The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click the title to access any article; most of the insight and analysis is behind the paywall and you can access a free trial by clicking below; thanks for your support.

D.C. Dogs & Ponies

U.S. canna is on the clock.

March 18, 2024

For the first time since joining the ticket as President Joe Biden’s running mate in 2020, Vice President Kamala Harris has called for the legalization of cannabis, which signals a possible shift in the administration’s platform heading into the elections.

The VEEP told a room of cannabis pardon recipients at the White House on Friday that “we need to legalize marijuana,” a participant in the meeting revealed, which perhaps offers a glimpse into what a second-term agenda/ promise might look like.

“Everything about today—and there were some words expressed about doing more things like this—the White House wants to engage on this policy consistently. That’s clemency, criminal justice, marijuana legalization… right now the White House has an important role to play and they’re doing it.” -Advocate/ Attendee Chris Goldstein

We Are the World

World leaders gathered in Vienna for the first time since 2019 to assess the status of the international drug policy amidst a global drugs crisis that claims hundreds of thousands of lives every year and drives systematic violations of human rights.

In a first ever showing of such unity, a coalition of 60 countries led by Colombia took the floor at the opening of the event to call for the reform of the international drug control system, which hasn’t changed since the height of the War on Drugs.

The joint statement sounded the alarm on the catastrophic consequences of punitive drug policies, which fuel violence, corruption and environmental devastation, while also undermining health, development and human rights.

Boies in the Hood

In a new federal court filing, lawyers for a group of marijuana companies argue that ongoing cannabis prohibition has “no rational basis,” pointing to the government’s largely hands-off approach to the recent groundswell of state-level legalization.

The lawsuit alleges that while Congress’s original intent in banning marijuana through the CSA was to eradicate illicit interstate commerce, lawmakers + the executive branch have since abandoned that mission as more states move to regulate the drug.

“Dozens of states have implemented programs to legalize and regulate medical or adult use marijuana,” and “safe, regulated, and local access to marijuana” in those states “have reduced illicit interstate commerce, as customers switch to purchasing state-regulated marijuana over illicit interstate marijuana.”

Manic Monday

A week ago today, a bullshit WSJ article re tensions at the DEA knocked the ETF 8% lower after it had already been waxed the previous month; the mood, as you’d expect, was venomous but as fate would have it, MSOS finished last week on a high note.

Following the ETF’s 15% gain on Friday, the weekend mood on social media was the mirror image, which hasn't translated to positive performance in the past. It also felt a bit premature, as MSOS had only clawed back losses from the previous week or so.

It was and remains way too early to take a victory lap with MSOS still a single-digit midget. The latest sound bites have been encouraging but there is much to be done and plenty of peeps who won’t believe any of it until it actually is.

Still, the positives: MSOS held triple-lindy support (tested on light volume, thrusted higher on big volume); earnings were solid, for the most part; SIII gained a powerful ally, SAFER signals continue to persist and Señor Garland is waiting in the wings.

The trick to our trade, again, will be MSOS, which is the most scalable solution able to funnel the necessary liquidity for a rising tide to lift these boats; and the asterisk on that dynamic remains composition of volume until such time institutions can custody.

In other words, same as it ever was but this time with a lot more eyes + much higher stakes, which feels about right as The Everything* Rally shows signs of fatigue + US canna readies to flex after 1132 days of hardcore training + somber soul-searching.

Volatility is the Opposite of Liquidity: This is Insane btw

Mary Jane’s Last Dance

The Biden Administration needs to deliver.

March 19, 2024

President Biden recently reaffirmed his commitment to federal cannabis policy reform but activists contend that rescheduling alone won’t help those who have been most harmed by prohibition.

The President responded to a sign held by a cannabis activist last week that stated “no one should be jailed” and he assured the crowd that he was “taking care of that”—but the only way for Biden to “fulfill his promise” is to remove cannabis from the CSA.

This, of course, has already emerged as a central plank for Biden-Harris 2.0.

Amish Upon a Star

A top Pennsylvania House Democratic committee chairman says it’s “high time” to legalize cannabis and lay the groundwork for state businesses to export cannabis to other markets if federal law changes—and he sees a “real opportunity” to do so, even as his Republican counterpart is downplaying that possibility this session.

