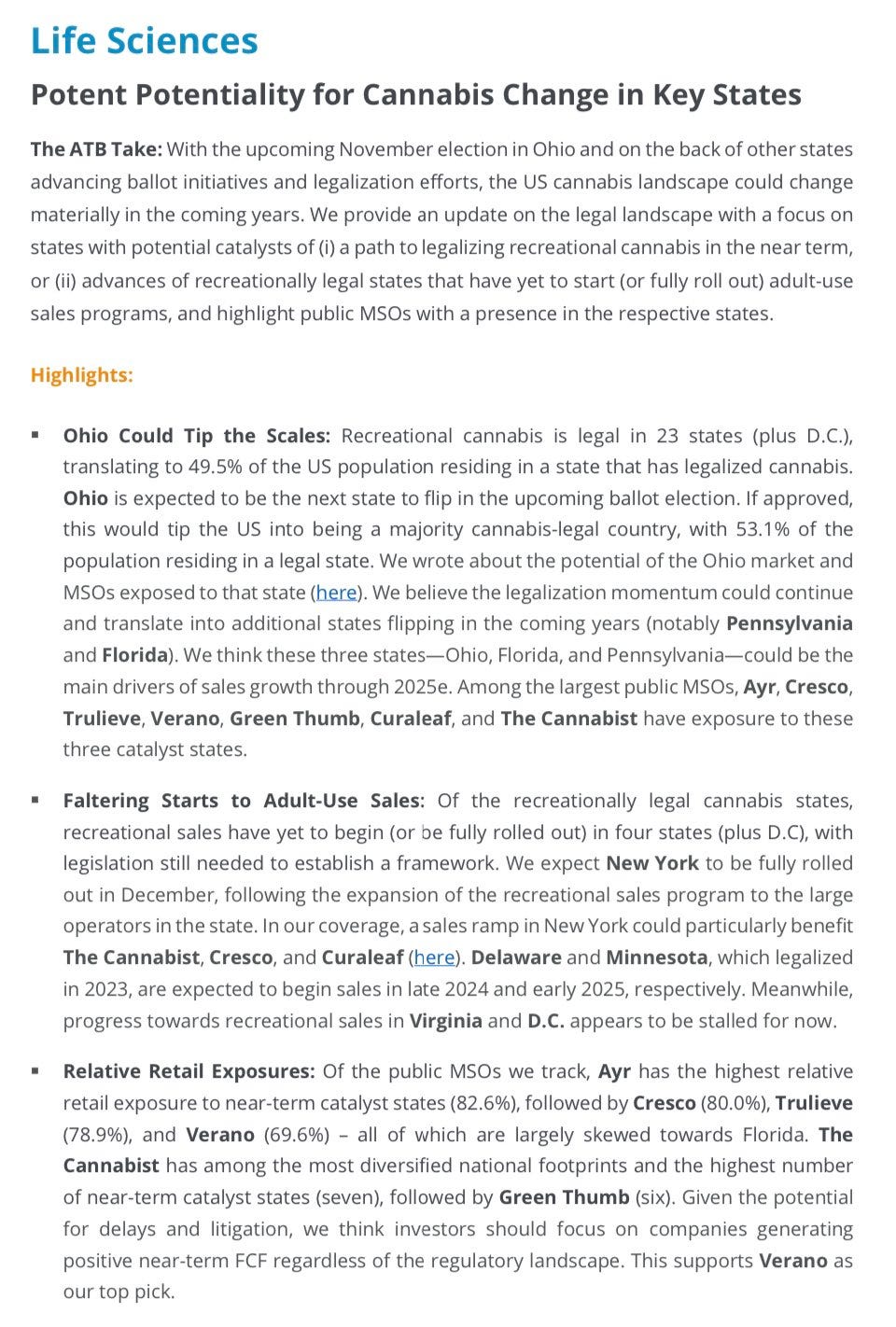

Freddy Benson Gomes of ATB: Ohio is the U.S. Canna Tipping Point

Hump Day Hash-Out

Previewing a November to Remember.

November 1st, 2023

A Pennsylvania House committee approved a Senate-passed bill that would allow all licensed medical marijuana grower-processors in the state to sell cannabis products directly to patients, along with an amendment to further permit independent growers and dispensaries to expand their operations.

Two recently released polls show that Ohioans remain solidly behind an Election Day effort to legalize marijuana possession, home cultivation, and sales. Separately, a new study predicts legalization would add $260M annually to the Buckeye State economy.

Home values in states with adult-use canna laws have outpaced home values in other states by nearly $49,000 from 2014 to 2023. The typical home in a state with legalized cannabis saw its value appreciate by $185,075 since 2014 vs. $136,092 in states that are stuck in the dark ages.

