The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click the title to access any article; most of the insight and analysis is behind the paywall and you can access a free trial by clicking below; thanks for your support.

In too VEEP

Kamala confuses Cannaland.

February 12, 2024

Vice President Kamala Harris posted a video to social media on Friday that cited the Biden administration’s moves to reform federal marijuana laws in an effort to appeal to young voters. There’s just one problem: her specific claim that cannabis policies have already been “changed” is blatantly premature.

“We changed federal marijuana policy, because nobody should have to go to jail just for smoking weed,” - VP Kamala Harris

Quaker Ridge

Pennsylvania’s governor said he thinks state officials “don’t even have a choice anymore” on legalizing cannabis and feels that there is enough bipartisan momentum for lawmakers to leverage to get the job done.

“This really comes down to an issue now of competitiveness,” as the state is currently “losing out on 250 million bucks a year in revenue that could go to anything from economic development, education, you name it.” -PA Gov. Josh Shapiro (D)

Reading the Tea Cannabis Leaves

We powered up a fresh five-session set shaking off our Super Bowl hangovers and trying to make sense of that late-Friday Veep video.

We’re assuming one of three things happened:

The administration is gaslighting the snot out of their constituency and hoping they’re too dumb to realize the inherent conflicts between what she said on that video and what’s been done to date.

A sloppy and disorganized Democratic party jumped the gun by releasing the video before the announcement; embarrassing but somewhat on brand.

The decision was lined up for late last week but the it got pushed after the leak + someone forgot to tell the VEEP’s office to delay the video, too.

While we can’t assign a zero percent probability to #1, we can assume an extremely low likelihood given all the chatter + 252 pages of documented proof.

I haven’t the slightest idea if it’s #2 or #3 but assuming either is true, it would likely be more of a positive than a negative with the variable of timing still twisting in the wind.

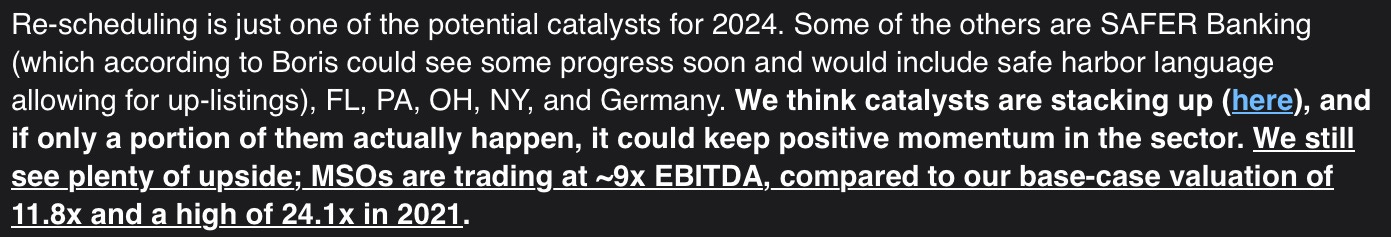

We remain of the view that SIII + Garland will find their way into the public domain with the latter timed as a function of the former, and hopefully we’ll get SAFER too.

Even if we leave the last leg of that trifecta on the backburner for obvious reasons, the DEA decision, either via proposed or final rule, and the Garland Memo, are either on their way or (per the VP of the United States) already done.

ATB on U.S. Cannabis:

Cuckoo’s Nest

The nuts & guts of U.S. Canna.

February 13, 2024

A group of lawyers argued in a newly released legal opinion that contrary to what the DEA has asserted in the past, international drug treaties ought not stand in the way of moving marijuana to Schedule III of the CSA, as the HHS has recommended.

“In light of the failed war on drugs, devastating impacts on communities of color, and the public health risks associated with a dangerous illicit market, placing Marijuana in SIII would further the public health, safety, and welfare better than Schedule I or II could.”

Hoos for Tuesday

Virginia’s Senate formally signed off on a proposal to legalize retail marijuana sales in the commonwealth despite concerns raised by local law enforcement groups.

The vote came a day after the House approved a separate marijuana retail sales bill and those differences still need to be reconciled if lawmakers hope to send the commerce legislation to Gov. Glenn Youngkin (R) this session.

Metro Card

A New York lawmaker introduced legislation to revamp the state’s medical cannabis program, in part by allowing out-of-state patients to shop at New York’s dispensaries.

