U.S Cannabis: Better SAFE than Sorry

2021 comes down to the wire--and the Senate Armed Services Committee

November was a wild ride for U.S cannabis…

The sector started the month in JP Morgan’s Crosshairs but that quickly mixed into a recipe for an upside surprise. NYSE-listed $MSOS—aka the Trojan Horse—rallied 32% in seven short sessions before giving back two-thirds of that rally the following seven sessions on much lower volume.

Bulls call that a healthy retest through the lens of a higher low / double bottom. Bears call it yet another trap, akin to what we’ve witnessed for eight straight months. Me? I’d call it the fast and the furious bc of how quickly the prices moved / the mood that immediately followed, as if people were waiting to get paid next month.

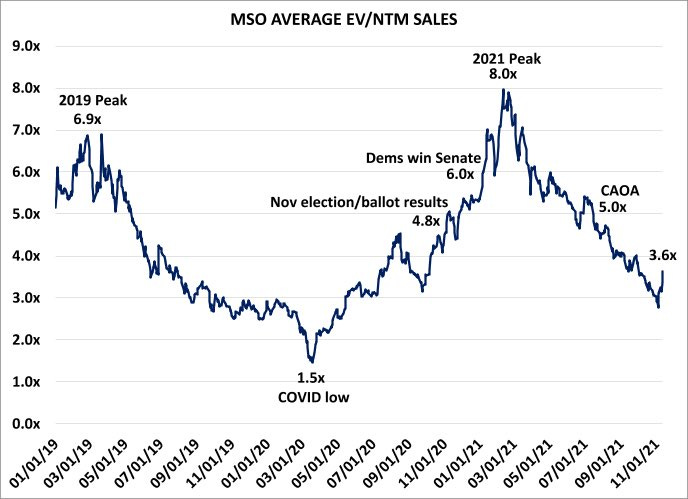

We can jump up and down about the growth @ value multiples which got halved this year or a credit curve that’s 500 bps to the better but nobody seems to care about the improving fundamentals—it’s all about federal legislation, haven’t you heard? Still, those things should matter to investors who are watching this opportunity unfold.

