The following is a sampling of last week’s content on Cannabis Confidential.

Animal Farm

Bulls and Bears battle in Cannaland

Monday, September 18, 2023

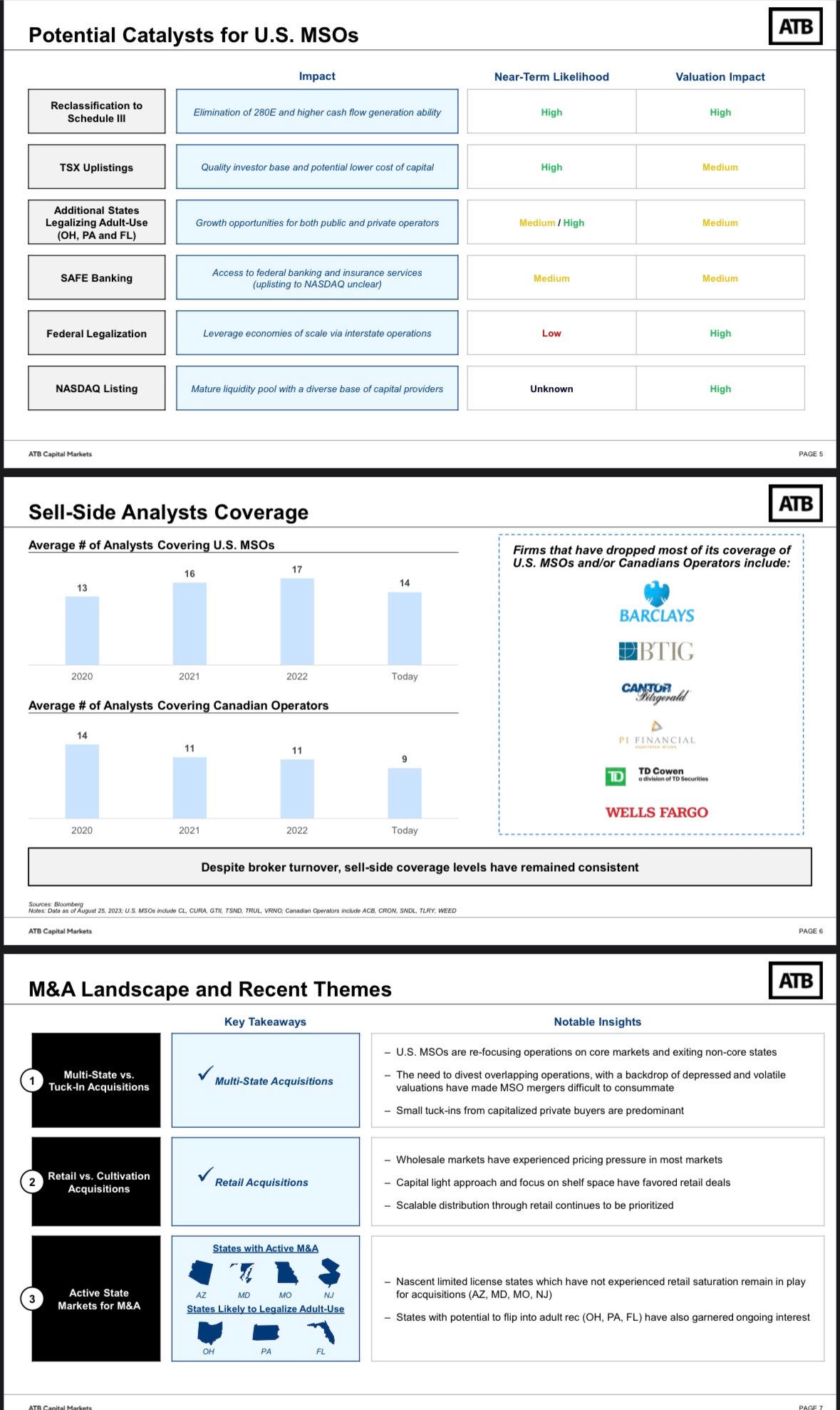

A key Senate committee officially scheduled a vote on SAFE Banking, signaling that disagreements between certain Democrats and Republicans over key provisions have been addressed.

As Republicans soften their stance on federal marijuana reform in a shift that could make it a reality, a congressional report predicted that the DEA will likely approve the HHS reclassification recommendation.

A renewed drumbeat of negativity has emerged from some of the louder voices on X, coinciding w/ fresh new capital raises—which again, are a welcome development with a nod to timing + source—and bear raids, which have also picked up in pace.