“Pennsylvania, if we want to get in front of things, it’s high time that we legalize adult-use cannabis, tax it and create the industry here.” - Jordan Harris (D)

Disaster Recovery Plan

Gov. Kathy Hochul has told New York officials to come up with a fix for the way the state licenses cannabis businesses amid widespread frustration over the plodding pace of the state’s legal rollout and the explosion of unlicensed dispensaries.

The governor ordered a top-to-bottom review of the state’s licensing bureaucracy, which is weeks after she declared the rollout “a disaster” and called off a meeting when she learned the Control Board was prepared to hand out only a few licenses.

The IRS has issued a new memo clarifying rules for reporting large cash payments between marijuana businesses, which the agency says should not automatically be considered “suspicious” just bc of the federally prohibited nature of the industry.

“The memorandum provides guidance on many of these issues in a question-and-answer format. We are working on additional guidance on questions related to cash couriers and armored cars who transport cash between growers/manufacturers and dispensaries/sellers.” -Special Agent Carl Hanratty

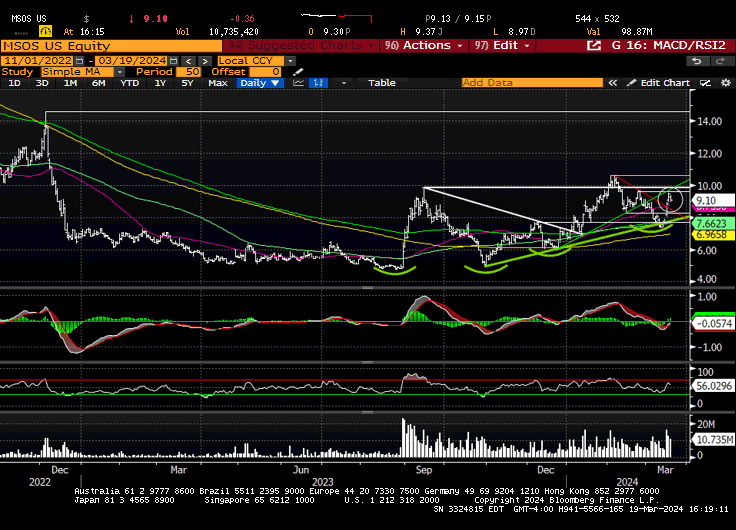

Chart Check

Technically, there’s a lot to like after the ETF held triple-lindy support following the false-breakdown, including recapturing all of the moving averages, which is big, with only a few minor levels between here and the Feb. highs, with room above after that.

We offered this morning that a pullback/consolidation to form a 'higher low' and/or a right shoulder (Inverted H&S) was possible but it feels like dips will be bought ahead front of potential catalysts including SIII, SAFER, Garland, Florida and Pennsylvania.

Canna Gets Whipped

Banking has bipartisan support.

March 20, 2024

As Congress prepares to pass a final package of spending bills for the 2024 Fiscal Year ahead of Friday’s deadline, renewed attention has shifted to other legislative priorities, including the Secure and Fair Enforcement Regulation (SAFER) Banking Act.

The chairman of the Senate Banking Committee said that passing marijuana banking legislation remains a priority for the chamber and a top Republican congressman has reaffirmed his support, despite not being “a marijuana guy.”

"Like it or not, if your state has enacted laws creating cannabis as a legal entity that is legitimate, our bankers should be allowed to bank. -House Maj. Whip Tom Emmers

Swing State Cometh

Pennsylvania lawmakers held another hearing on marijuana legalization, this time focusing on the criminal justice implications and potential benefits of reform.

As the governor steps up his push for legalization, including the policy change in his budget request last month, members of the Health Subcommittee met today.

“I think we are really well-positioned to move forward with legislation.”

Red State Weed

A bipartisan group of 20 state attorneys general are imploring Congress to take action to address a looming public health “crisis” due to the burgeoning multibillion-dollar market for intoxicating hemp products.

Congress legalized hemp under the 2018 farm bill, touting it as a boon for struggling farmers, but the market has become increasingly dominated by intoxicating products that are largely unregulated and often sold at gas stations and convenience stores.

What Hump?

We hiked to the hump after yesterday's respite that followed a two-day technical bull market. The premarket price action this morning was in the Canadian LPs, led by CGC 6.19%↑ trading 13% higher as the former 🦍 continued to squeeze.

Chatter, or should I say hope, abounds that we'll hear from the DEA as soon as Friday, prior to the two-week congressional recess. That's been The Don of DC™️'s persistent vibe and while we're wary of more rumors, it's out there so might as well take note.

