Angels & Demons

The push-pull continues in canna.

Note: Cannabis Confidential is shifting content strategy in 2026 with more insights from trusted partners, industry insiders, and corporate leaders who’ve got something to say—and now a place to say it. There will be no more paywalls or content fees; think of it as The Players Tribune for the cannabis industry, with an ethos of honesty, trust and respect.

I will continue to share real-time insights daily on X-subs, which costs less than what the monthly fee was for Substack—and it’s in real-time—so if you enjoy and are in a position to support those efforts, I sure would appreciate it as we ready for a year to remember in Cannaland. #LFGrow 🌿

It’s January expiration tomorrow, the first since the last expiration, which was the day after President Trump’s historic Executive Order to reschedule cannabis.

$505M notional traded in the ETF that day (MSOS finished that session -27%, before losing another penny on the final expiration Friday of the year.

President Trump said that day, December 18th, that “this will be the law of the land in 30 days,” while the EO itself said to ease federal restrictions on cannabis and increase research of medical cannabis “ in the most expeditious manner possible”

This was consistent with the story arc that we (were one of the few to) narrate and amplify in this space throughout 2025, and it’s one we believe we continue.

The Trump administration spent the last year busting Chinese crime rings and Mexican cartels and shuttering illicit grow operations and vape manufacturers before Congress set a timer on closing the intoxicating hemp loophole.

Most investors thought a Trump administration and GOP-controlled congress would be the third coming of Prohibition, which is why the cannabis sector spent the first half of last year in the toilet—but promises made were promises kept.

I don’t know when Pammy will Pam and the final rule will post but we continue to take POTUS at his word that he will follow through on his campaign pledges or S3, banking (capital markets), clemencies, and states’ rights.

And yes, we believe we’ll see more—perhaps a lot more—prior to the midterms given the youth vote polling and the loss of (some of) the crypto crowd. More here, here.

Top Stories

Legal Cannabis Sales In U.S. Pass $2.3B In December, $27B in 2025

Flurry of cannabis M&A that followed Trump EO a sign of things to come

Republican Lawmakers Openly Defy Trump On Cannabis Rescheduling

Texas Medical Canna Finally Poised To Boom, But One Major Obstacle Remains

Smart & Safe Florida Raises More Than $52M to Support 2026 Initiative

Gov. Andy Beshear Cuts Ribbon At Two Of Kentucky’s Medical Cannabis Facilities

Campaign To End $1.6B Massachusetts Cannabis Industry Likely To Proceed

59% Of Indiana Voters Support Legalizing Adult-Use Canna, 84% Support MMJ

Medical Cannabis Finally Rolling in Alabama

Like Standard Drinks, but for Cannabis

Industry Headlines

Ascend Announces Opening of New Dispensary in Englewood, Expanding Ohio

Verano Upsizes Revolving Credit Facility to $100M and Extend Maturity Date

Safe Harbor Expands Consulting and Managed Services Platform

OTC Markets Group Welcomes Cannara Biotech Inc. to OTCQX

TDR: Michael Bronstein, President of ATACH

Random Thoughts

We edge into tomorrow’s expiration with the last expiration still staining sentiment.

I’ve seen posts re: market makers manipulating markets to inflict maximum pain on holders and as we saw, they’ve gotta lotta firepower when they need it.

A final rule will go a long way toward regulatory clarity although (amigo #2).

Will the 5-10% chance of a legal stay give new investors pause? 🤷♂️

The WH isn’t happy with the price action since the EO, or that US canna has to list in CAD, but timing a Trump Truth (re: listing) is trickier than trying to game a final rule.

POTUS is aligned with an American Cannabis First policy and there’s simply no way to do that without access to custody, listing, capital markets, M&A, et al.

The growth is coming (post-hemp + new states), regulatory parity has been ordered, and we hear of a possible settlement with the IRS, as opposed to prolonged litigation.

GOP Congressmen filed a bill to delay the hemp ban by two years but it remains to be seen if Moscow Mitch or Andy Harris let any extension pass; hemp will remain a fluid situation into November.

Schwab has banned trading in select Canadian cannabis companies but we’re told it has more to do with internal small cap volatility rules vs. anything to do with canna.