“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.” John Templeton

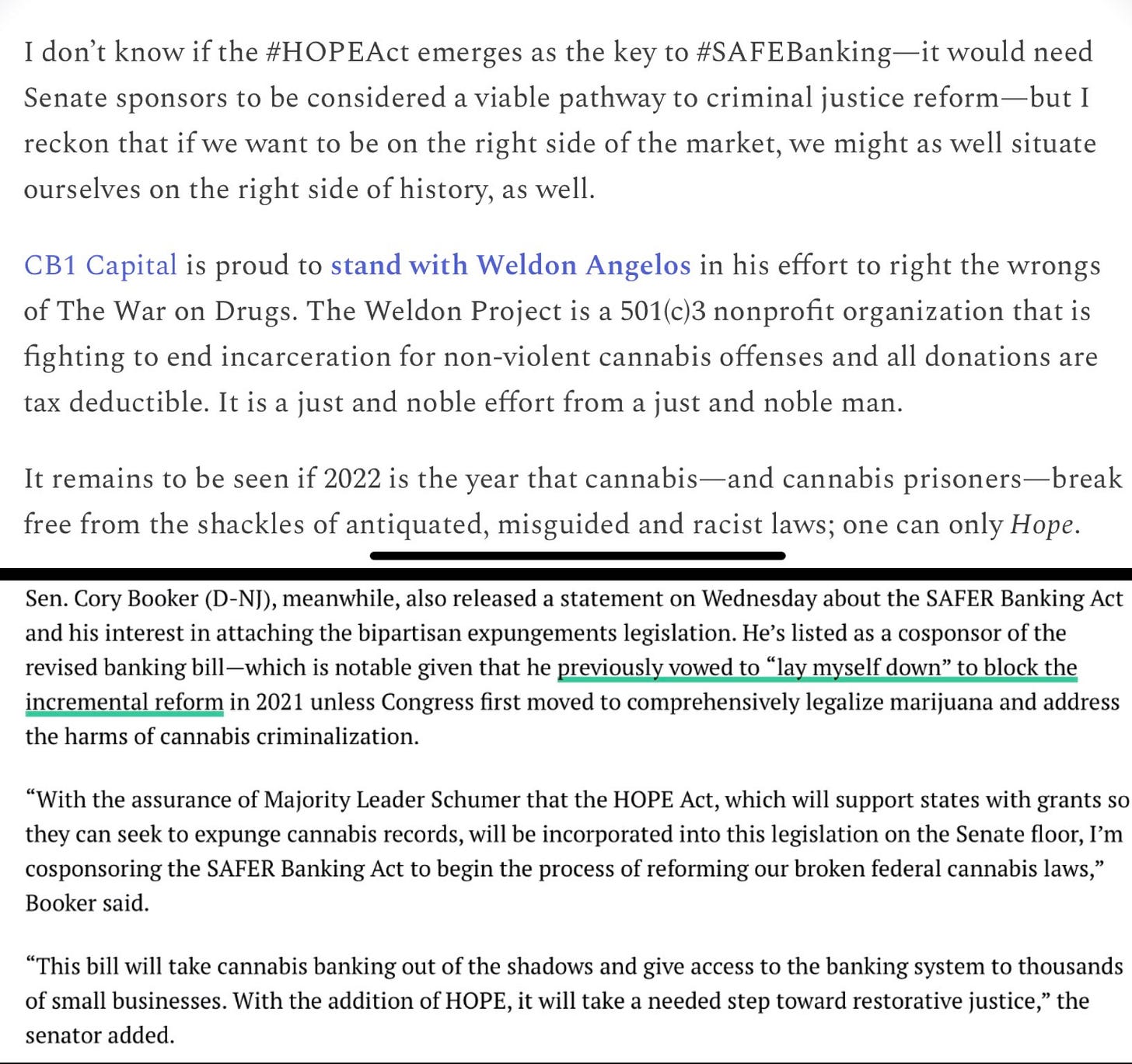

Verano has launched a round-up for cannabis reform dispensary donation program to benefit The Weldon Project’s Mission [Green]. This is their second such initiative + a huge step forward in our continued efforts to be the change we hope to see.

If you would like to join the Mission [Green] Alliance as a participating dispensary or simply donate to collect your karma coins/ be on the right side of history, please click here bc nobody should be in prison for a plant.

D.C. On Deck

U.S. canna goes to Washington.

Tuesday, September 19, 2023

In the coming days, members of the United States House and U.S. Senate are poised to take action on multiple important federal cannabis bills.