NYS Sen. Jeremy Cooney, who introduced the legislation, said it’s problematic that New York, with about 1 million out-of-state workers coming and going daily, doesn’t allow non-residents to access medicine prescribed by health professionals.

It's February 13th, 2024.

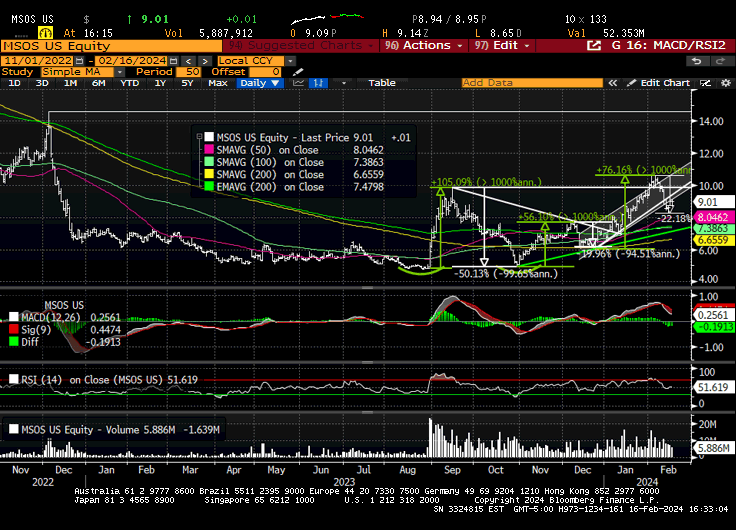

$MSOS is +22%, overbought conditions have largely been worked off and in the first six weeks of the young year, there's been a steady drumbeat of good news:

On January 3rd, Punchbowl reported that the DEA told House lawmakers the cannabis scheduling review is ongoing.

[industry-watchers knew this but it catalyzed sector and attracted new money into a space desperate for liquidity]

On January 12th, the U.S. govt released 252 pages of documents explaining cannabis “has a currently accepted medical use in treatment in the United States” and a “potential for abuse less than the drugs or other substances in Schedules I and II.”

On January 24th, the DOJ asked a federal court to dismiss a cannabis industry lawsuit that is seeking to block the enforcement of marijuana prohibition against state-legal activity, in part because “the court should not get ahead of a possible cannabis rescheduling decision that’s being considered.”

Imagine that, now imagine walking into this exact scenario at any point over the last three years—yesterday was the three year anniversary of #MSOGang—and you’re gonna tell me there’s not a lot to be thankful for?

This is the lens I'm trying to view this madness through; call it perspective, call it zooming out; call it head-in-the-sand—that's up to you—but these are still exciting times for U.S. cannabis, even if they're bumpy.

Premarket Prep

We fired up Turnaround Tuesday and opined that the previous day’s price action was more-or-less on-brand for most of the session (heavy, until late) ‘til the reversal (lower)-of-the-reversal (higher) stuffed the bulls and put several technical levels on notice.

We've remained conscious of the near-term overbought conditions (following the 48% 5-week rally, and that's just the ETF) as well as the composition of volume (fast money tourists) but the late-day Monday flush almost felt structural, akin to the price action during the week of January expiration, when there was an 8.5% dip.