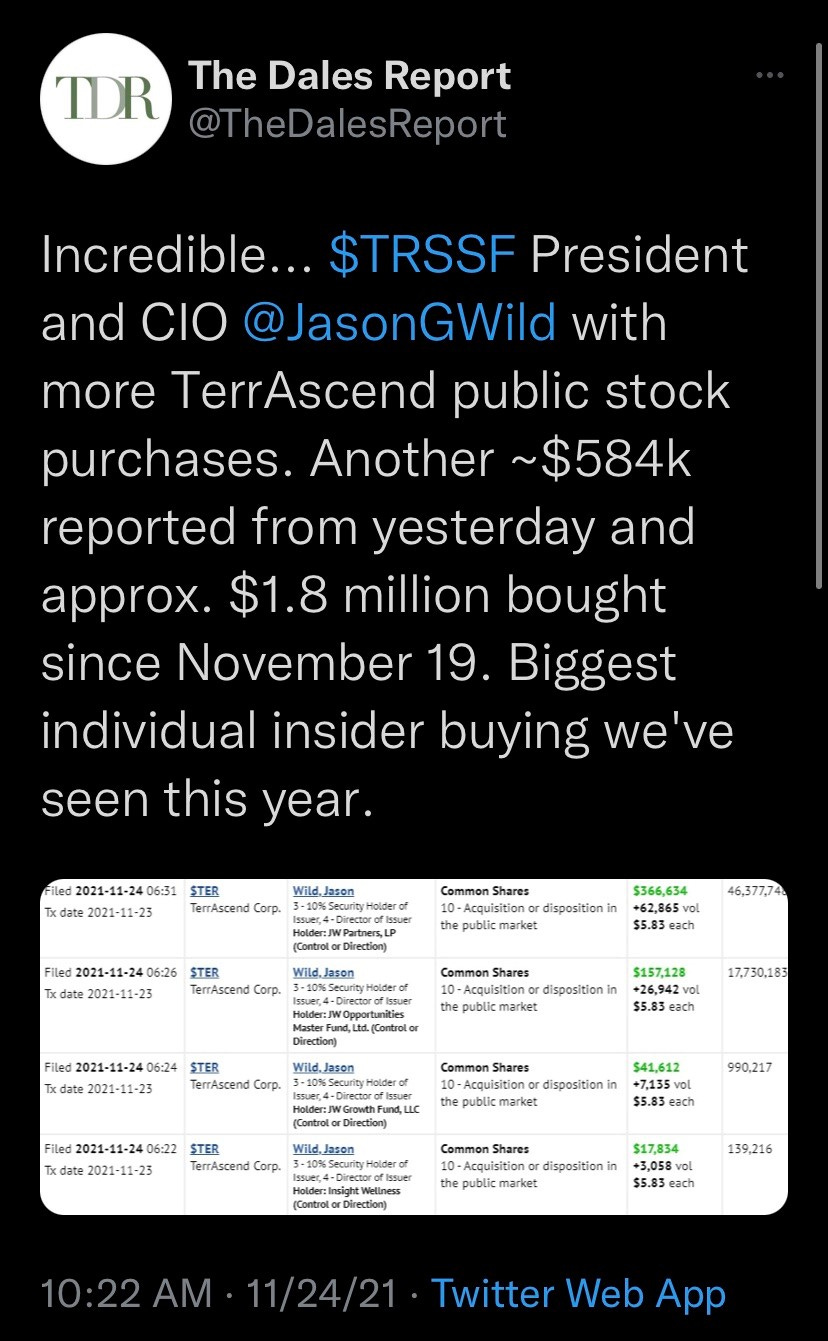

The smart money seems to be paying attention…

…and the wise ones among us are taking advantage of these prices, too.

…but as we give our thanks and cast a glance toward Santa, there’s only one thing that U.S cannabis investors really wanna know…

