These are trying times for the stock market as currencies, rates and inflation wreak havoc with what’s quickly turned into the “other side” of fiscal pandemic pleasure.

As global anxieties rise, tensions mount and the S&P tests the June lows, conventional wisdom is that Federal Reserve Chairman Jerome Powell has painted us into a painful corner, per this perspective by our pal Peter Boockvar:

While market participants are actively positioning for such things…

…the market itself has been pricing it in for quite some time, as evidenced by the Feb 2021 peaks across growth sectors in the market…

…of which, U.S cannabis ETF MSOS has been the worst relative performer.

We’ve chronicled the artificial impediments that have littered this landscape and as free cash flow is king—not just for cannabis but in any industry given the current financial conditions—the stakes have again been raised.

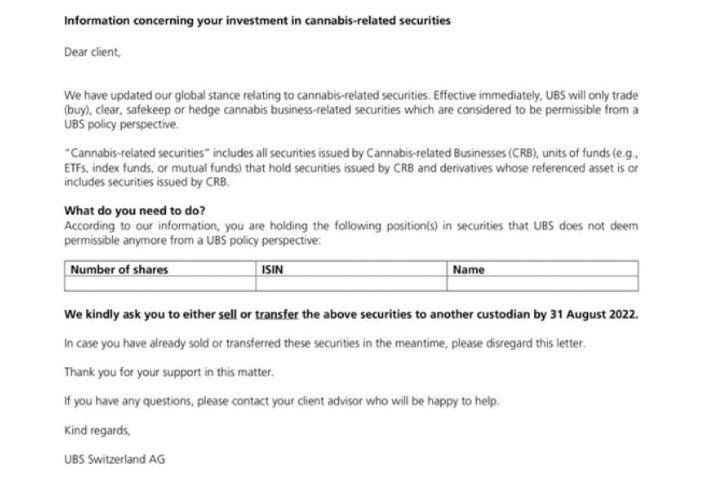

As banks continue to restrict access to U.S plant-touching securities…

…the phantom market continues to shrink, as evidenced by the volume on Fed Day, when $21M notional traded across ~$15B in aggregate MSO market caps…

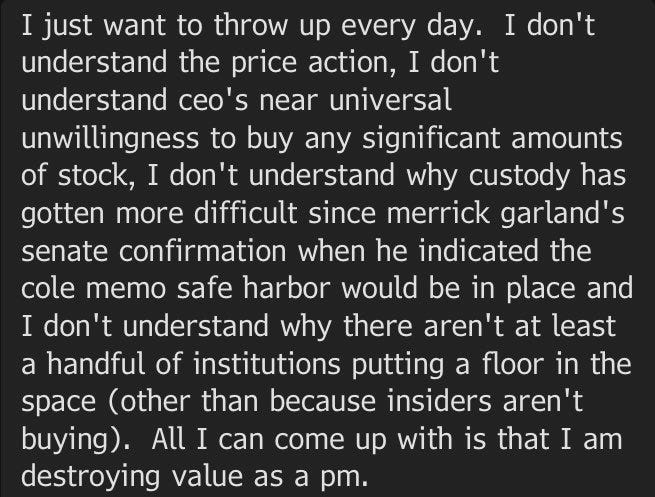

…and investors who’ve weathered the storm are pulling out what’s left of their hair.

All of which begs the obvious question—one a prominent analyst recently raised—is this decline cyclical or secular; in other words, will the U.S cannabis industry survive?

Yes, this conversation is inherently bullish—as long as the answer is cyclical.

As organizations the world over struggle with the uncertainties surrounding costs, the consumer and credit markets, the combination of capital constraints and an effective 70% tax-rate (under 280E) has, for most operators, made business miserable.

As the economy continues to struggle and states look for new sources of tax revenue, the simple truth is there aren’t many emerging growth industries capable of driving billions in new tax revenue and half a million jobs (currently, with room to grow).

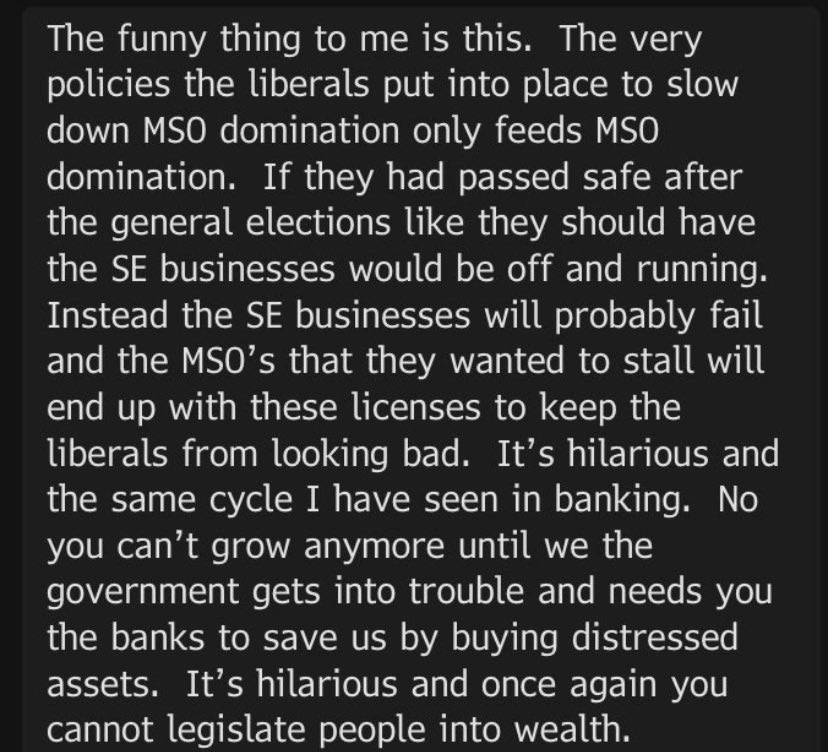

But the stark reality is that w/o swift changes to the regulatory regime, only a handful of top-tier companies (+ select others) will be in a position to participate: banking and 280E has created the very oligopoly the government so desperately seeks to avoid.