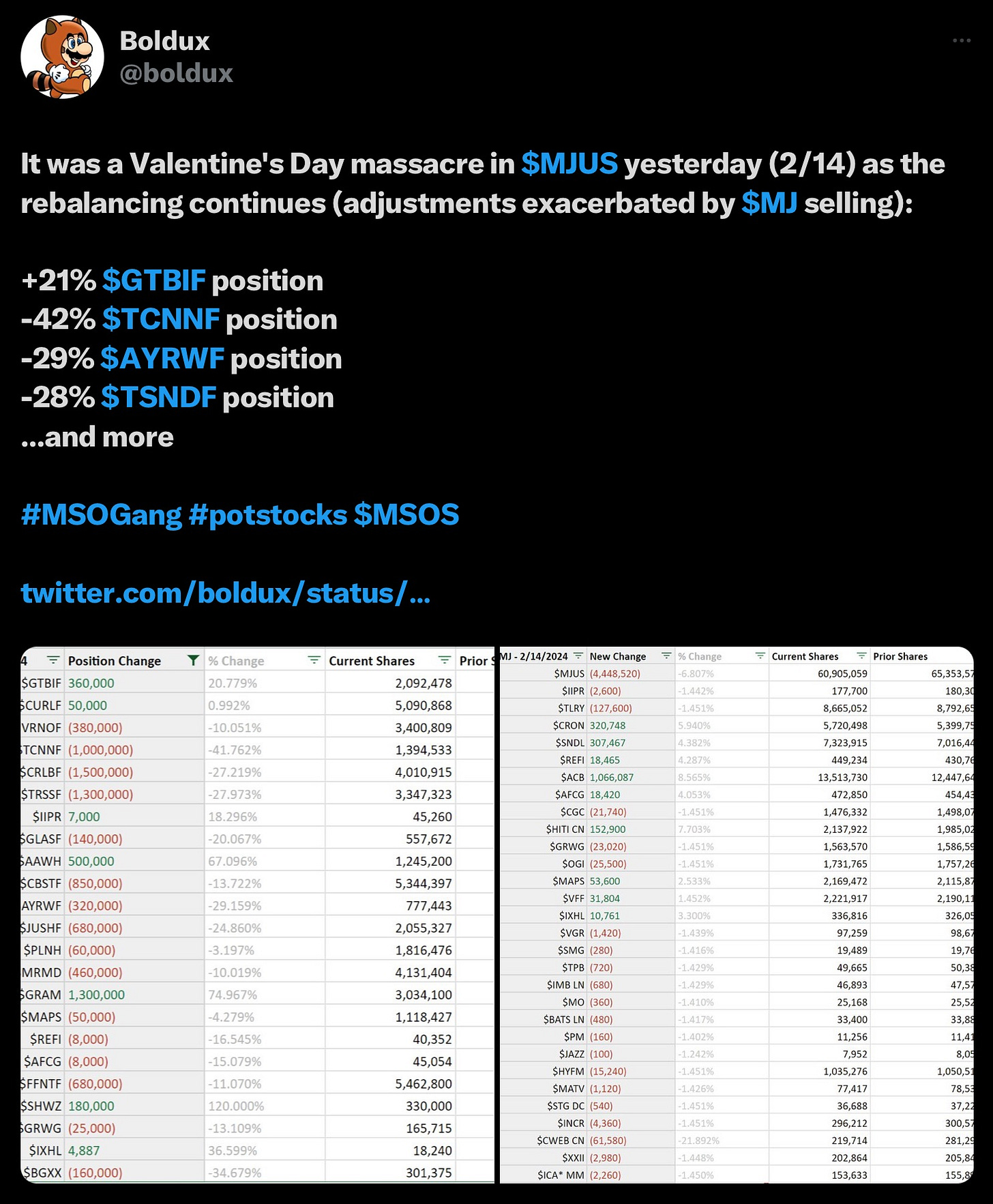

Several ETF rebalances are in play, too. MJUS, for one, definitely colored Monday’s price action. These are not liquid securities, as evidenced by Ascend Wellness’ 24% intraday rally on Monday before it printed 14% lower on the final tick.

CGF on U.S. Cannabis

Mounting the Hump

Canna creeps across the weekly midpoint.

February 14, 2024

The Drug Enforcement Administration and AG Merrick Garland missed a Feb. 12 deadline to respond to 12 U.S. senators regarding the DEA’s cannabis rescheduling process, multiple congressional sources confirmed with Cannabis Business Times.

Transitioning

Pennsylvania Gov. Josh Shapiro recently asked lawmakers to tee-up cannabis for this legislative session and established medical players are looking to be first to market.

The decision to allow adult-use via a legislative process, rather than through a vote, will likely allow the state’s existing medical operators to benefit the most as many of them already possess wide footprints, large canopies, and ancillary businesses.

Palmetto Pot

South Carolina’s Senate passed a medical marijuana legalization bill today, sending it to the House of Representatives for consideration.

The bill still needs to clear the House—a prospect that’s far from certain. The Senate had passed an earlier version of the legislation in 2022 but it stalled in the House over a procedural hiccup.

Box of Chocolates

We limped to the Hump this morning after six days of thesis-testing that erased about half of the year-to-date gains. We can point to any number of triggers:

The nose-bleed overbought conditions that carried into February, the influx of fast-money tourists that go-out-through-the-in-door, several well-meaning target-missing predictions on the timing of federal movement, the fever possibly breaking yesterday in the broader tape, outsized sector ETF rebalances, Friday’s expiration, gravity, or even Taylor Swift—but it doesn’t matter.

All that matters is price and time, and how those dynamics coexist.

Nothing has changed as far as we know regarding the scheduling process or the Garland Memo, which we expect will help sort all of this out. Trying to time those catalysts, however, or at least narrow it down to a week or month, is more elusive.