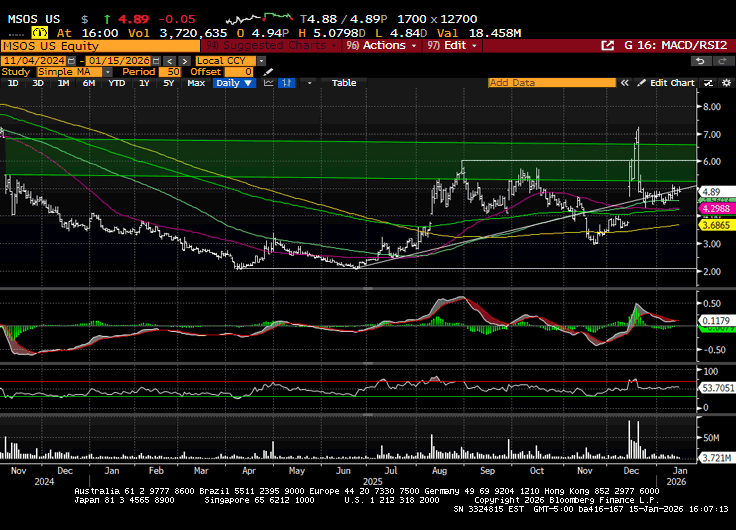

Chart Check: MSOS

This year’s price action has been like Pinocchio’s girlfriend (tell the truth, tell a lie, tell the truth, tell a lie) as we edge higher on light volume. It’s quiet, but that’s subject to change ofc.

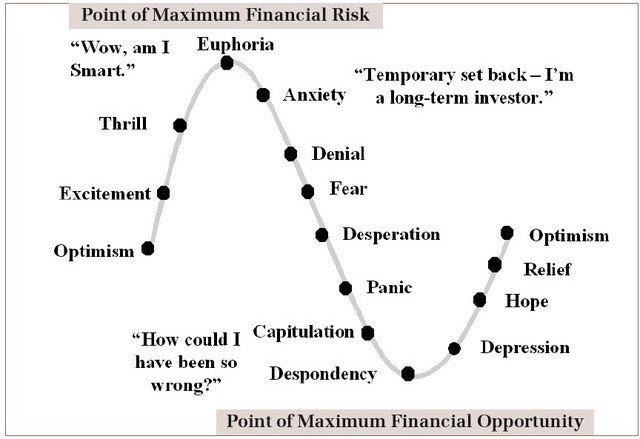

Mood Ring

In a normal world, Wednesday’s relative 💪 in cannabis would be a tell but 1) we’re Abby-normal sans reg parity, and 2) volumes were so light it’s hard to tell what’s real; still, investors remain super-depressed, although a select few have a dash of hope.

