Weekend Update

Recapping the second week of September

The following is a sampling of last week’s content on Cannabis Confidential.

Strength and Gratitude

The bull run continues for cannabis.

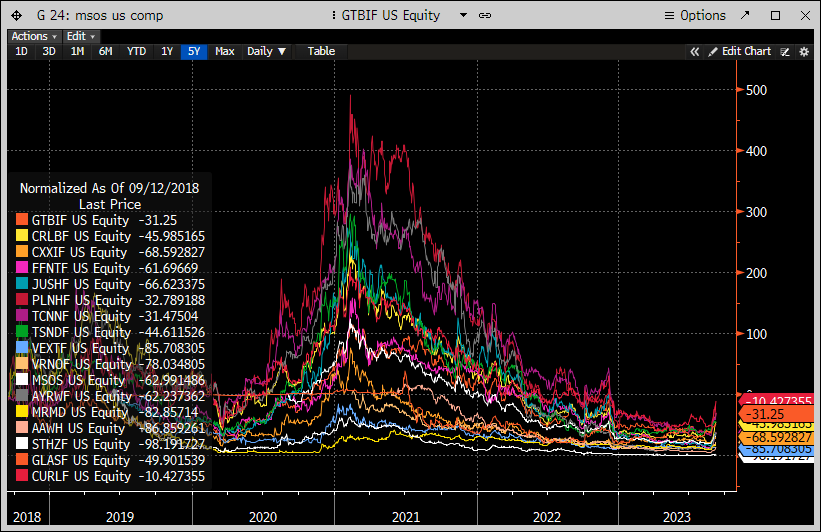

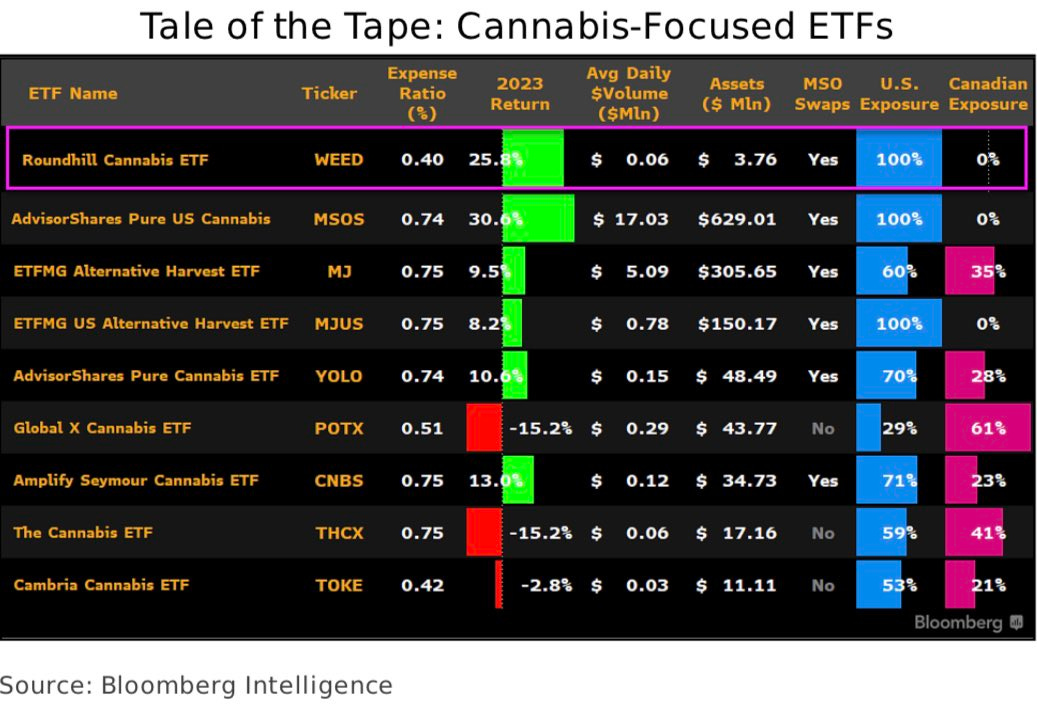

The cannabis rally resumed on Monday as U.S. cannabis ETF MSOS continued it’s pattern of making higher highs and higher lows since the HHS news leaked August 30th. The NYSE-listed ETF was down 31% YTD eight short sessions ago but after today’s move, it is now up 31% YTD (still -24% YoY).