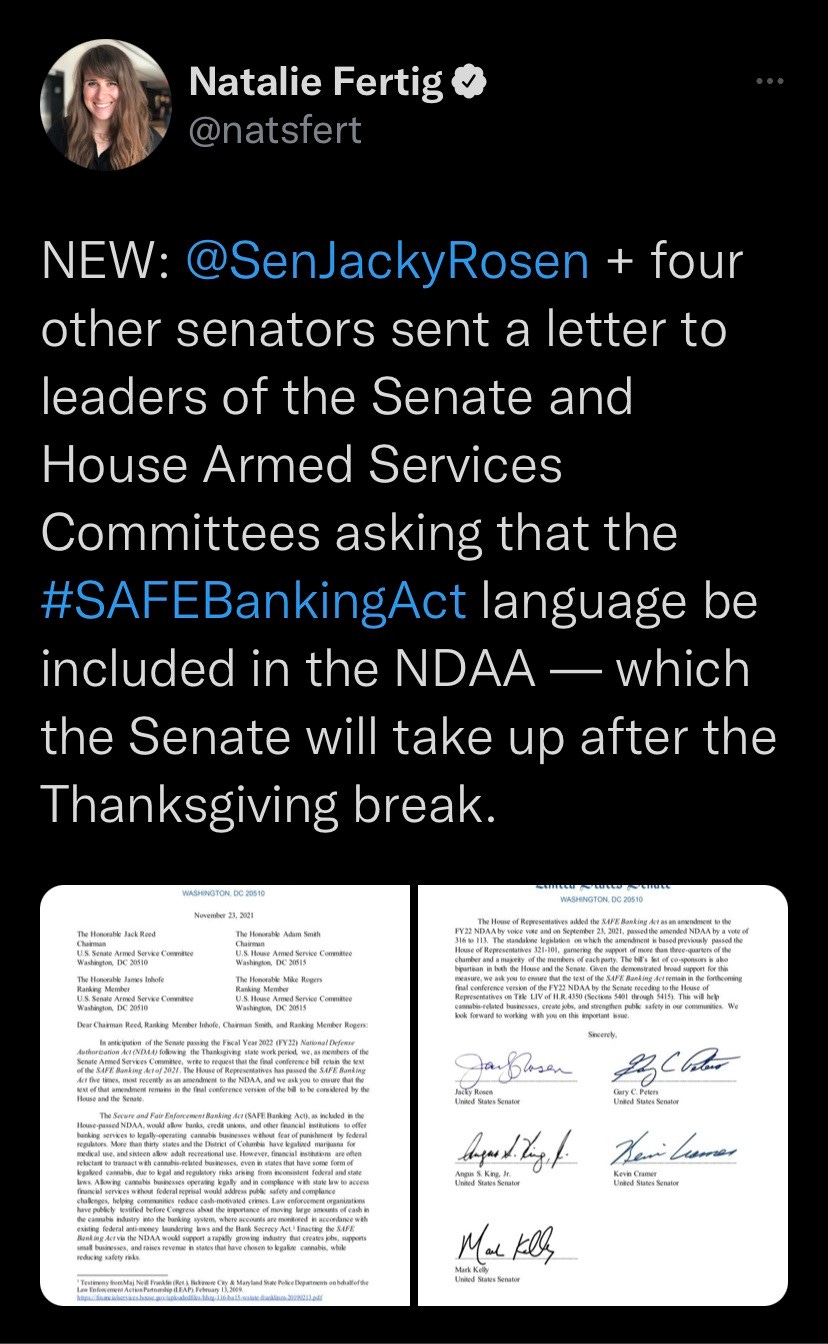

…and that’s whether SAFE banking can somehow make its way into the NDAA that is slated for the Senate this week / must pass in 2021. With that language already in the House version of the NDAA, there is mounting pressure on Senate Majority Leader Schumer to include it in the Senate version despite his stated stance on the subject.

Minority cannabis business owners are asking for it…

…as are twenty four Governors…

…numerous Attorneys General…

…and the Senate Armed Services Committee (SASC) which well, hold that thought.