The bulls task, between here and there, is to keep their shit together and hopefully reclaim the recently lost technical levels, including the MSOS trend channel and the Sept. intraday + closing highs, both for the ETF + many of the underlying stocks.

Random Thoughts

Our space got over our skis sentiment and %-return wise right into the buzzsaw at S&P 5K, which is giving me a lil’ NASDAQ 5K tickle from Y2K.

Recent tourists may not appreciate the structural impediments facing U.S. canna or the volatility created by the friction between NYSE-listed ETFs and underlying securities that trade by appointment given custody restrictions.

The Florida Supreme Court decision (on whether to allow for the Nov. adult-use vote) is expected by April; we’re told that news is released Thursday’s 11:00 AM.

Been watching GTI + TRUL + VRNO for their ability to hold Sept. support levels in down tapes, and for them to exhibit leadership qualities in up tapes.

ETF rebalances are a natural process in financial markets; the custody issues are driving the volatility.

And new rule! You’re not allowed to be angry about sell-side rebalances and then be happy about buy side imbalances. For instance..,

We can't confirm the amount bc it’s subject to change based on market dynamics but per the allocations and allowing for cushion, TD-Cowen estimates ~4.6M shares of Verano, or ~seven full days of avg. trading volume—need to be bought before Feb. 28.

Connect the Dots

Making sense of the canna madness.

February 15, 2024.

Negotiations over a key section of the cannabis banking bill — addressing protections for gun shops — are close to wrapping up, according to one of the lead negotiators on the legislation.

Rep. Blaine Luetkemeyer (R-Mo) told POLITICO on Wednesday that lawmakers have continued to work on it for the last six months, sending bill text back and forth. Most recently, he approved another version that was sent back to the Senate just last week.

Green Berets

In what has been described as a ‘great victory’, Ukrainian President Zelensky signed into law legislation permitting the prescription of cannabis-based medicines for conditions including pain, cancer and PTSD.

The legalization of medical cannabis in Ukraine has been a long-time coming, with activists campaigning on the basis that it could help millions of veterans and patients across the country.

Fire Marshal Bill

Virginia lawmakers have advanced bills that would allow public sector employees to use medical cannabis without losing their job. These efforts look to extend to state public employees rights that already exist in the private sector.

“The key was we left our brave first responders out of this. That was never our intent and so this bill is meant to fix that.”

Sloppy Sue and Big Bones Billie

We awoke this morning to find tangible evidence of the funky footprints we’ve seen traipse across Cannaland of late, remembering that we can’t hate the player as much as we should observe how uneven the structural field has become for our game.

While past performance is no guarantee of future results, we can recall that the space bounced hard after they finished the last time. Heck, we even helped take them out of some exposure. This one rattled some cages, no doubt, but that may have had more to do with positioning than a transitory bump on our volatile road to redemption.

Moose Knuckle Tracks

We saw MJUS footprints again today (selling TSND, FFNT, AYR, among others) but our sense, for what it’s worth, is that they’re close to finut.

The why behind the recent price action (mechanical vs. something changed) may have provided some confidence on the margin but either way, we got a 50% retracement of the rally off the December lows and corrections must feel onerous for them to work.

Simmering Stew

Investors patiently await federal change.