While the relaxation of U.S cannabis regulations would be incrementally bullish for global cannabis markets, including Canada, the move to SIII, if codified, would disproportionately benefit U.S. multistate operators, or MSOs.

"We believe there is still significantly more upside in cannabis MSO multiples. Investors who fear that they may have missed the move should reflect on historical multiples and discounted cash flow analysis, both of which will reveal significant incremental upside potential to be realized." -Viridian

Price-to-EBITDA multiples (closest comp would be 2024) (CB1 Capital)

Brokedown Palace: Reflections on the 22nd anniversary of 9/11

The Bumpy Cusp

There's a bull-bear battle in Cannaland

Experts told MJBizDaily that an initial proposed rule could be issued by the end of the year and the process finalized by next spring.

What the DEA cannot do is reject the HHS recommendation outright.

Marijuana’s days as a Schedule 1 drug are ending. It’s only a matter of when.

NY'S POT RULES OPEN RECREATIONAL MARKET TO NEW APPLICANTS

The move will expand the market beyond the first social-equity applicants with new applications starting in October. Additionally, the office’s chief of staff and senior policy director, Axel Bernabe—the architect of the state’s regulations since inception—announced his retirement.

We’ve been expecting scary headlines and air pockets—scare pockets—as we ventured from here to wherever there might be and that’s exactly what we got today to shake the bulls and feed some bears. We expect the volatility to continue, quite hopefully in a manner that works it’s way up and to the right.

Volumes remain elevated although today’s pullback was on about half the volume we saw during the recent run. Some might say that’s constructive, if not bullish.

There’s been minimal, if any, institutional flow, which continues to make sense since until these stocks find proper homes (custody), most shops will stay on the sidelines.

J-Dubs doing what J-Dubs does (leading by example w/ insider buying)

Boris Jordan on Cannabis

The Curaleaf Chair shares his latest takes.

Curaleaf Chairman Boris Jordan spoke with Mayor Toby on Twitter X last night about global cannabis markets, the likelihood/ impact of Schedule III and his latest take on SAFE Banking. Give BoJo a listen if you haven’t done so yet and given we live in such an A.D.D-immediate gratification society, we transcribed it for you too.

A New York Minute

Big Apple canna is finally getting baked.

New York will finally open it’s adult-use cannabis market to all businesses, including large multistate operators and medical cannabis companies starting next month.

The new shops are expected to be open by year-end and if they are, we’ll finally have some kind, tested products available in—or at least closer to—my stomping grounds.

Insofar as most New Yorkers already think the corner bodega is the legal framework, the transition from the illicit market will take a minute. We’ll dig into the new rules below to find out what it means for the many denizens of the Empire State.

Bipartisan lawmakers have already called on Gov. Kathy Hochul to sign a ‘Cannabis Crop Rescue Act’ given that a quarter-million pounds have been left to rot. It’ll be tough without distribution at scale but at least the space is no longer stuck in traffic.

[nine out of ten illicit grows test for nasty pesticides + knock-off vapes often contain chemicals and emulsification agents that are literal poison; legal is where it’s at]

The chart below is [Wednesday’s] price action, which is dizzying even in hindsight…

For/ with our money, we wanna buy dips and see how our year-end wish-list evolves. Boris said the quiet part out loud last night and while this might be my confirmation bias talking, it aligned with what we’ve been hearing. That doesn’t mean any of it will happen but the fuse has been lit and the biggest domino tipped when the HHS news was leaked.

Steppingstones

Searching for a path to prosperity.