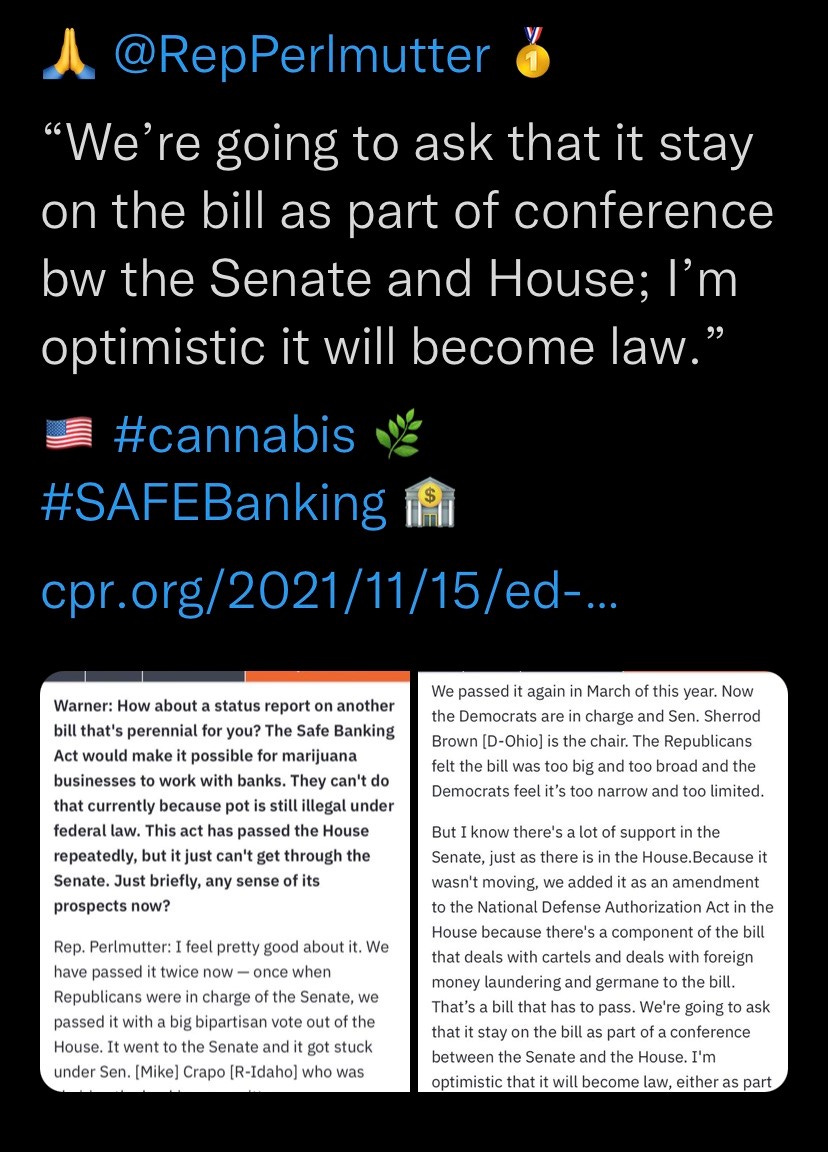

Therein lies the political calculus. Representative Perlmutter (D-CO), bless his heart, has championed SAFE Banking for years; this is the fifth time the House passed it.

Two weeks ago, Representative Nancy Mace (R-SC) introduced a common sense bill to legalize cannabis, setting the table for U.S cannabis into next year’s midterms.

We have a bipartisan slate of attorneys general, governors (including NY) and senators who sent letters asking for it’s inclusion in the senate version.

And if Senator Schumer doesn’t oblige because he presumably wants to pass cannabis legislation in a single comprehensive legislative package with a giant blue bow on top (despite not having fifty much less sixty votes) the NDAA will go to conference where the SASC will help sort it out.

It probably makes sense to reiterate that all of this is pure speculation. It’s something that Brady Cobb and I have discussed at length throughout the year, which def doesn’t make it true—it is just a potential outcome on a probability spectrum of outcomes.

[this is another outcome, so it’s said—that SAFE Banking does not get included in the NDAA, from someone super-smart on the subject matter. So see both sides, please]

NOTE: if we see POTUS grant cannabis pardons, we can assume the fix is in.

Bringing it Home

A few weeks ago, we spoke about the set-up (←solid podcast w Jesse Felder)

We wrote it down a few days later and shared it for the world to see.

Since then, U.S cannabis blasted off on huge volume, retraced on lighter volume and (thus far) made a higher low, which is / would be a technical positive.

All of this during a tax-loss harvest; into year-end; with shorts naked and pressing.

Where you stand is a function of where you sit. Traders and investors often look at the same stock and see two different things but on occasion, those worlds collide.

We’re invested in U.S cannabis stocks for what’s to come; we don’t know how or when but we know the base-case bull thesis is state-led and consumer-driven and all of that is before the efficacious agility finds it’s way through multiple clinical pathways.

[as long as the U.S government insists on continuing its repugnant War on Drugs, U.S cannabis is a Long Squeeze-in-waiting and the longer it takes to repeal those onerous regulations, the more powerful/valuable the resulting entities will be on the other side]

We also have a trade on for SAFE: December / January $MSOS calls + 2023 leaps. We bet a set amount of money (and plan to monetize the fronts to pay for the outs) but we understand it’s a wager on the variant view: SAFE somehow squeaks through in 2021.

[we’ve read that if SAFE doesn’t pass, $MSOS will drop < $20 and it would be all over for U.S canna. We disagree, all else (+ other variants) being equal. $MSOS gave back 50% in nine months as fundamentals got better; we like the set-up into 2022 nmw]

It has indeed been a wild ride for U.S cannabis, not just in November but the full year. We saw huge gains early (on top of the eye-watering returns last year) only to have the rug pulled month-after-month while everything else in the world ripped.

Sync your time horizon and risk profile, remove emotion from your process and keep your head about you while others are losing there’s.

2021 has been the definition of frustration but it’s not over yet.

/positions in stocks mentioned

position / advisor $MSOS