Random Thoughts on Cannabis

Braving the January chill.

Note: Cannabis Confidential has shifted content strategy in 2026 with more insights from trusted partners, industry insiders, and corporate leaders who’ve got something to say—and a place to say it. There will be no more paywalls or content fees; think of it as The Players Tribune for the cannabis industry with an ethos of honesty, trust, and respect.

Todd Harrison continues to share real-time insights daily on X-subs, which costs less than what a monthly fee was for Substack.

Random Thoughts

We hiked to the weekly Hump with the U.S. Cannabis ETF sitting on the 100day with a few moving averages below as the bears 👀 the Dec. 18 EO gap—and bulls not-so-patiently wait for a final rule from the Attorney General.

Following the market reaction to the EO, one would expect current holders to sell into that news out of fear of a repeat rug-pulling performance.

Where you stand is a function of where you sit (trader vs. investor). More importantly, it’s a function what you hold, be it individual names or vehicles (options, stocks, ETF).

I remind myself this is the third week of the year and thus far, the political progress to change canna’s classification (and the halo that’ll create) remains very much on track.

Not all cannabis companies are created equal and S3 isn’t a magic bullet. Many good businesses have a chance to be great, but the bad businesses will remain in trouble.

Expiration hangover + macro (bond sell-off in Japan yesterday) + expiration fuckery has markets on edge and sentiment in our space on the ropes. I get the moody blues but that doesn’t change the forward story.

It’s January 21 aka three days past “this will be the law of the land in 30 days,” vs. the December 18 Executive Order. While some will see that as a negative, we continue to believe, as we have, that DJT will do what he said—and so will the AG.

Thus far, our sources have been dead-on balls accurate, and they remain optimistic regarding next steps in short order (‘weeks not months’).

There are other happenings—Virginia, Florida, Pennsylvania on deck—but the states, banking, M&A and the other halo benefits remain on the other side of a final rule.

Lawsuits will follow, but the industry is ready, or so they believe.

Quite the day (with a Nooner to boot) ahead of the ESPN/Disney Sunshine Showcase with my girlie Thurs-Sun (❄️ dump in the northeast could push to Mon. AM).

One step at a time, here, there, and everywhere.

Top Stories

Cannabis Industry Outlook: Lessons From 2025 And What Lies Ahead in 2026

Cannabis M&A Didn’t Vanish. It’s Just Not Happening in Public

The marijuana business is growing up

Michigan Canna Sales Top $3.2B in 2025 as Price Drops of All-Time Low

Montana Adult-Use Cannabis Sales Hit Record $327 Million

Georgia Under Pressure to Expand Low-THC Medical Cannabis In 2026

Study: Cannabis Beverages Associated with Reduced Alcohol Consumption

Big Alcohol’s Weed Panic Isn’t Random. The Data Explains It

Weed Companies Are Cashing in on Dry January

Industry Headlines

Curaleaf Announces Strong Preliminary Unaudited Q425 Results

The Truth About Verano: Is This Quiet Cannabis Giant About to Explode?