Congressional researchers are saying the quiet part out loud: that the DEA is ‘likely’ to reschedule marijuana, which would have ‘broad implications’ for taxes, housing, immigration and more. “If the past is prologue, it’s likely that DEA will reschedule marijuana according to HHS’s recommendation.”

That would be a seismic shift for the U.S. cannabis industry if it were the only item on the agenda, but it’s not. Consistent with our year-end wish list, we could see a steady drumbeat of positive catalysts that help pace this space into next year’s election.

To that end, The Hill reported this morning that senators are pushing to pass cannabis banking after the rescheduling recommendation, echoing sentiments that were shared earlier this week by Senate Banking Committee Chair Sherrod Brown (D-Ohio), who said, “We hope to be able to announce something in the next few days.”

“What happened on Schedule III was good, another potential breakthrough,” Sen. Ron Wyden (D-Ore.) said, adding: “We’re finally moving to end the days of Reefer Madness. The federal government just been behind on pot.” Sen. Mark Warner (D-VA) added that the HHS decision was “a recognition of reality.”

Virtually Recorded August 23rd, 2023.

NBC NEWS: Republicans soften on federal marijuana reform in a shift that could make it a reality

A bill that would let legal marijuana businesses get access to major financial and banking institutions will likely have the votes to pass the Senate.

Lost & Found

A classless asset looks for a home.

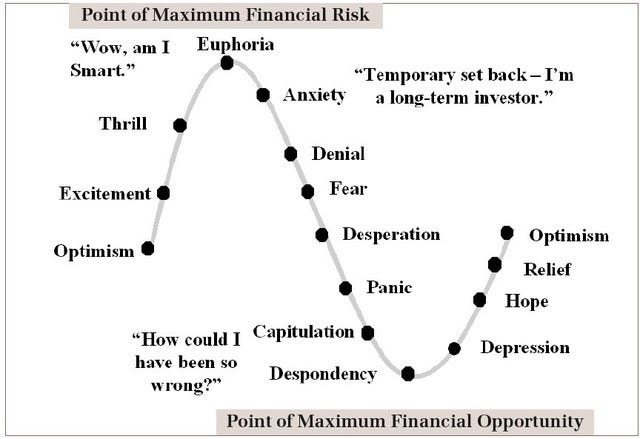

We’ve watched U.S canna evolve from a red-hot growth sector that was gonna ride a blue wave to generational wealth…

…to value plays because they got so damn cheap…

…to value traps when there was no visibility on how or when the federal government would get off the schneid and provide visibility—any visibility—on how U.S. cannabis companies could generate enough free cash flow to service their debt.

This space, having endured not one but two 80% drawdowns during the last five years, managed to alienate growth investors (after companies were forced to slash CAPEX to survive) and value types who succumbed to the notion that the status quo is called the status quo for a reason.

Make no mistake, this has been a long, dark and dreary road. There are no victory laps on the road to redemption but there are signs and guideposts; and those of us who obsess about follow such things have found them to be encouraging.

The proposed change is wholesale. The entire space will benefit. The only people who won’t benefit are those who remain in prison for this plant but we’ll save that for another day.

The sector was left for dead as naked/ structural/ algorithmic shorts piled into what became an almost-too-good-to-be-true shooting-fish-in-a-barrel trade that paid-off most days but here’s the thing: the denial, migration, panic thing swings both ways.

We used to contemplate what might happen if SAFE passed/ 280E went away/ stocks could list on major exchanges/ CPG M&A was back on the table/ institutions ungated/ MSOS trended on WSB/ there was insider buying and stock buybacks—but I’m not sure that anybody contemplated these catalysts potentially happening all at once.

The timing of last week’s leak into the barren wasteland of summer’s end + the (listed and naked) short base + potentially seismic catalysts + napkin math suggesting a 2-3X fundamental turn sans 280E = perhaps the single best set-up I’ve seen in my 34 years on Wall Street.

/end

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.