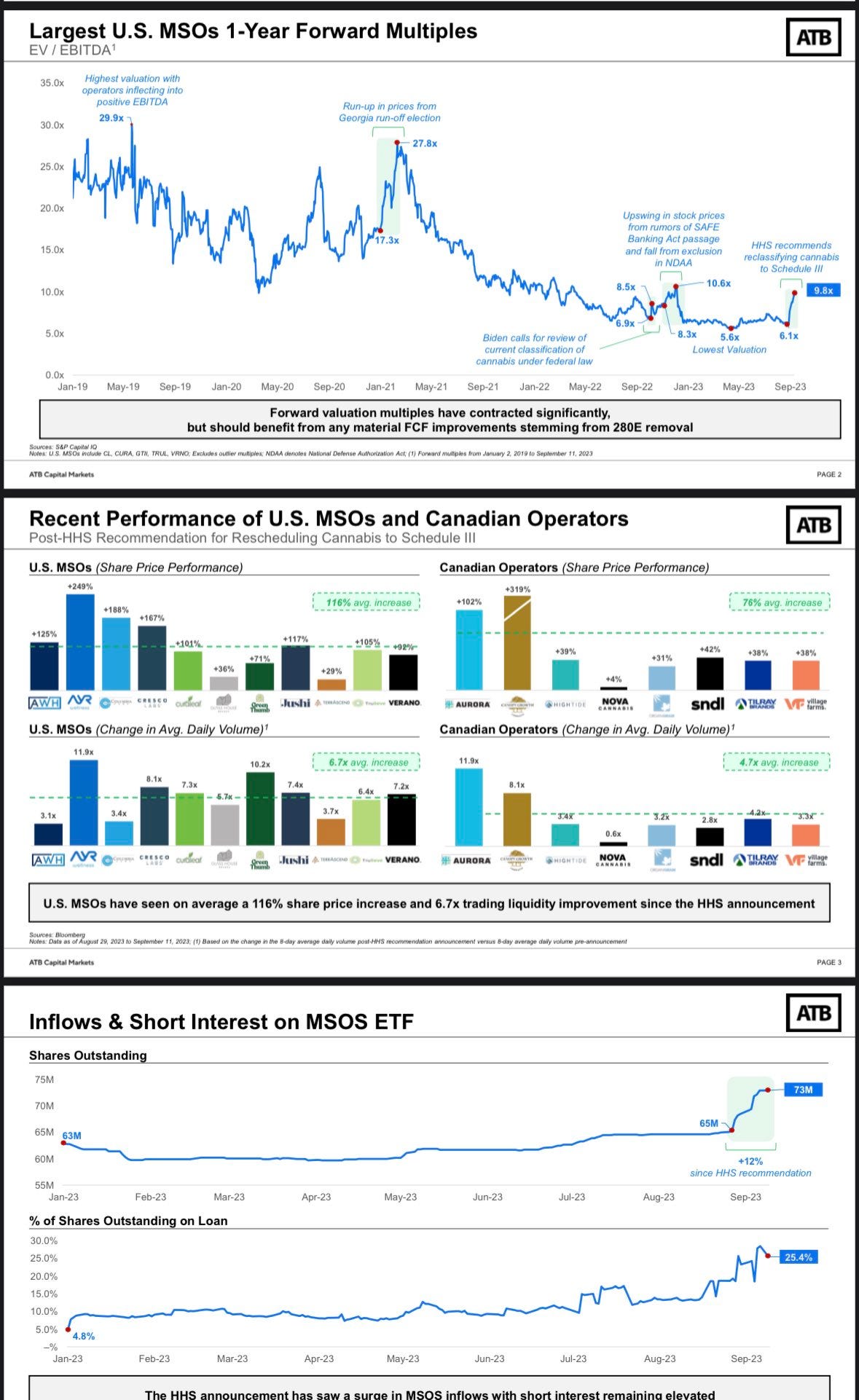

U.S. cannabis stocks finished lower for a second consecutive session in volatile trading, which has been a steady theme since the HHS news first leaked.

With bears pressing lower, math pointing higher and the real buyers sidelined sans custody, the flows were decidedly one-sided today as Canadian hedge funds tried to break the will of the only holders of these names: insiders, retail and a few funds.

The volatility likely continues as we weigh the seismic shifts that happened twenty days ago against the specter of a government shutdown that could prolong the federal reform process.

A shutdown is the biggest fly on timing/ duration, but not destination; the federal reform train has already left the station.

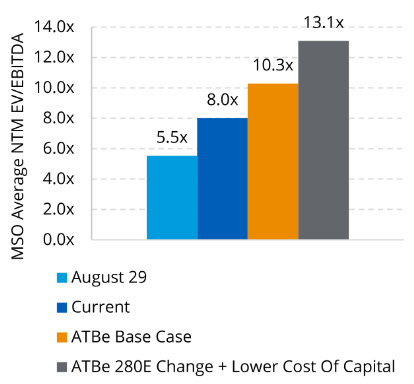

Spoke with a seasoned Wall Street fund manager about the conditional elements in place and the skepticism that still plagues the space. We walked through the math behind the repeal of 280E, the need for a continued drumbeat of positive catalysts + likelihood that when we get DEA affirmation of the HHS recommendation, that’ll be the tipping point.

