There are an abundance of superlatives regarding the stock market performance in the first half of 2022 but perhaps the single best thing that can be said is that it’s over.

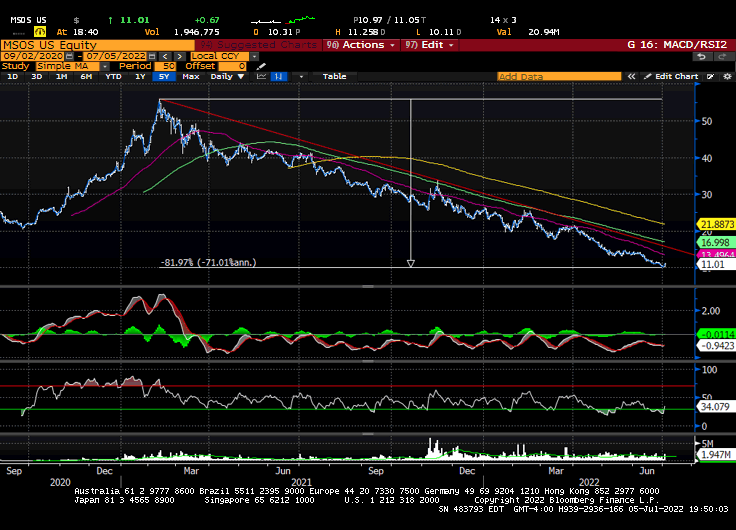

There was nowhere to run and few places to hide—the S&P lost over 20%, the NDX 30%, biotech 33%, ARKK 58% and the U.S cannabis sector, as measured by MSOS fell 60% despite meaningful industry progress and regulatory relief hidden on the horizon.

We discussed many of the reasons why the sector endured a sixteen-month slide and can illustrate what that’s done to the resulting math…

…but gauging the when has been an exercise in futility, fragility and fruitlessness.

I mean fine; so maybe industry expectations got just a little over their skis…

…just as the time-released blue-sweep euphoria exhausted itself in February 2021.

The market priced-in the fickle federal legislators, the state-level delays (with budgets flushed with COVID-relief cash), the post-pandemic normalization and perhaps even the eventual recession, or worse.

At the same time, Wall Street continued to restrict access to U.S plant-touching securities, a process that began at Pershing in late 2019 and extended to Credit Suisse, UBS, JP Morgan and Vanguard, resulting in 96% retail-ownership of MSO cap tables.

Add in the rise of the machines that forced core holders to tap-out and here we are.

Meanwhile, the tri-state adoption is gaining momentum as early results from New Jersey are strong and the eastern seaboard will stagger an expanding TAM over the next several years as this economic and employment engine takes root.

[the consumer crosswinds will shift the slope of forward growth, but it will also richly reward the operators who adjust and deliver. That remains our view: that the winners across each category / price point will earn share / succeed.]

Still, investors—or investors able to custody / clear these stocks—have the perception that this sector is singularly predicated on the binary outcome of federal legislation…

…and as we enter the 17th month of this bear market—the previous bear cycle was 17 months and endured an eerily similar drawdown—we’re finally seeing signs that our long-perceived process of incremental federal legislation is in motion.

Last week congress signaled that it is willing to build upon SAFE banking and that could potentially include other items such as HOPE, SBA, CLIMB (up-listing) and protections for veterans. [more here]

This, in addition to continued clemency efforts would, baring intervention from the judicial branch, seemingly be the extent of cannabis reform for this congress and by extension, this executive term.

[the AG recently said he would address marijuana policy in the coming days and bipartisan lawmakers just added SAFE to the upcoming must-pass defense bill]

We don’t know the precise when (but midterms are in five months) or the exact how (a standalone SAFE+ / CAOA-lite would def address more of the issues but will it have enough votes? And was a boilerplate SAFE attached to the NDAA as an end-around should the broader (yet far from comprehensive) bill falter?

Either way, we don’t foresee congressional leadership returning to their home states without functional banking for their social justice initiatives and the market, which foresaw this cyclical sludge well before the rest of us will price-in these developments.

And given the market typically looks forward about six months…

…one would think that this oversold, left-for-dead, structurally-shorted growth sector trading at value if not distressed multiples will soon garner someone’s attention.

To be clear, our investment thesis was never predicated on federal reform; it was / is based on inside-out state-led legalization that would evolve as the U.S government caught up; our bet is on the companies doing it right and the jockeys on the horse.

^ by the time we get comprehensive federal reform that includes interstate commerce, FDA oversight and all the rest of the regulatory bells and whistles—which could take two to six years, or longer, depending on elections—the winners (across price points / categories) will have separated themselves from the fake-it-till-you-make-it crowd.

^ the reason banking / custody / up-listing is so critical between now and then is the difference bw the best MSO’s being the hunters or the hunted; both will earn returns for their investors but the size and scope will be meaningfully different.

^ SAFE or no SAFE, most cannabis companies will fail, much like dot-com, for every FAANG there are 1000 Pets.com’s.

As we look how historically inexpensive these stocks are, as measured by EV / Sales…

…I will also say, “I get it.” The cannabis sector has endured a monumental ass-kicking not once but twice in four years. Think about that; 80% x 2. Nucking futz.

As investors, we know that the chasm between perception and reality is where the education profits are; I also know that every monster bet I’ve made in my 32 years on Wall Street—fading NASDAQ in Y2K, financials into GFC, if you know you know—I was always early.

^ only difference bw being early and wrong is whether you’re still there to collect.

We are not glib nor naïve about what is happening across global financial markets or the consumer landscape, the direction of interest rates, or the scourge of inflation; nor do we believe our complex will be immune those macroeconomic headwinds.

We continue to believe, however, that the leaders that emerge through this process will stake claim to a multi-billion-dollar industry that is still in it’s embryonic stage.

And that, to us, remains super-exciting.

Random Thoughts

Illinois posted June numbers; notably durable vs. recent discretionary trends.

BTIG double-dosed the SAFE Banking post, first with Camilo Lyon who said, among other things, “We remain steadfast in our view that federal cannabis reform will occur this year, which we expect will lead to a significant re-rating of the US MSOs”…

…and Isaac Boltansky, who sees the NDAA as the most-likely shot on goal.

position / advisor $MSOS