This conversation took place on Thursday bw two investors in the space (neither me)…

…bc the unintended consequences of the senate policy pivot—comprehensive canna legislation never had the votes; incremental reform was always the plan—has come full circle, a reality that Senator Booker seemed to acknowledge yesterday on Twitter…

…when he said, among other things, “…now we have a twin crisis; one, a crisis because people, by the hundreds of thousands every year are being arrested still for marijuana possession and the other crisis is that we now have people that are doing businesses in states and can’t afford to do business bc they can’t access banking services… which is putting [small businesses] in crisis; they’re being bought up by national multi-state operators that are well-capitalized, which is making the industry woefully not diverse.”

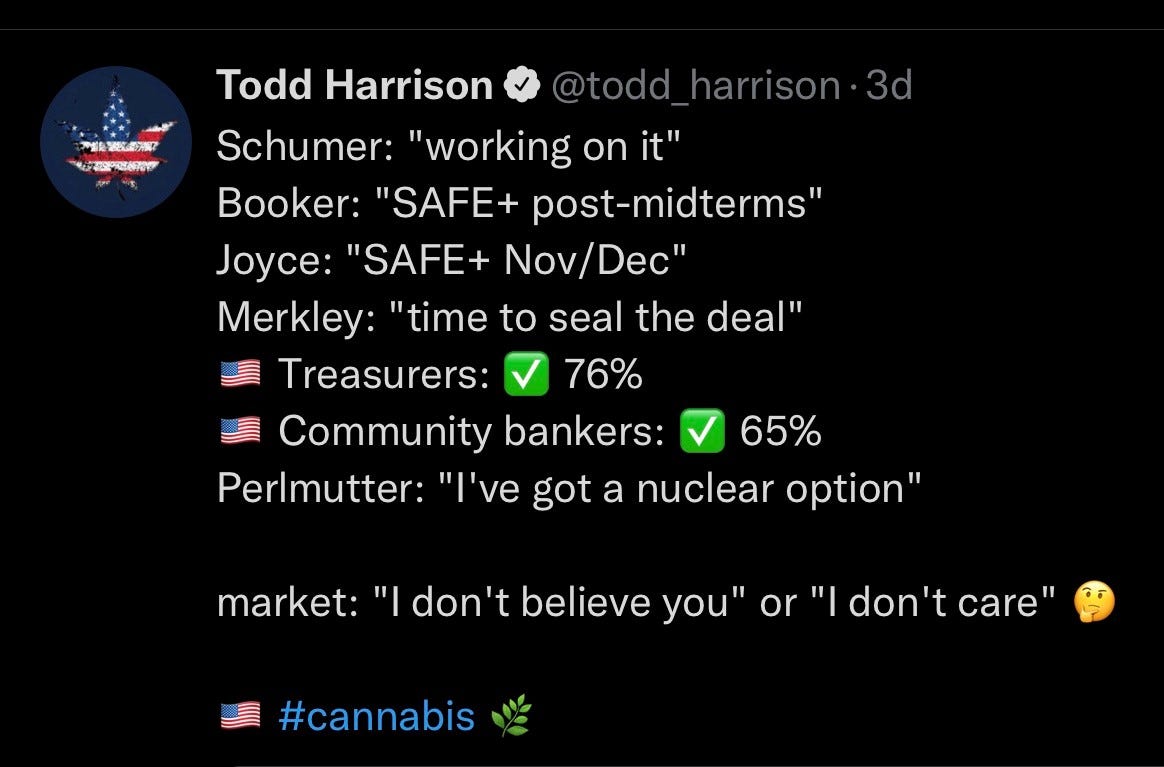

Meanwhile, as analysts grow increasingly confident that we’ll see SAFE+ this year…

…and policymakers have themselves signaled their political intentions…

…investors are left to wonder whether the market doesn’t believe them anymore…

..or if it simply doesn’t care (if things like 280E / capital markets aren’t addressed).

Either way, select MSOs should generate significant free cash flow from operations next year. With increased revenues from states turning adult-use (CT, RI, NY), lower CAPEX and the optimization of existing operations, they should be approaching a welcome stretch, particularly for those with northeast exposure.

The US cannabis industry isn’t going back in the box anytime soon but it’s face will be shaped by the sequencing of regulatory change, including banking, tax treatment, and how and when interstate commerce arrives.

Some things, however, have become abundantly clear: politicians can’t let the perfect be the enemy of the good and if this industry is to succeed, regulators and legislators—as well as more MSOs and social justice programs—need to work together.

It would seem that lesson has crystallized; let’s just hope it’s not too late.

position / advisor MSOS