We also discussed how the same bears who were pointing at bloated balance sheets + lack of financing options a few weeks ago are now screaming "dilution!" Companies that need to raise should raise but the type/ source/ timing will most certainly matter. The last point he made is this juncture isn't like the past junctures when we were wishing on SAFE as the savior.

[HHS is much bigger/ already in motion/ not mutually exclusive to SAFE]

From another professional money manager: Hedge fund longs sold 2M MSOS shares $8.50+ above (w/o 9/8) and sold short 2M+ shares short (9.20+) since, with another 1.1M sold short today @ $8.40. I guess the thinking is they can overwhelm retail and force them to capitulate before institutional access opens up.

Meanwhile, JW keeps buying TerrAscend; like… every single day.

Whale Watching

The ATB NYC Canna Conference Recap

Wednesday, September 20, 2023

Full recap of content here.

Crash Test Dummies

The back-test continues for U.S canna

Thursday, September 21, 2023

Senate Majority Leader Chuck Schumer reaffirmed his commitment to expeditiously advance the SAFE Banking bill and plans to attach legislation on expungements—the HOPE Act—and gun rights for medical marijuana patients (the GRAM Act).

A key House committee approved a bipartisan bill Wednesday that would prevent the denial of federal employment or security clearances based on past marijuana use. The CURE Act passed 30-14 and marked the first time a standalone cannabis bill has ever moved through a Republican-led chamber.

When SAFE failed in 2021, a small group of people led by Weldon Angelos got to work in an attempt to bridge the partisan divide. We revisit those efforts here but suffice to say the results have been a long time coming. The first bit in the screenshot below is from February 2022 (worth a read) and the second was the ‘breaking news’ yesterday:

Schedule III, SAFE Banking, the CURE Act—the current trifecta on our horizon—are important incremental steps toward ending the War on Drugs but they’re not the dub we need or what the people in prison deserve. Please help us support Weldon and Mission [Green] as he really is the man in the arena and those arenas ain’t cheap.

~26% of the ~$100B U.S TAM is currently legal; 90% of tested illicit market grows contain dangerous pesticides and an unknown amount of the emulsification agents used in illicit market vapes contain vitamin E acetate + other harmful ingredients

MSOS $7.50 is a ~50% retracement of the monster first-move that followed the HHS leak but we’re drawing things in crayons not pencils these days. The thesis remains catalyst dependent but again, there are companies that have won with worse.

The bumpy cusp woulda been bumpy enough w/o the shutdown situation but the path of maximum frustration should be par for the course. There was already a wide berth on the expected timing of the DEA response and further uncertainty would seemingly expose the soft underbelly of our currently classless state as it gets pushed around.

The chatter we heard at ATB re: a response from the DEA ranged from the week after next, with some positing the one-year anniversary of the Biden proclamation, to next year.

Our sense going in: the DEA affirmation + Garland Memo would arrive together in the coming months, ahead of the eight-step review that will finish up into the election.

For A.D.D immediate gratification types, a one-year horizon—if that’s what it is—is an eternity. There are different strokes for different folks which is why it’s important to sync your risk profile and time horizon. We know the next few months will be an active season for red headlines as time and price converge.

[^ as we get from what these changes imply to when those changes arrive]

Fear and Loathing in U.S. Cannabis

Uncertainty and Doubt continue to run deep.

Friday, September 22, 2023

As the Senate finance committee prepares to mark-up the SAFER Banking Act next week, Sen, Majority Leader Chuck Schumer (D-NY) circulated a petition to ‘demand’ federal marijuana legalization as he works to advance the cannabis banking bill.

Two GOP senators, including the lead Republican sponsor of SAFER Banking, filed new legislation that would prevent federal agencies from rescheduling cannabis w/o congressional approval. Uber-Lobbyist Don Murphy believes this move was designed to provide the political cover needed for them to pass the banking legislation.

The NCAA Committee on Competitive Safeguards recommended each of the three divisional governance bodies introduce and adopt legislation that would remove cannabinoids from the list of NCAA banned drug classes.

Glass House + TerrAscend stood out in the flavor that followed ATB. Knowing both of those companies well, we’re not surprised but always great to hear genuine excitement from market pros who’ve seen it all.

We saw a 100%+ two-week pop on massive volume-> a back-test on lower volume alleviates the overbought condition into support ahead of several massive catalysts. That’s textbook stuff, as those things go; MSOS is still sporting a 67% gain since the HHS leek and is up 15% YTD, besting the S&P, even after the latest-and-greatest scare pockets.

There will be no Cannabis Confidential on Monday in observance of Yom Kippur—> I’ll be in Chicago Tuesday-Thursday for the Benzinga Canna Conference—> weekend w/ our eldest daughter in Columbus—> Vancouver first week of October with clients.

Subscriptions will be paused/ subscribers won’t be charged while I’m off-the-grid.

/end

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.