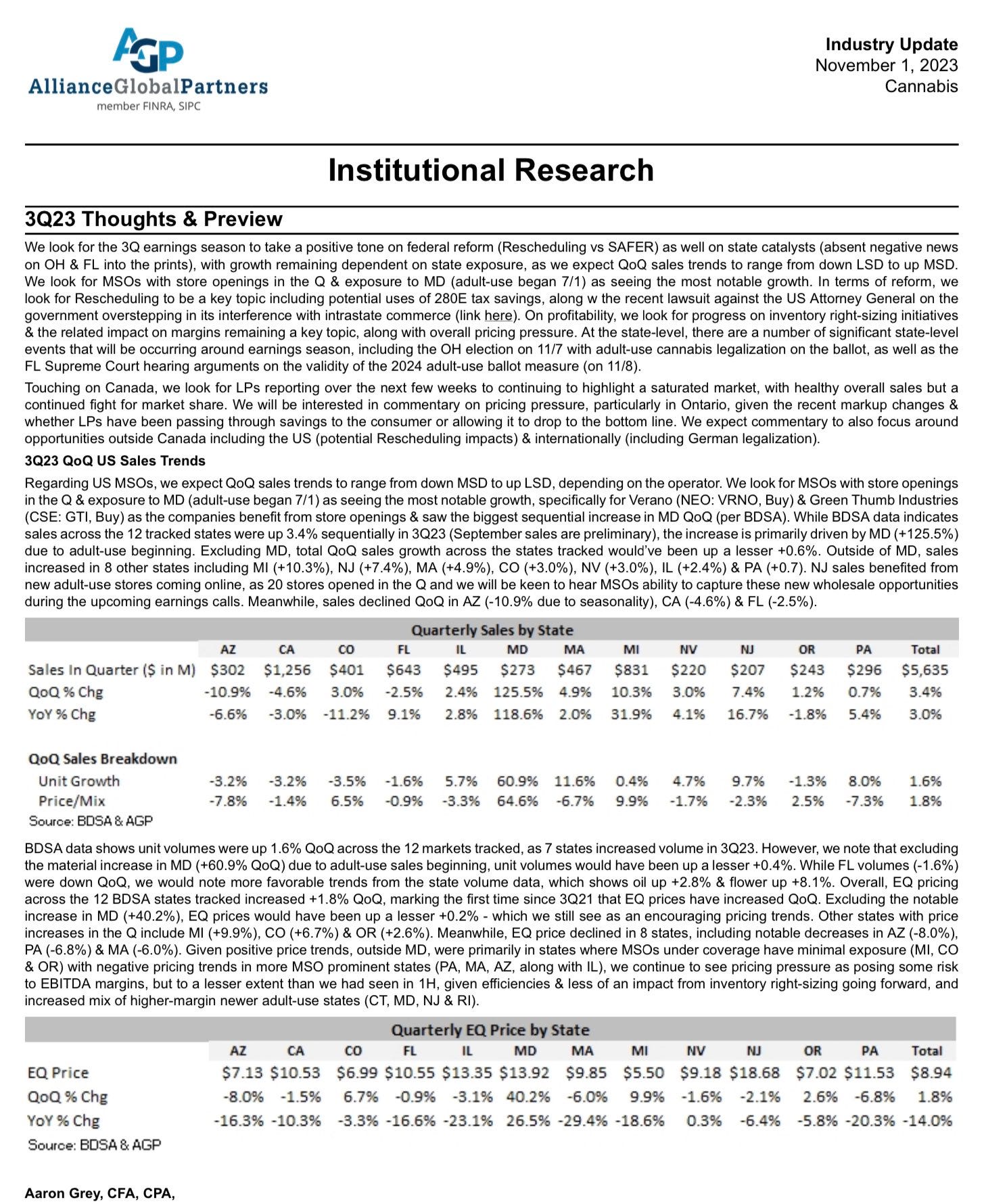

Aaron “A Touch of” Grey at AGP previews earnings:

AYR Announced (1) an agreement with senior noteholders to extend the maturity date by two years, (2) a commitment for US$50 million of new money financing and (3) an amendment to the LivFree Wellness, LLC promissory note.

Our take: dilution, but they pick up three years of runway and oodles of optionality through the duration of these maturities. Narrative shifts from potentially running out of cash in 2024 to allowing time for multiple levers of CF generation to trigger: FL, OH, PA, CT at the state level or SIII/280E, SAFE, et al on the federal level.

Pulse Fiction

D.C stirs but investors still shrug.

