A few months ago, we shared the following vibes:

To appreciate where we are, we must understand how we got here. In the interest of time, I’ll skip the 30,000 years when an array of cultures benefitted from the vast wellness properties of this amazing plant, and breeze through the prohibition when the U.S. government weaponized “marijuana” as an immigration tool and for their War on Drugs.

The industrial evolution of cannabis, which is pertinent to this discussion and far more relevant to our financial futures, has three distinct phases:

Cannabis 1.0: Canadian cultivation enjoyed spectacular gains in 2016 and 2017 before that bubble burst, leading to a 92% decline in global cannabis stocks from January 2018 until March of this year. Canadian LPs remain mired in over-capacity and stymied by a slower-than-expected international roll-out, but we see select opportunities up north, including low-cost producer Village Farms ($VFF)

Cannabis 2.0: U.S.-led consumer packaged-goods (CPG) that use cannabinoids as ingredients will drive the next leg of this secular bull market. We are at the nascent stage of this phase as consumers educate themselves on the novel end-products and various form factors, including beverages, nutraceuticals, cosmetics & vanity, and pet supplements, as well as the industrial use cases.

Cannabis 3.0: Efficacy-driven solutions will solve medical riddles across a wide range of indications and ailments and finally shift the popular perception of cannabis from a gateway drug to a wellness solution; one with a treasure trove of active pharmaceutical ingredients (API). This will follow a biotech pathway, where clinical successes drive medical adoption; GW Pharmaceuticals (GWPH) is the leader there.

We can juxtapose these buckets against the three phases of any market move: denial, migration, and panic.

The sheer carnage of 1.0 and the exodus that followed has most industry followers in denial that a recovery, much less a new bull market, is possible. Banking reform will, in our view, trigger migration to the space as institutional investors chase organic growth; and demonstrated efficacious agility should, over time, turn late-cycle adopters into panic buyers of the wellness thesis.

OK, me, back, now: We loved G-Dubs.

G-Dubs. GW. $GWPH.

Said it was The Amazon of Cannabis, Derrick. For Real.

GW was a top-five holding but it was more than that; this was my baby, my purpose; my muse. The north star of cannabis 3.0. In a league of her own.

G-dubs got lifted for ~$220 a few days ago which tbh is about half of what I thought she’s worth, but a wins a win. My grandfather once told me that if the dealer puts chips in front of you, take them; so we took them. Thanks grandpa.

we did a few things with those funds:

1. sprinkled right-sized seeds across the 3.0 farm system.

2. edged ourU.S cannabis "FAANG" allocations higher.

3. left a GW trailer + May $250 fliers lest there’s a higher bid (doubtful)

4. squirreled some powder for fresh meat (Verano, etc).

[note: “right-sized seeds” = 50 bips to 1% of our cannabis book]

This part is important, bc given Cannabis 2.0 (US-led CPG) is just now rolling, that’s where our focus, and the meat of our exposure is.

If you don’t know why, read The U.S Cannabis Long Squeeze

But either way, the GW takeout planted that 3.0 flag and there’s a handful of super-risky potential candidates that will jockey for relevency in that universe.

None of these names are advice; we’re just illuminating them so u can do the work, and this list is by no means exhaustive; so please add other names to comments.

Finally, if you want to “follow the science” please check out our research respository where we list a host of potential indications. We believe in the efficacious agility of cannabis and if you dug a little, you will too.

$BOT.AU

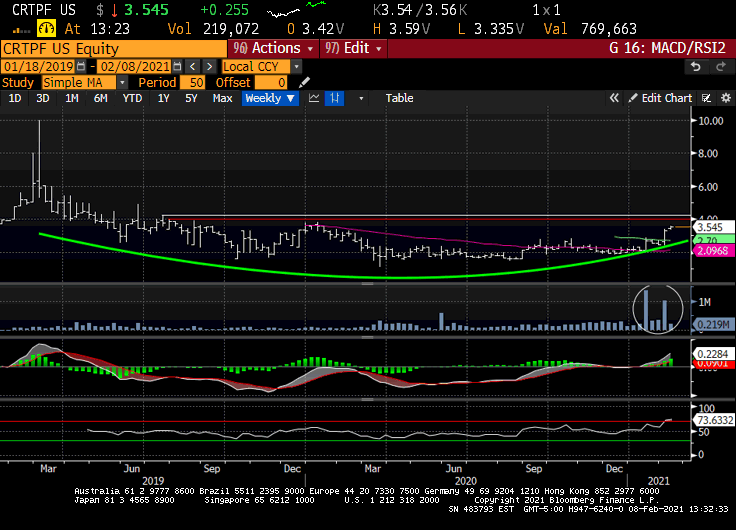

$CRTPF

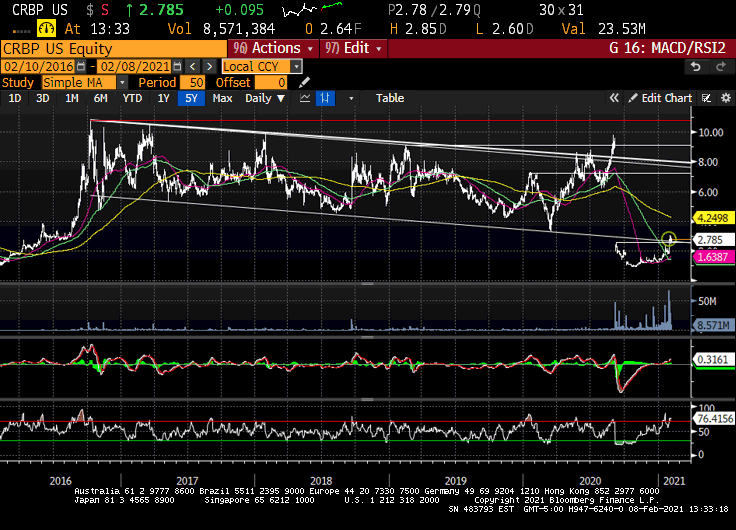

$CRBP aka Corby the Love Bug

$INM aka… never mind.

$SKYE / ne’ $EMBI

$TBPMF

_______ $WLLW

$VBIO

again, none of it advice / super risky / the focus s/b on 2.0 IMO but fyi / fwiw / glta!

/positions

Have you given any thought to CRON as a 3.0 contender? Gingko + Redwood + Altria is a very compelling framework for the "wear it, rub it on, stick it in, take a bubble bath in it" niches of 3.0. CGC as well, I suppose. But I've never really paid them much attention, so can't say for certain.

Todd trying to send email and being blocked by Google service provider named AMG solutions founded by Josh Mudryk who is also investment firm called MUDZ INVESTING, he is website developer for Bulls on wall street stock alert services and has Bulls on Wall Street servers connected to the Brokerage TC2000. Emails pics to prove that they are working with RAGINGBULL who has charges filed against them for 137m in assets frozen