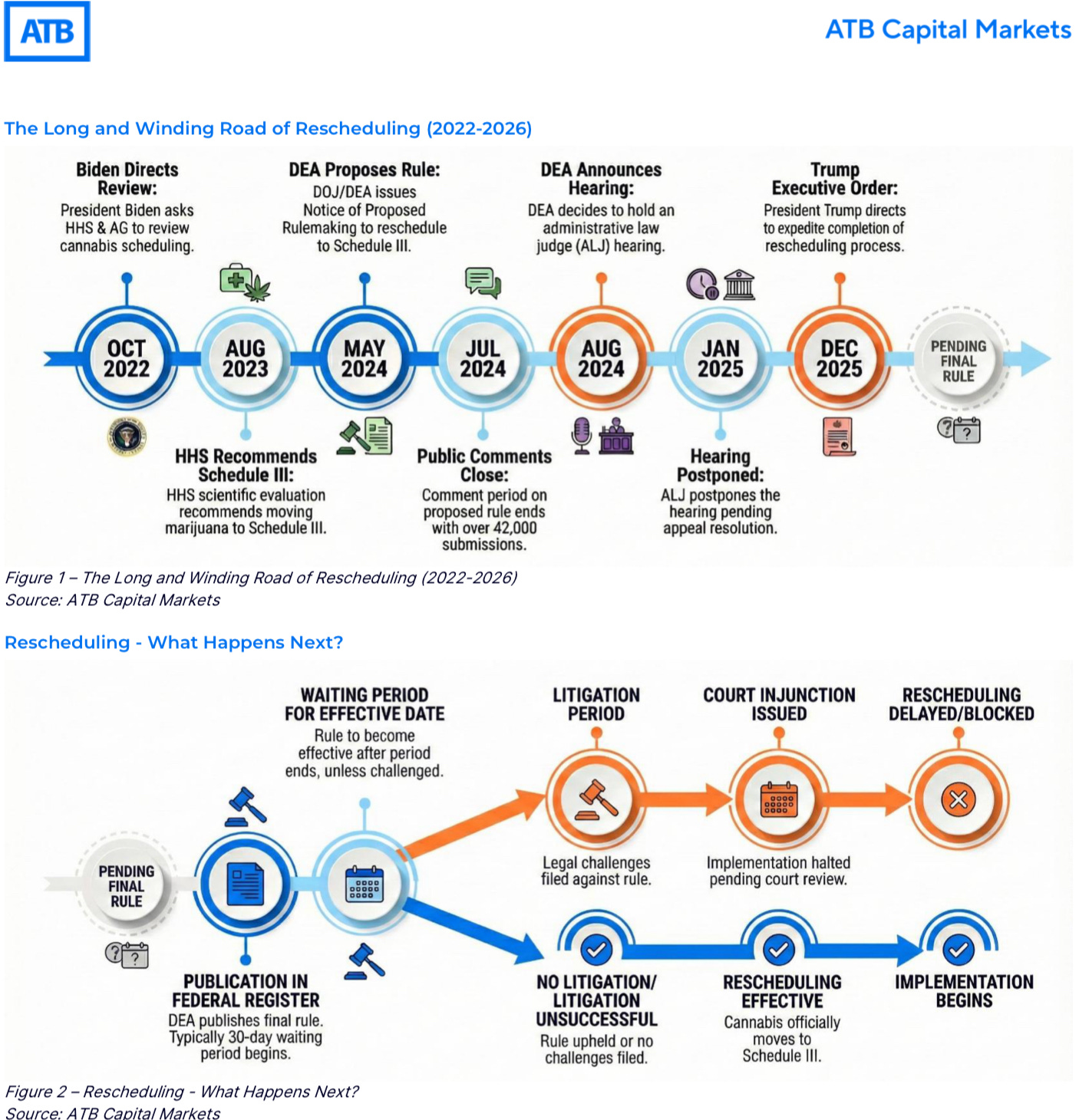

AGP 2026 Cannabis Outlook

To summarize, we view the scenario of rescheduling becoming effective (280 benefit and first domino), cannabis banking reform (exchange listing, capital markets and strategics) along with more markets legalizing (return to robust growth) sets up the bull case scenario for re-rating with each of these steps building momentum for the next domino to fall.

ATB on U.S. Cannabis

We reiterate our bullish call on MSOs for 2026.

Our thesis is simple: We view rescheduling as the most likely scenario this year. Upon materialization, we project >100% equity upside driven by significant multiple expansion.

The Valuation Gap: Tier 1 MSOs currently trade at <7x EBITDA. We believe a rerating to >10x EBITDA is justified post-rescheduling.

Why 10x? Our confidence in this multiple is supported by three pillars:

Fundamental Fair Value: Our DCF-based models support intrinsic valuations at these levels and higher upon reform.

Investor Sentiment: Our Fall 2025 Investor Survey indicated that the majority of buy-side participants view >10x EBITDA as the appropriate fair value under a rescheduling scenario.

Historical Precedent: As shown in the chart below, the sector has reached 10x during previous periods of regulatory optimism.

Stems & Seeds

Scientists Resurrected Extinct Cannabis Enzymes And Traced The Drug’s Origins

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.

The tension between enforcement against illicit operations and closing the intoxicating hemp loophole reflects the complexity of federal cannabis policy evolution. Your point about the Trump administration's approach—targeting Chinese crime rings and Mexican cartels while setting a timer on hemp—reveals a strategic enforcement framework that most analysts missed. The "promises made, promises kept" narrative you tracked throughout 2025 is particularly compelling given how many investors expected Prohibition 3.0. The fact that GOP Congressmen filed a bill to delay the hemp ban by two years while Moscow Mitch and Andy Harris remain wildcards shows how fractured the conservative position has become on this issue. The real story is regulatory parity creating the foundation for American Cannabis First, regardless of expiration volatility.