November 2nd, 2023

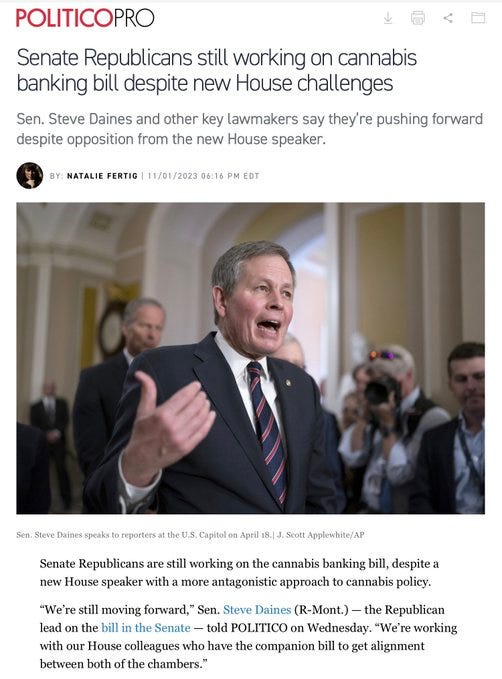

Politico Pro is reporting that Senate Republicans continue to work on the cannabis banking bill despite the new House speaker Mike Johnson (R-LA), who has been a harsher of the canna industry’s mellow for as long as he’s been a public servant.

“We’re still moving forward,” Sen. Steve Daines (R-MT), the Republican lead on the bill in the Senate, told POLITICO on Wednesday. “We’re working with our House colleagues who have a companion bill to get alignment between both chambers.”

Wyoming Sen. Cynthia Lummis (R-WY), who’s been involved in deliberations over the bill in committee, said a floor vote is ultimately up to Majority Leader Chuck Schumer but for Senate Republicans, she said “I really don’t think that it’s going to make any difference that the new speaker opposes it.”

The Senate also approved a bill that includes a provision to allow doctors at the U.S. Department of Veterans Affairs to issue MMJ recommendations to veterans living in legal states. The House has separately advanced similar language in its own version of the appropriations legislation.

House lawmakers in Pennsylvania looked into the legalization of adult-use cannabis in the Keystone State and what it could look like if passed into law. A spokesman said there will be additional hearings and anticipated the issue could potentially be put to a House floor vote in 2024.

A small but arguably significant development occurred last week in Vienna, although it went almost completely unnoticed by industry observers. Shane Pennington, a self-professed law nerd, penned a promising Substack that detailed several comments that were made before the U.N.’s Commission on Narcotic Drugs (CND).

In short, Mr. Pennington openly pondered whether the U.S. Representative has laid the groundwork for the U.S. approach to the Single Convention and if so, whether it’s designed to accommodate state-level cannabis legalization efforts.

We’re keeping our eyes on the prize (SIII + no 280E + Garland + maybe OH FL VA SAFE) but our journey to that destination will likely be littered with the same sorta detours and pot-holes that we’ve come to expect.

While we understand the world is a particularly unpredictable place right now, we continue to hold the variant view that elements of our year-end wish list remain in place and the month of November began the active period for red headlines.

Hurry up and Wait

U.S. canna readies for big week.

November 3rd, 2023

Senate Banking Committee Chairman Sherrod Brown (D-OH), after a long process of soul searching, voted in favor of the Ohio ballot initiative, calling it a “hard decision” but one that was based on his belief that the reform would promote “safety” for his Ohio constituents. That safety, quite obviously, will be shaped by SAFE Banking.

New York regulators are expanding on the medical cannabis retail licenses for large multistate operators for the first time since the state launched MMJ sales in January 2016. MSOs will pay a premium to enter perhaps the nation’s most untapped retail marketplace, which currently has only 26 operational licensed adult-use retailers in the entire state nearly a year.

After a week that saw the bulls and bears take turns at holding serve, stocks sat in a holding pattern for most of the session before closing slightly higher on light volume. U.S. cannabis ETF MSOS will start earnings week nestled between a potential double bottom and a confluence of moving averages. after launching adult-use sales.

MSOS quietly managed to put in a series of higher lows + higher highs this week for a much needed constructive signal for those squinting to see something positive…

…but we still need to mount those moving averages to awake the zombie apocalypse…

…and put some distance between us and what could turn into a nifty double bottom.

While next week will be all sorts of busy—Ohio, Florida, Virginia, Verano, Village Farms, Green Thumb, Trulieve, Curaleaf—it’s the news we don’t yet know—DEA timing, fate of SAFE Banking, depth of the Garland Memo—that’s gonna pave our year-end path.

Enjoy your weekend, be safe, hug a kid/ pet and please enjoy responsibly.

/end

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.