Expectations are a double-edged sword—or, to date, a single edged sword, as in an optimist's guillotine—but I'll again say that with Biden-Harris 2.0 framing the next phase, they'll obviously need to land the first phase to be taken somewhat seriously.

I don’t know if that process will lurch forward as Congress heads home but if it does, it would be a weekly threepeat following SOTU + the WH—if not, those with battered and abused canna bull syndrome might exhale on the other side of the weekend.

Shadow Boxing

U.S. canna is ready to face the future.

March 21, 2024

The Biden administration’s top health official once again defended his department’s recommendation to reschedule marijuana against Republican criticism, while pointing out that the incremental move wouldn’t decriminalize cannabis despite the president’s campaign pledges to do so.

“What we’re talking about here is the federal treatment of cannabis because federal law treats cannabis differently than most states, and what the president asked us to do is examine where we are with cannabis.”

Truth & Consequences

Rep. Earl Blumenauer (D-OR), founding co-chair of the Congressional Canna Caucus, laid into U.S. Department of Health and Human Services Secretary Xavier Becerra on Wednesday over “political malpractice” regarding the administration’s canna agenda.

“We’re still waiting, Mr. Secretary. This is an area that is profoundly affecting millions of people in the United States. We are denying opportunities for research that almost everybody agrees will be transformative and we’re not in the forefront.”

Math Class

Whitney Economics forecasts that U.S. adult-use and medical cannabis sales will top $31.4B in 2024, an increase of $2.6B from 2023, or roughly 9% YoY growth.

The U.S. legal cannabis sales forecast for future years are as follows: $31.4B in 2024, $35.2B in 2025 (12% YoY growth), $67.2B in 2030 and $87B in 2035.

Brilliance (take a moment)

FDA says marijuana has a legitimate medicinal purpose

German Bear Hug

Deutschland helps squeeze the shorts.

March 22, 2024

Ongoing federal marijuana prohibition has created a “real problem” for banks amid the growing state legalization movement, Treasury Secretary Janet Yellen said, adding it would be “desirable” for Congress to pass reform legislation to address the issue.

“It is a shame that the Senate has not passed legislation that we passed in the House to fix the banking problem.” - former House Maj. Leader and the most senior member of the House Democratic Caucus, Rep. Steny Hoyer (D-MD)

More Bank Shots

Senate Banking Committee Chairman Sherrod Brown (D-OH) says passing marijuana banking reform legislation this year is a “high priority,” as he reiterated his support as congressional attention shifts from funding the government to other legislative items.

“It’s a high priority. Sen. Maj. Leader Chuck Schumer wants to do it and I wanna do it.”

Puff and Schnitzel

A bill to legalize marijuana in Germany will be implemented on schedule in April, with lawmakers representing individual states in the Bundesrat declining to refer the bill to a mediation committee that woulda meant adding six months to the timeline.

“The fight was worth it, legalization of cannabis is coming on Easter Monday! Please use the new opportunity responsibly and help protect our children and young people. Hopefully this is the beginning of the end for the black market today.”

Must See TV 📺

FDA says marijuana has a legitimate medicinal purpose 📺

Rep. Joyce Questions Sec. Yellen on SAFE Banking 📺

The February MSOS gap ($9.75-$10.15) was defended by the bears all morning…

…which hit the ETF as much as 4% lower as CGC 53.51%↑ ripped to the upside. We saw sizable short covering in that name all week across several desks, and the recent tax chatter + today’s German news likely helped juice the squeeze.

But today’s Germany news, while monumental, with numerous readthroughs, will take time to materialize on the bottom line—today was a step, not a solution, and certainly not a reason for the stock to rally 150% 160% 180% in six sessions.

My best guess, away from a massive squeeze—the stock was left for dead with one analyst assigning a Blutarsky—the tax stuff and the eventual European opportunity is the stock is getting repriced for their U.S exposure and eventual, if not inevitable U.S. presence. IDK if that’s true, mind you, but it’s the best I can come up with.

The afternoon featured more of the same—a squeezy Canada + lethargic underlying U.S. stocks—bc so few people can access the names and MSOS is the primary pipe—as I shook my damn head at the volume disparities between the Canucks vs. MSOs.

MSOS landed a percent lower and remains poised, with no promises, for next week.

Also worth your time 👇

Enjoy your weekend, stay safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.