Unchoke the Smoke

Time for a Deep State Heimlich.

Daily Recap

There’s an adage that a man can hold his breath under five feet of water for a minute but cannot hold his breath for five minutes under a foot of water. I think of that often as I reflect on the conditions U.S. canna has been forced to endure the last six years.

Last week we pointed to the DEA Deep State because, and forgive our recency bias, it has almost felt as if the agency doesn’t wanna see canna rescheduled differently than drugs such as LSD and crystal meth. The War on Drugs, generationally deep, persists.

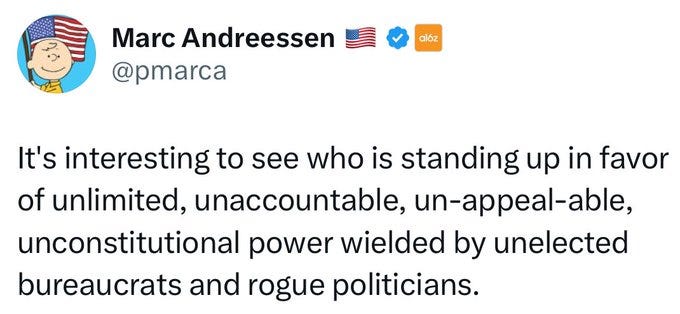

A few days later, after questions arose regarding ex-parte communications between the DEA and anti-cannabis lobbyists, we highlighted how an portion of a conversation between Joe Rogan and Marc Andreessen had gone viral for all the right reasons.

If anyone has missed our many discussions about the monster-truck f*ckery that has come to define the U.S. cannabis sector, or if you just wanna learn how perniciously “pure and silent government powers” can be, check out Operation Chokepoint 👇

Why does this topic matter to us as it suddenly skyrockets through social awareness?

Because there’s currently a bipartisan bill floating around called SAFER Banking and within that is a little-known provision called Section 10—the inclusion of which the GOP has insisted upon for over five years—which would literally smoke that choke.

Here’s the best part: if Elon and Vivek are focused on a more efficient, transparent government, and if President-elect Trump was sincere in his campaign promise to get U.S. canna banked and listed (as we believe he was), this has the potential to be a genuine, if not immediate solution—all that remains is the political will.

Make it Make Sense

The cannabis world has high hopes for the second Trump presidency. While 38 states have legal canna sales in a market that’s estimated to be $30B annually, it is still illegal federally. This means plant-touching companies fall under a punitive tax code meant for illicit drug traffickers that eats into profitability.

Despite the ubiquity of Americans continuing to smoke, eat, and drink THC products, unlicensed cannabis sales are rampant, and legal intoxicating hemp products are sold everywhere. The Biden Administration began the move to reschedule the plant to a less severe category in the CSA, but that bureaucratic processess continue.

The parting on the left…

The first DEA hearing on the Biden administration’s canna rescheduling proposal took place today, as proponents and opponents appeared for a procedural meeting that’ll prepare the court for hearings early next year.

…is now parting on the right.🎶

President-elect Donald Trump’s pick to lead the Drug Enforcement Administration has previously voiced support for decriminalizing marijuana possession.

Hillsborough County, Florida Sheriff Chad Chronister, who Trump plans to nominate as the new DEA administrator, applauded a 2020 move by local county commissioners to treat possession of marijuana as a civil offense instead of a misdemeanor.

Stocks & Stuff

It was another quiet session in Cannaland as less that $27M notional volume traded in the U.S. cannabis ETF. MSOS finished the session more or less flat as the final month of the year commenced.

Below, we’ll top-line the landscape, bottom-line growth rates sans new states, chew through whether this time could be different, and otherwise hold the fort as part of the industry heads to MJ Biz, others make their way to D.C, and others to Boston.

All that and more, just scroll down.

SPY 0.00%↑ QQQ 0.00%↑ IWM 0.00%↑ MSOS 0.00%↑ ETF Notional: $27M

Top Stories

Why Donald Trump Will be Good for Weed

Trump’s DEA Pick Celebrated Marijuana Decriminalization Vote In Florida County

Marijuana sales near $10 billion in Michigan, a few years after legalization

Biden’s Pardon Of Son’s Drug-Related Crimes Draws Calls From Advocates To Free Marijuana Prisoners

Once the Face of N.Y. State’s Cannabis Loan Fund, He Now Fears Foreclosure

Costa Rica Court Blocks Recreational Cannabis Referendum

Marijuana sales near $10 billion in Michigan, a few years after legalization 👇

Industry Headlines

Watch Live: DEA’s Marijuana Rescheduling Hearings

Pregame (written in real-time at 8AM ET) 👈

Welcome to the first week of the last month of the year, one that will feature an ALJ hearing today, the Boies oral arguments on Thursday and the return of the Senate, which might provide hints on the fate of the Farm Bill, if not, um…

We're not expecting too much from the ALJ hearing, other than clarification on next steps—and recall, we got word that the President-elect's DEA appointee FL Sheriff Chad Chronister, who will oversee the final phase of the S3 process, had applauded a move to treat possession of cannabis as a civil offense instead of a misdemeanor.