February 16, 2024

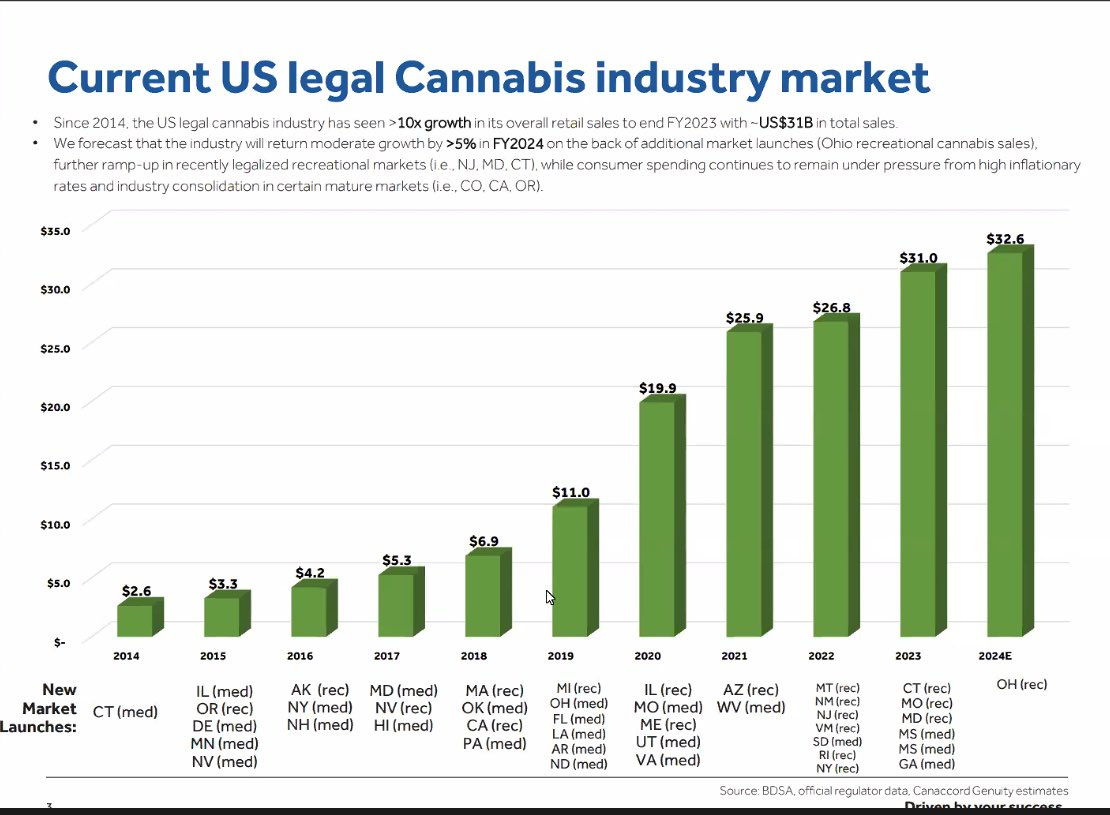

After a recent surge of legislative and financial activity, experts in the canna industry are closely watching the unfolding narrative surrounding the potential rescheduling of marijuana from Schedule I to Schedule III.

This shift, coupled with the advancement of the SAFER Banking Act by the Senate Banking Committee—and word this week that the legislation is “down do the last few words”—could herald a new era for cannabis businesses.

Go Bucks

Ohio regulators have issued proposed rules for medical marijuana businesses and provisional license holders to convert to dual-use licenses to serve both the medical and adult-use markets.

The draft rules primarily focus on the application process, qualifications and other administrative protocols to meet a Sept. 7 deadline to issue adult-use licenses.

Tax-ee!

New York cannabis regulators awarded 110 new adult-use licenses today, including 24 cultivation licenses, 9 distribution licenses, 26 microbusiness licenses, 12 processor licenses, 25 retail licenses, and 14 provisional retail licenses.

It’s unclear how quickly the operations will be able to start, and they represent only a small fraction of the entrepreneurs attempting to enter the market.

Thunder Road

To recap the last six months: U.S. cannabis ETF MSOS traded from $5 to $10 to $5 to $10 to… trying to make a higher low despite the carnage asada caused by MJUS’ ETF rebalancing. 34 years staring at screens, I’ve never seen vol like this and I’ve seen vol.

This latest leg lower has been harsh but it’s also been on brand. We know volatility is the opposite of liquidity so after all of the custodian banks restricted ownership of the underlying securities and liquidity evaporated, voila—here we are.

This week was a doozy in and of itself, as many of the underlying names continued to get banged around by the ongoing MJUS rebalancing. We saw their footprints again today as sellers of Verano, TSND, Cresco, AYR and 4Front, among others.

The ability of Green Thumb, Verano and Trulieve to hold their Sept. highs through all this mishigas, the last two despite the continued MJUS mooseknuckle, is positive on the margin as the Generals have led the troops higher in past cycle turns.

Horse Trading

Earnings are set to begin in a few weeks, which will offer a nice distraction from the binary Phase III DEA readout people are losing their shit over. We’re not expecting any great shakes—most of the majors guided to down mid-single digits—but it’ll be good to hear from the jockeys after taking a ride on their horses.

Work to Live

Markets are closed Monday and to that end, I’ll be joining my wife and our youngest for her Spring Break in Miami for the first part of the week. I plan to publish Tues, Wed + Fri, with Thurs as a travel day, and maybe even steal some sun in my cheeks.

Enjoy your weekend , stay safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.