Why Cannabis Commercialization Wins, by Hirsh Jain

AlphaNooner: Mackenzie Peterson and Todd Harrison 📺

Glass House Brands announces accelerated 2026 expansion strategy

TDR: Michael Bronstein, ATACH President

White House Touts Trump’s Canna Rescheduling Order as a Top Win in First Year

Joe Rogan and Rand Paul on THC

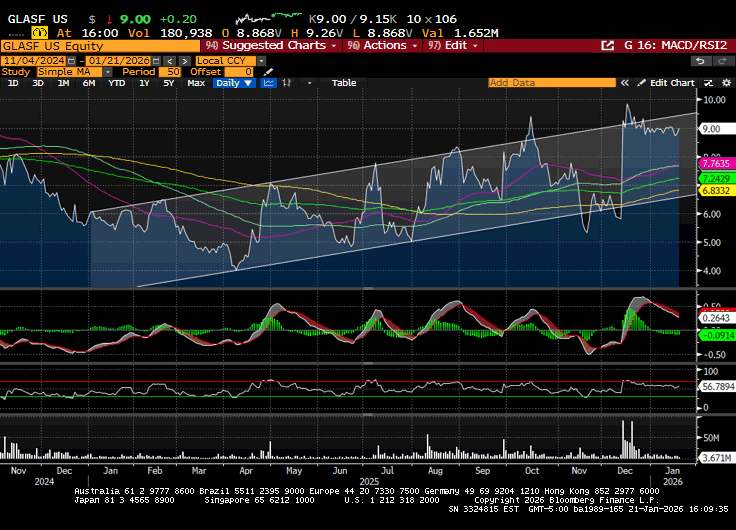

Chart Check: Glass House Brands

Industry low COGS + ☀️ + hemp-derived CBD 👀

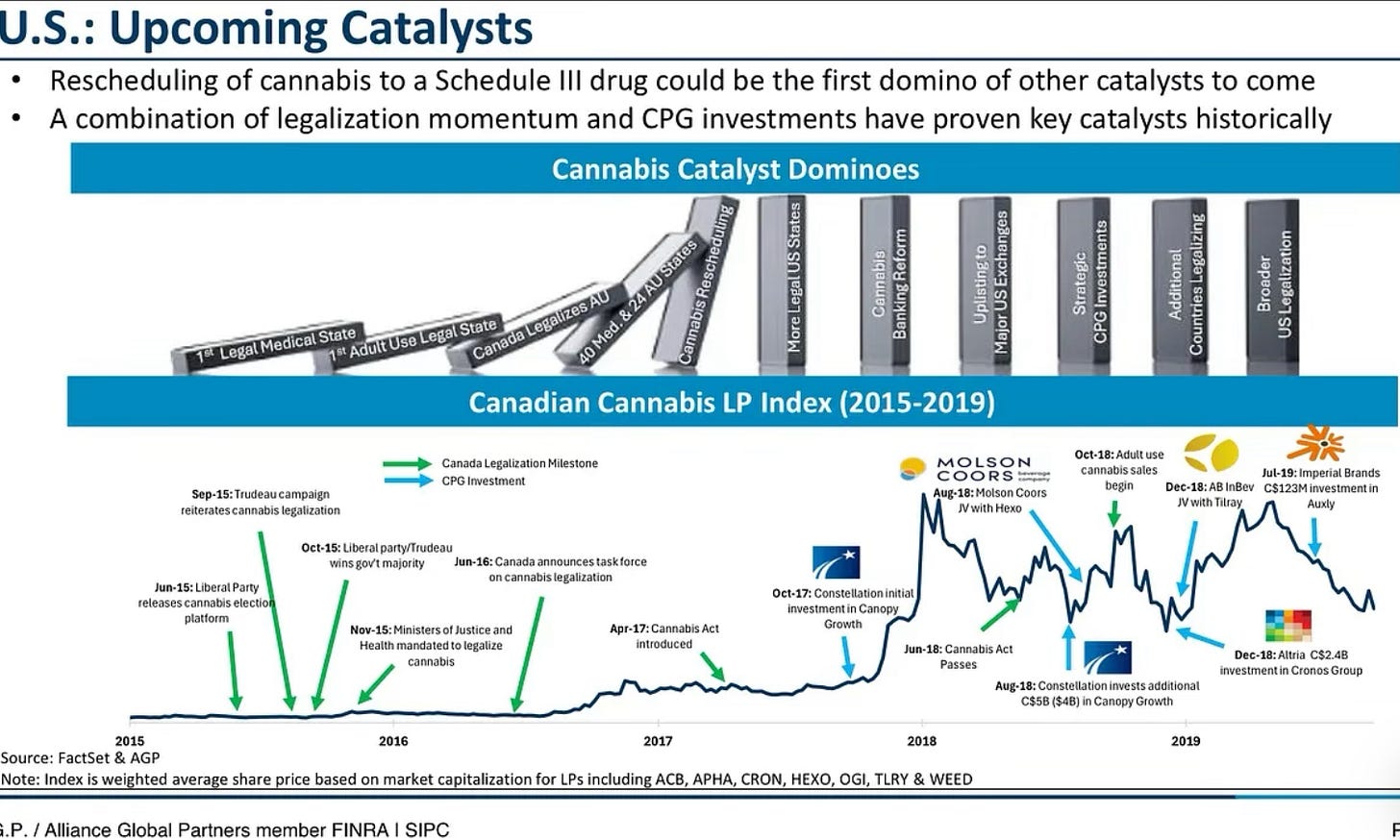

AGP on U.S. Cannabis

AGP on Curaleaf

CURA announced preliminary 4Q25 sales of at least $330M, coming in above the Street estimate of $326M, despite $2.4M from 3Q now discontinued (hemp, Missouri).

Organic QoQ growth of 4% was ahead of management’s +LSD QoQ guide, which we attribute to new store openings (full Q of OH stores), as well as growth in NY, FL and international. While the preliminary GM was below our estimate, we hold our 4Q25 EBITDA est. due to the top line beat offsetting.

Net/net, we are encouraged with the preliminary print, and continue to view CURA’s international exposure differentiating itself from other MSOs while having exposure to meaningful potential catalysts such as the legalization of adult use sales in PA, FL.

Maintain Buy rating and C$6 PT.

Stems & Seeds

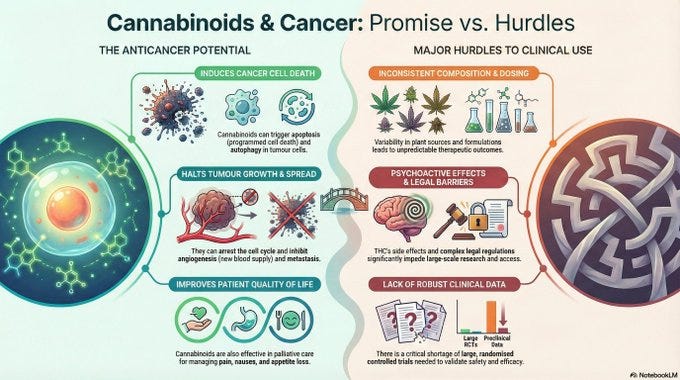

Exploring the therapeutic potential of cannabinoids in cancer

^ see: Killing Cancer with Cannabis 📺

Cannabis Oil Matches Lorazepam for Treating Insomnia, Improves Quality of Life

Have a safe journey, please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in/ advises some of the companies mentioned and nothing contained herein should be considered advice.

What do you think of holding June MSOS calls? Are they far out enough to have a small position? So much FUD out there right now.