The Boies lawsuit should be interesting, particularly as three-letter agencies, already weakened by the Chevron ruling this summer, face intense scrutiny over the wasteful and deleterious bureaucracy that ground our once functioning government to a halt.

I wasn't going to spend much if any time on the specter of SAFER banking in the lame duck session—for obvious reasons—but a nuance has emerged that could impact the timing and process after some deep state debauchery crossed into pop culture.

The f*ckery we've been forced to deal with for the past decade is now front and center after "Operation Chokepoint" was exposed and further amplified over the weekend when Rep. Richard Torres (D-NY) said,

“I sit on the House Financial Services Committee, which oversees banking regulators. I am aware of no real limitation on the ability of banking regulators to de-bank law-abiding citizens and businesses without due process of law.

The federal government’s unfettered powers of de-banking represents an insidious threat to civil liberties in America. Marc Andreessen raises a real issue that transcends partisanship.” 👇

For those who need a refresher, most of the GOP support for SAFE banking has been tied directly to Sec. 10, which was language added by Rep. Luetkemeyer that insisted Operation Chokepoint would be gutted.

This has been a primary source of contention between the Dems and GOP, but it may now be a potential point of compromise if Sens. Schumer (D-NY), Daines (R-MT) and most importantly, President-elect Trump—via his influence over Speaker of the House Mike Johnson (R-LA) —want to move on this sooner rather than later.

Of course, nobody wants to hear about any of this much less believe it, which’ll keep our space vulnerable through several lenses, including technical (charts), fundamental (growth), structural (listing/ banking) and psychological (sentiment) metrics.

There is another side to this cycle—for some, anyway—we just gotta get there.

Quote of the Day

“The Supreme Court this year overturned “Chevron deference” in its Loper Bright ruling, which deals a seismic blow to federal bureaucracy. Under the old standard, federal courts deferred to agency interpretations of law when a statute was deemed ambiguous… Overturning Chevron deference, combined with the Major Questions Doctrine codified in West Virginia vs EPA, paves the way for not a slight but a drastic reduction in the scope of the federal regulatory state. It’s coming.”

Vivek Ramaswamy, Department of Government Efficiency

CGF Flash Update on U.S. Cannabis:

US President-elect Donald Trump announced that Chad Chronister will be appointed as the next DEA administrator to replace Anne Milgram. Should Chronister receive a successful Senate confirmation, the new administrator would be responsible for the ongoing marijuana rescheduling process.

Back in 2020, Chronister supported the local board of county Commissioners decision to decriminalize marijuana possession of up to 20 grams, shifting the consequence as a civil offence instead of a misdemeanour. Chronister signaled a favourable view on decriminalizing low marijuana-related offenses.

Next steps include: (1) evidentiary hearings with witness testimonies (in Jan.) (2) ALJ’s filing of report on hearings (3) DEA responds and finalizes report on final rulemaking; (4) report is sent to the OMB for final review (~90 days); (5) posts on Federal Register; (6) Congressional review (60-day period); and (7) formal rule-making is complete.

As of Friday’s close, US MSOs were trading at ~6.1x 2024E EV/EBITDA.

ATB on U.S. Cannabis:

We now anticipate a 5-year CAGR of 4.6% from total legal canna sales of $30.3bn in ‘24 to $38.0bn in ‘29e. This is a substantial reduction from our previous forecast, which had a 5-yr CAGR of 9.6% to ‘28e sales of $45.1bn.

Our forecast is useful to understand organic growth opportunities in core markets, since we are not factoring in additional states passing legislation to allow for medical or adult-use cannabis. For instance, potential Pennsylvania, Virginia, or even Florida adult-use legalization are not included through our forecast period.

Our lower estimates reflect a continuation of trends seen over the past few years in regulated canna markets, with pricing and competitive pressures impacting growth rates. We also think illicit and hemp-derived products are eating into legal cannabis sales growth.

For instance, we have seen sales declining in certain mature recreational states (Arizona, California, Colorado), and flattening growth in others (Michigan, Illinois, Massachusetts).

We expect higher, double-digit growth rates in states such as New York, Ohio, and Virginia, and challenging growth (low single-digit growth or even declines) in markets such as Florida, Pennsylvania, Illinois, California, Colorado, and Arizona.

Stems & Seeds

In Indiana, ‘safe and regulated’ marijuana is what voters want

Legalizing Medical Cannabis In Utah Helped Reduce Opioid Use By Pain Patients

Have a safe journey and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.